- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD's daily bearish close below 1.2580 could be significant

USD/CAD's daily bearish close below 1.2580 could be significant

- USD/CAD closed below 1.2580 on Tuesday amidst USD weakness.

- This could open the door to more downside for the foreseeable future.

USD/CAD was making a fresh cycle low on Tuesday as oil continued to recover and print higher and as the US dollar melted. This was so despite sentiment for a faster run down of quantitative easing and a faster pace of interest rate hikes from the Federal Reserve. At the time of writing, USD/CAD is trading at 1.2570 and consolidates above the overnight night low of 1.2567.

Fed will tackle inflation

Investors were reassured that the Fed will tackle inflation which led to stocks rebounding overnight and reversing the recent downward trend. Fed Chair Jerome Powell reassured explained in a testimony that the Fed is prepared to tighten monetary policy to maintain price stability.

Powell commented, “if we see inflation persisting at higher rates than expected then we will raise interest rates… we will use our tools to get inflation back.”

Analysts at ANZ Bank explained that the chair ''expects supply-side pressures to ease somewhat but said if that doesn’t happen then there is a risk that inflation becomes more entrenched and therefore the Fed would then need to respond. He also said he expects the economic impact of the Omicron variant to be short-lived.''

This is a common theme between banks which is starting to outstrip demand for the greenback. Investors are inclined to move into riskier assets and the onset of inflation is a plus for the commodity sector as well. Commodities tend to perform well in the face of inflation for which the loonie trades as a proxy. Oil, for instance, is heading higher for all the reasons noted here.

National Bank of Canada said in a note today, ''the Bank of Canada's commodity price index for 26 commodities produced in our country and sold on world markets stands at a new record high early in Q1 2022 when expressed in Canadian dollars. That’s good for the trade balance, profits, job creation, and the Canadian dollar.''

All in all, ''rising commodity prices, a current account surplus, a strong labour market and positive interest rate differentials argue for an appreciation of the Canadian dollar,'' analysts at the bank added.

The fundamentals tie in with the following technical outlook:

USD/CAD technical analysis

- USD/CAD Price Analysis: Bears to target 1.2480 on a breakout below daily H&S neckline

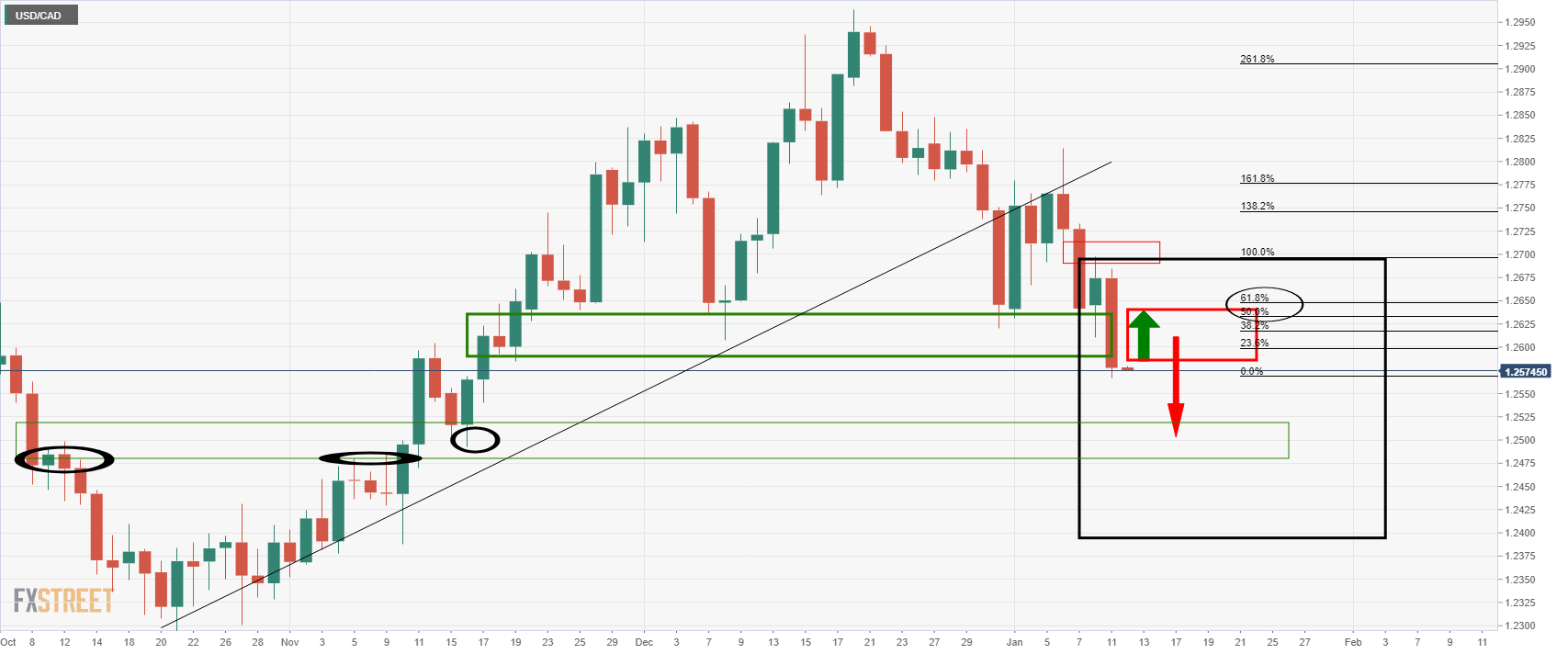

The price closed below the neckline of the head and shoulders formation. A restest of the old support between here and 1.2650 (61.8% Fibonacci retracement area) would be anticipated to hold and lead to a downside continuation for the days ahead which puts 1.2490 on the map.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.