- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/NOK extends the consolidation below 10.0000

EUR/NOK extends the consolidation below 10.0000

- EUR/NOK trades on a choppy fashion so far this week.

- The Norges Bank left the repo rate unchanged at 0.50%.

- The central bank signalled an interest rate hike in March.

EUR/NOK alternates gains with losses so far this week in the area just below the psychological 10.0000 mark.

EUR/NOK muted on NB decision, looks to oil

EUR/USD resumes the upside following Wednesday’s decline after the Norges Bank left the policy rate unchanged at 0.50% at its meeting on Thursday.

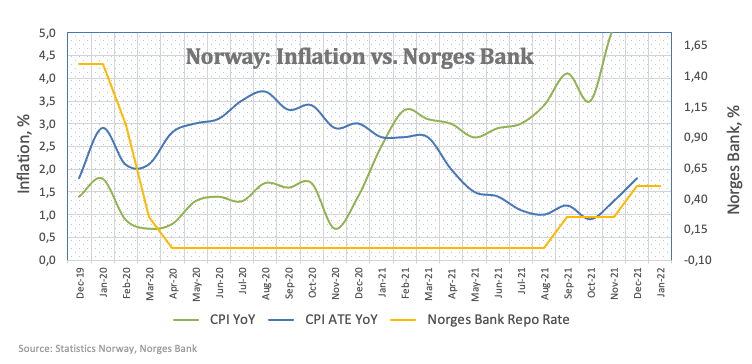

Indeed, the Scandinavian central bank matched estimates on Thursday although it reiterated its intention to hike the key rate at the March event. The Norges Bank justified the decision on the solid performance of the Norwegian fundamentals and noted that the elevated underlying inflation is now approaching the bank’s target.

The bank also noted that there is still uncertainty surrounding the progress of the omicron pandemic, while the Committee expressed its concerns over the potential increase in prices and wages stemming from the supply disruptions and price pressures overseas.

Despite prices of the barrel of the European benchmark Brent crude rose sharply since mid-December, NOK failed to appreciate in an equally (or even close) pace during the same period.

EUR/NOK significant levels

As of writing the cross is gaining 0.18% at 9.9777 and faces the next resistance at 10.0443 (55-day SMA) followed by 10.0782 (2022 high Jan.6) and then 10.1181 (200-day SMA). On the other hand, a breach of 9.9018 (2022 low Jan.13) would open the door to 9.8383 (low Nov.17 2021) and finally 9.8166 (low Nov.1 2021).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.