- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD rebounds from lows and regains the 1.1350 zone

EUR/USD rebounds from lows and regains the 1.1350 zone

- EUR/USD reclaims some ground lost in the mid-1.1300s.

- The knee-jerk in the greenback helps the recovery in the pair.

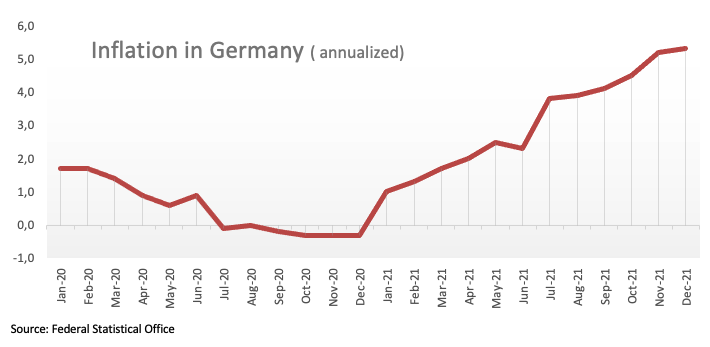

- German final December CPI rose 0.5% MoM and 5.3% YoY.

Finally, some respite for the single currency now motivates EUR/USD to leave behind the area of recent lows and retake the 1.1350 region on Wednesday.

EUR/USD focused on dollar, yields

EUR/USD sees some light at the end of the tunnel after three consecutive daily pullbacks that dragged spot from YTD highs around 1.1480 to Tuesday’s so far weekly low in the 1.1315/10 band.

Once again, dollar dynamics were the exclusive catalyst for the price action around the pair, always tracking the solid performance of US yields across the pond, which keep navigating in fresh tops. In addition, yields of the key German 10y Bund returned to the positive territory for the first time since May 2019.

Data wise in the region, final December inflation figures in Germany showed the CPI rose 5.3% over the last twelve months and 0.5% vs. the previous month. In addition, the Current Account surplus in Euroland widened to €26B in November and the Construction Output expanded 4.4% in the year to November.

Later in the US calendar MBA Mortgage Applications, Building Permits and Housing Starts will be in the limelight.

What to look for around EUR

EUR/USD came under pressure after hitting new YTD highs in the 1.1480 region earlier in the month, finding some contention in the low-1.1300s so far this week. In the meantime, the Fed-ECB policy divergence and the performance of yields are expected to keep driving the price action around the pair for the time being. ECB officials have been quite vocal lately and now acknowledge that high inflation could last longer in the euro area, sparking at the same time fresh speculation regarding a move on rates by the central bank by end of 2022. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: Germany Final December CPI (Wednesday) – EMU Final December CPI, ECB Accounts (Thursday) - ECB Lagarde, EC’s Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is gaining 0.16% at 1.1342 and faces the next up barrier at 1.1482 (2022 high Jan.14) followed by 1.1491 (100-day SMA) and finally 1.1510 (200-week SMA). On the other hand, a break below 1.1314 (weekly low Jan.14) would target 1.1272 (2022 low Jan.4) en route to 1.1221 (monthly low Dec.15 2021).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.