- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD bulls stepping in at daily support as full markets return

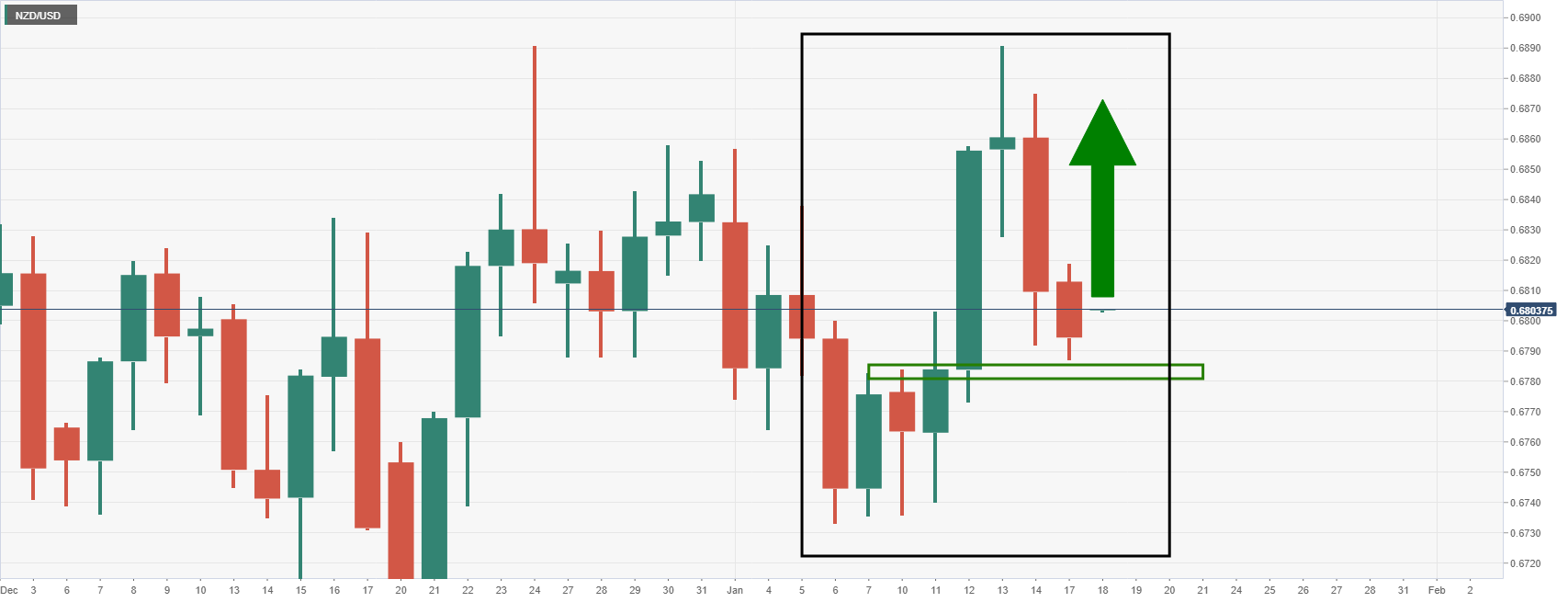

NZD/USD bulls stepping in at daily support as full markets return

- NZD/USD bears are being beaten back by bulls near the daily support.

- A pick up in price activity is underway as traders return to markets for Tuesday.

At 0.6804, NZD/USD is higher on Tuesday by 0.17% following a rally from a low of 0.6783 to a high of 0.6808. It is a relief for traders following a very quiet end to Monday's trade with the US on holiday for Martin Luther King Jr Day and no headline data releases in Europe.

''With 2022 well underway, the main sense we get is that it could be a bumpy ride as global central banks transition from easing to tightening, and as markets look for slower growth (or a decline in) liquidity as QT supplants QE,'' analysts at ANZ Bank said.

''Locally, Omicron remains a proximate threat (to activity and inflation), but going the other way, it’s not difficult to envisage inflation and jobs data surprising to the upside over coming quarters, and that could provide a leg of support. Plenty to think about.''

Meanwhile, traders continue to hold on to US dollars as per the latest positing data but there is a major segment of the market that expect that the Federal Reserve tightening plans are largely priced in. This is weighing on the greenback, while the euro eased from Friday’s two-month high. The US dollar index (DXY), which declined sharply last week until Friday's leap, is dripping pips by some 11% ton the day so far.

NZD/USD technical analysis

The bulls are moving in around daily support following a test at the neckline support of the W-formation. If this were to hold, the bulls will be looking to run the show back towards 0.6900. A break of support below 0.6780 will otherwise open prospects of a test to the daily lows near 0.6735.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.