- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD: H1 double bottom marked, bullish correction underway ahead of the Fed

GBP/USD: H1 double bottom marked, bullish correction underway ahead of the Fed

- GBP/USD bulls are attempting to breakout of hourly consolidation.

- The H1 double bottom is encouraging, but the US dollar bulls have not yet thrown in the towel ahead of the Fed.

Now oscillating around 1.35 the figure, GBP/USD is flat but turning green on the day following a recovery from the lows of 1.3436 and printing a recent double hourly bottom. The US dollar has fallen under pressure as the 10-year yields remain pressured.

The US dollar, as measured by the DXY, an index that compares the greenback to a basket of major currencies, is sliding from the highs of the day of 96.272. It trades near 96.10 at the time of writing and is moving in on a key level of hourly support, as illustrated in the technical analysis below.

Meanwhile, fundamentally, the markets are in high anticipation of the Federal Reserve interest rate decision and accompanying statement. ''A likely March rate hike has been well communicated, so a "prepare for liftoff" signal will not be market-moving,'' analysts at TD Securities explained.

''More important will be guidance on QT as well as the funds rate after March. We don’t expect definitive signals, unfortunately; the next dot plot update is in March. The result could be mixed messages.''

Domestically, the pound has been favoured of late, at least until the extreme risk-off flows started to emerge in the latter part of this month. GBP has been the top daily performer as we entered the New Year. Investors cheered the UKs management of the coronavirus while also investing in marginally higher rates following the Bank of England's first rate hike since the onset of the pandemic, increasing its main interest rate to 0.25%.

Money markets (IRPR) currently price in more than 100 basis points (bps) in interest rate rises in 2022 and an 87% chance of a 25 bps increase in February after data showed last Wednesday that UK inflation rose faster than expected to its highest in nearly 30 years in December. Overall, the BoE tightening story has been supporting the pound, but considering the UK's twin deficits, at times of risk-off, the pound tends to be regarded as a risky asset class.

GBP suffered a steep sell-off when geopolitics unsettled markets at the end of last week and the start of this week's business. For instance, the pound weakened broadly on Friday, pulling back from a 23-month high versus the euro touched in the previous session as weakness in Wall Street prompted investors to take profits after a rally last week.

Then, on Monday, the British pound dropped further and its lowest in three weeks versus the US dollar. If risk sentiment turns around on reduced tensions in central Asia and Ukraine, then profit taking would likely support the pound and weigh on the greenback. However, the situation is fluid and uncertainty still prevails in risk-off markets on Tuesday. US stocks were sharply lower in midday trading, unwinding a portion of Monday's late recovery amid continuing market volatility.

Meanwhile, Prime Minister Boris Johnson has fought to save his premiership amid a deepening revolt inside the Tory party over a series of lockdown shindigs in Downing Street, contrary to the lockdown social distancing laws at the time.

However, "the pound has not paid much heed to recent headlines regarding the position and character of PM Johnson as this can be explained by the fact that no general election is scheduled until 2024 in the UK and whoever is party leader will inherit a large parliamentary majority," Rabobank analysts argued.

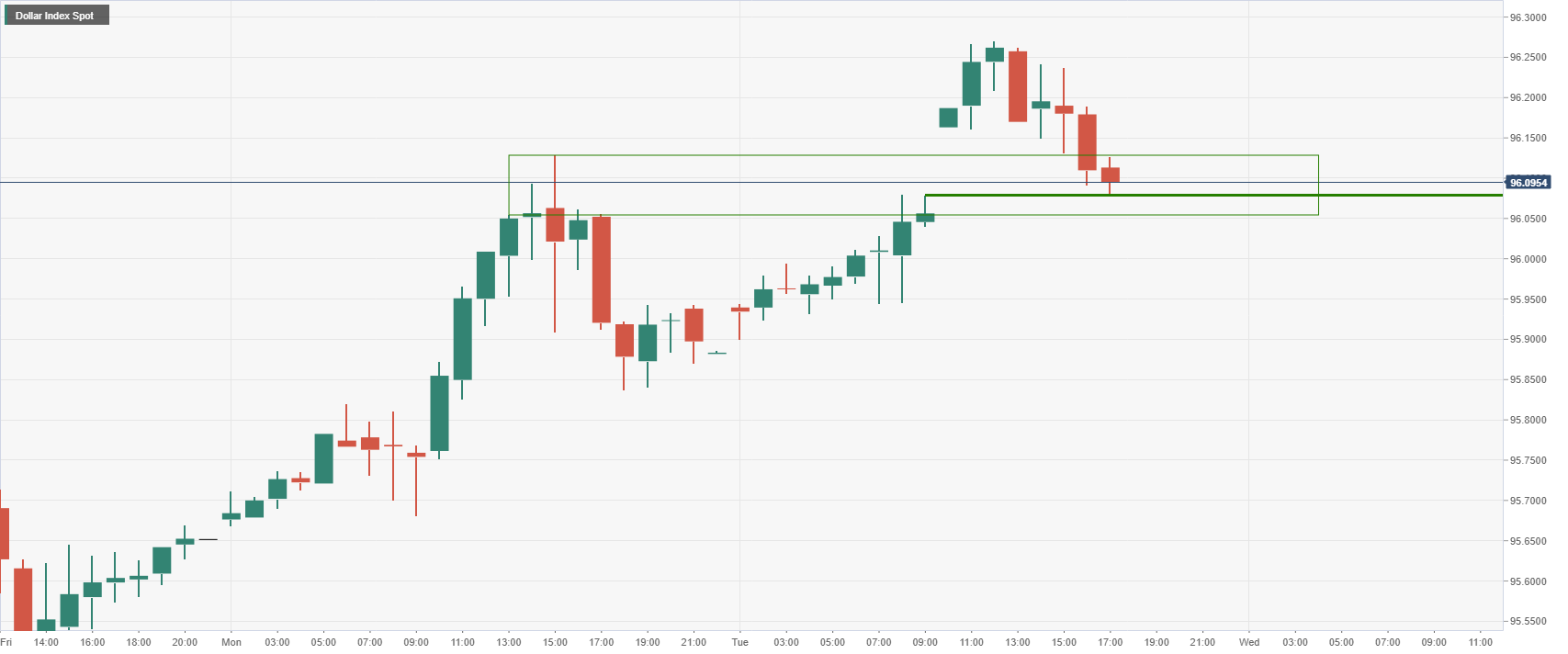

US dollar H1 chart

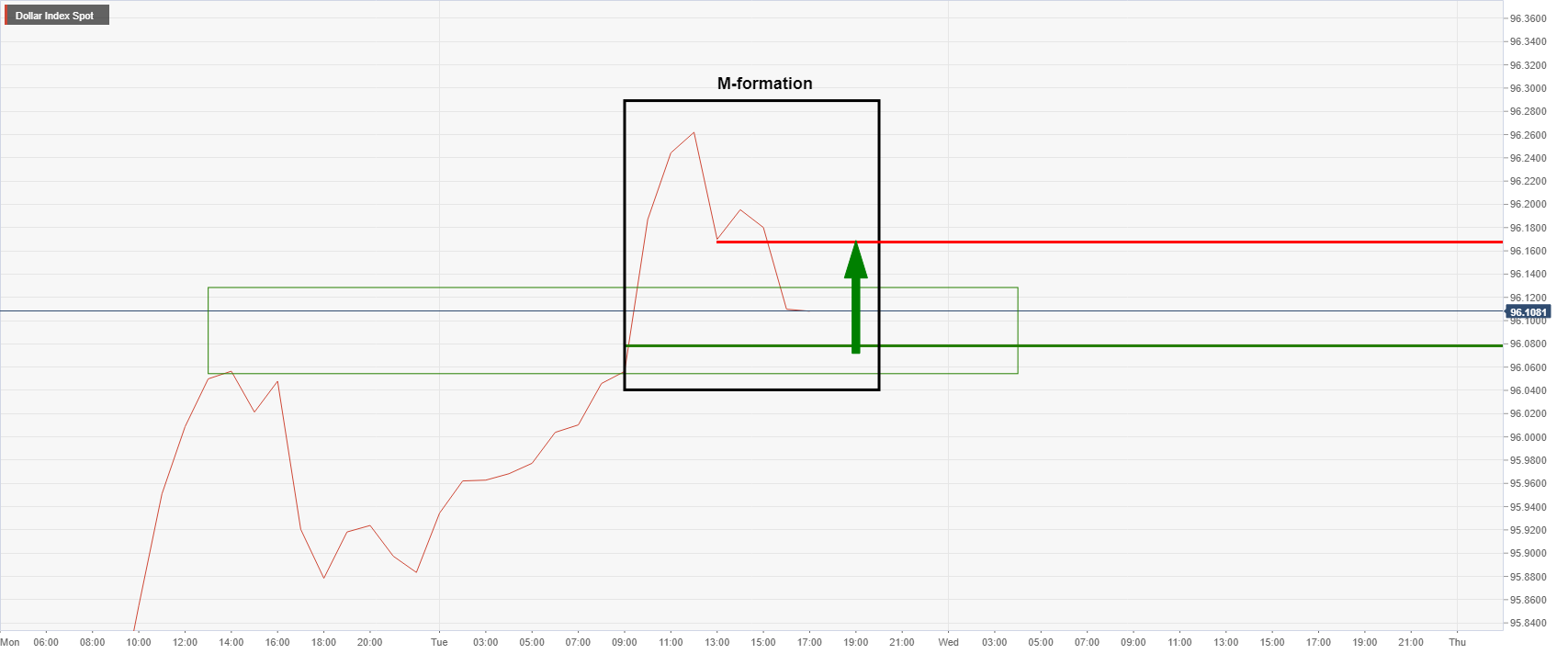

The US dollar is closing the gap but the M-formation being left behind is a reversion pattern and the neckline towards 96.20 could be retested in coming hours:

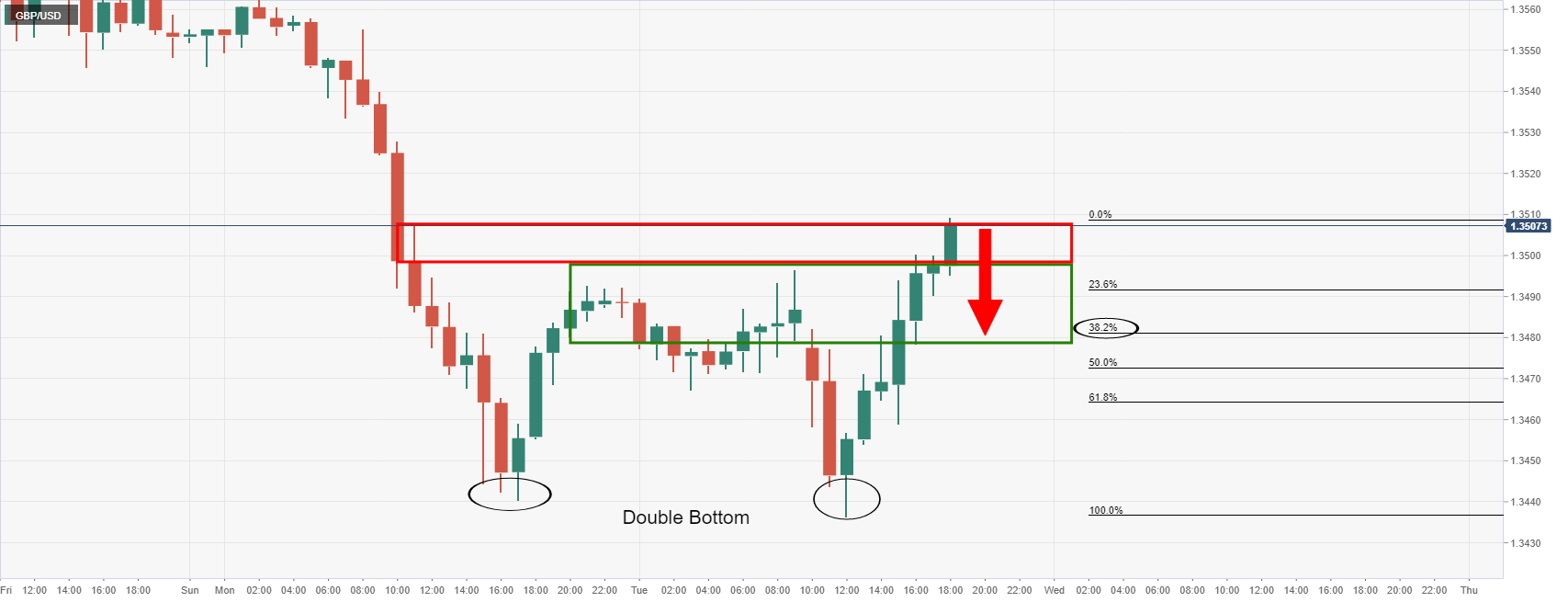

GBP/USD H1 and M15 charts

This would be expected to keep the pound anchored to 1.35 the figure or thereabouts:

The price has made a double bottom on the hourly chart and the break of the prior corrective highs near 1.3500 the figure is encouraging from a bullish perspective. However, from a lower time frame schematic, a correction would be expected at this juncture:

The price has run into a wall of resistance as per the 15-min chart and rejection in the first test here opens risk back to the 61.8% Fibo if the 51-min bullish impulse near 1.35 the figure. Support is seen into 1.3490. However, the 38.2% Fibonacci level near 1.3480 could come under pressure if the bulls do not commit at 1.35 the figure for the sessions ahead.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.