- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD Price Analysis: Bulls packing a punch through 1.35 the figure, 1.3580 eyed

GBP/USD Price Analysis: Bulls packing a punch through 1.35 the figure, 1.3580 eyed

- GBP/USD bulls look to 1.3580s for the days ahead.

- Near-term bears are in anticipaiton of a deeper correction on the lower time frames.

In ealrier analysis in the US sesison, 1.35 the figure was noted as an anchor point from which bulls would be expected to struggle to pull away from. However, a key level of resistance was penertrated and a high high for the day was scoed all of the way towards 1.3520:

GBP/USD, prior analysis

The price had run into a wall of resistance as per the prior analysis on the 15-min chart above. A rejection in the first test there was expected to open risk back to the 61.8% Fibo of the 15-min bullish impulse near 1.35 the figure.

However, the bulls have taken the reigns and pushed on through as follows:

The price rallied to a high of 1.3518 and is about to leave a bullish daily closing candle for the day which opens prospects of a deeper retracement of the bearish daily impulse as per the chart below. In the mean time however, there is now bearish structure forming on the 15-min chart in the form of a potential bearish head and shoulders topping formaiton.

If trhe right hand shoulder forms followed by a subsequent break and close below the neckline near 1.35 the fifure, then the hourly 38.2% % Fibonacci retracement will be eyed for a potential support for the sessions ahead. Should the dollar remain under pressure, then the bulls will be encouraged to renegage at a discount and that could lead to a bullish exptensio into the imbalance of price between the highs and the late 1.3530s.

GBP/USD daily chart

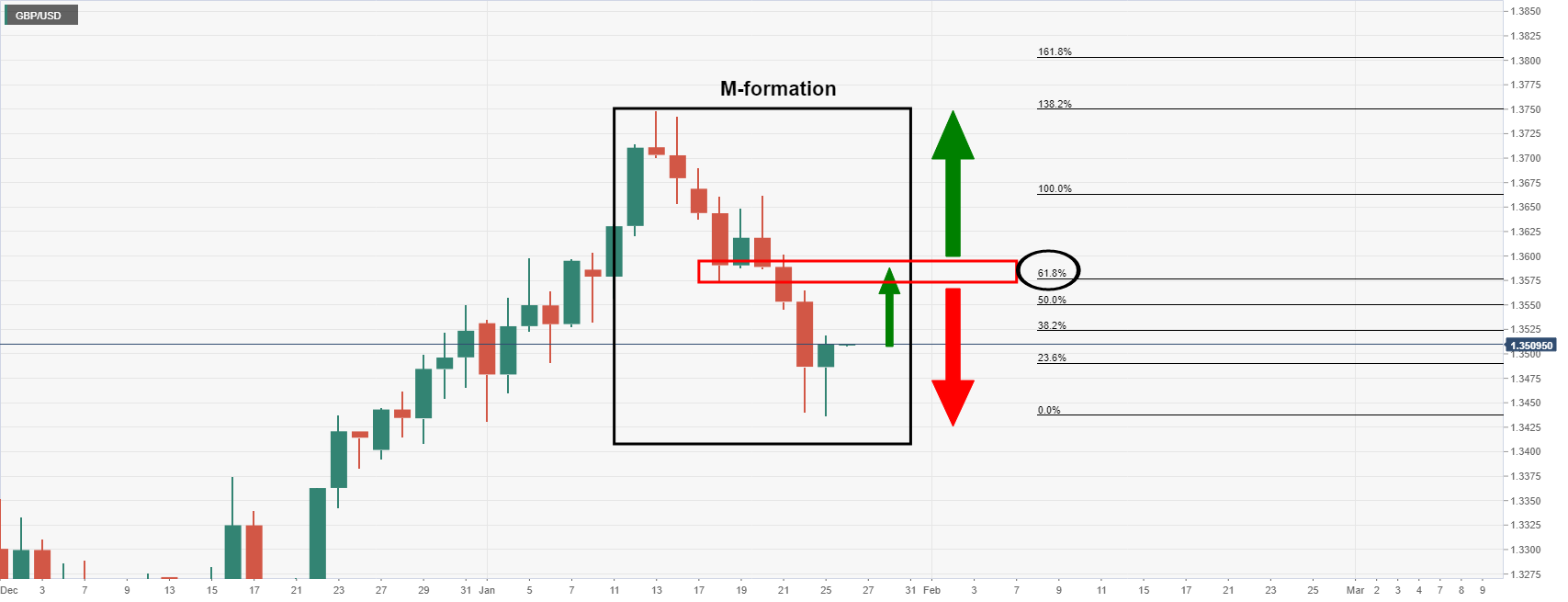

Looking further a field, the daily M-formaiton is compelling, especially given the prospects of today's bullish daily close:

The 61.8% Fibonacci retracement level has a cnfluence with the neckline of the M-formaiton. The W and M patterns have a high completion rate of the price being drawn back into the prior structure, aka, the neckline. In this case, near to 1.3580.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.