- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: Bears eye retest of critical trendline support

Gold Price Forecast: Bears eye retest of critical trendline support

- Gold is being held up by critical support on the daily chart.

- The week ahead and key events could move the needle as bulls ad bears battle it out

- XAU/USD poised for further losses on Fed's hawkish stance

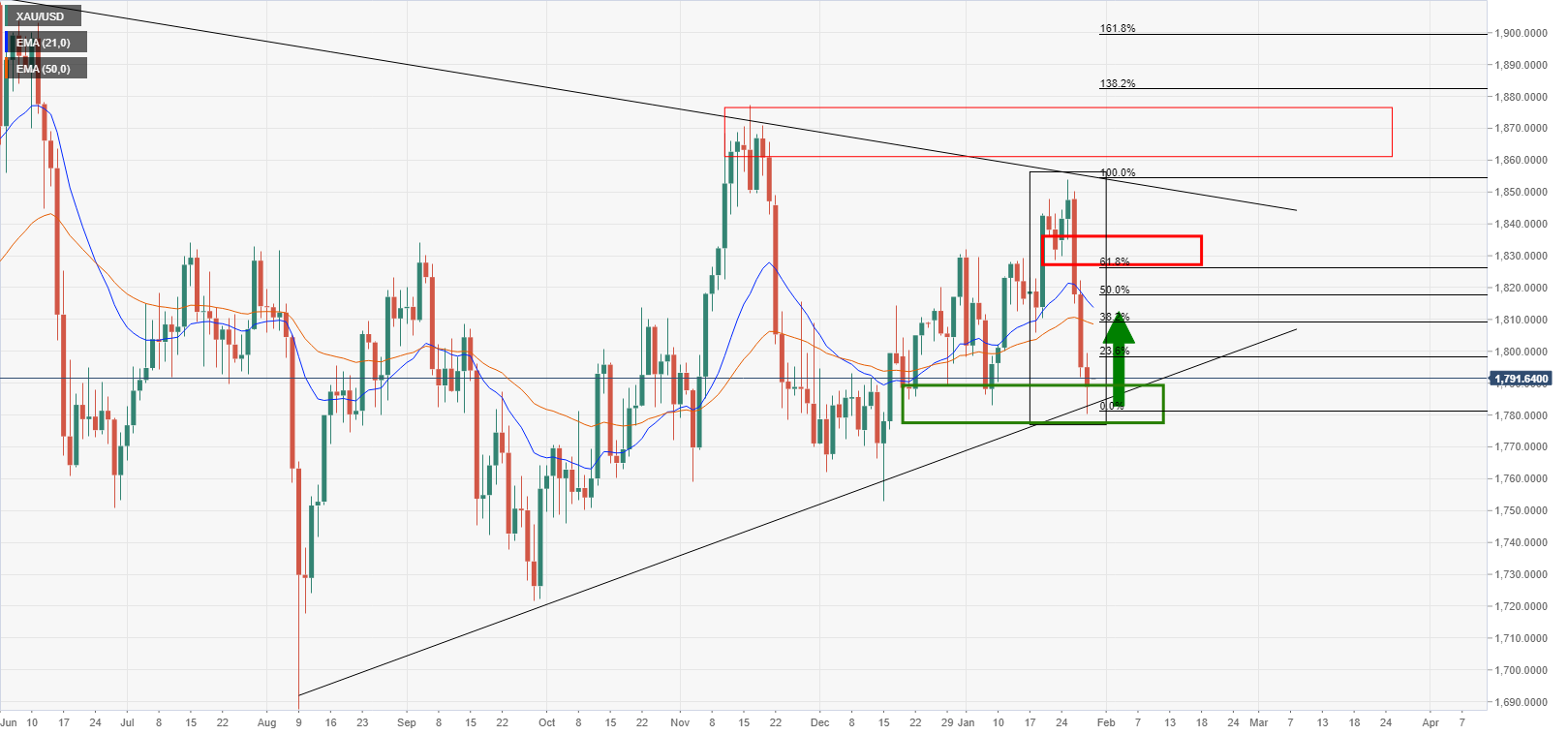

The price of gold, XAU/USD, ended the week on the front foot and was correcting from the lows of last week's bearish run from $1,780, moving in on the prior day's support near $1,800. Trading around Friday's close near $1,791, the yellow metal is on thin ice, technically, as it balances upon critical daily trendline support for the open.

Risk appetite improved on Friday. World stocks rallied with corporate earnings taking up the spotlight which was a positive focus and welcoming distraction from the geopolitical turmoil and Federal Reserve tightening concerns. Economic data also helped to ease inflation worries, which left the US dollar in consolidation and US yields on the backfoot.

US Treasury yields fell across the curve on Friday as the Fed's favoured inflation gauge, the core personal consumption expenditure price index (PCE), stayed within expectations. In the 12 months through December, the PCE increased 5.8%. That was the largest advance since 1982 and followed a 5.7% year-on-year increase in November. Nevertheless, the 2-year and the 10-year yield curve steepened to as much as 65.10 basis points after hitting its narrowest spread since November 2020 on Thursday.

The outcome was significant because the Federal Reserve on Wednesday indicated it is likely to raise rates in March when it also reaffirmed plans to end its pandemic-era bond purchases at the same time. This would clear the way for launching a significant reduction in its asset holdings which has the markets on edge, which had been weighing on stocks and supporting the US dollar.

''The Fed's hawkish tone is sapping risk appetite from the market, but safe-haven flows also remain subdued despite rising risks of a conflict in Ukraine, leaving investors with few avenues toward refuge,'' analysts at TD Securities explained. ''We expect that the precious metals complex will struggle to attract capital in this context.'' This is said after gold recorded its biggest weekly loss since August.

The week ahead

Meanwhile, the week ahead could be a critical one for gold considering the lineup of US events that include the US Nonfarm Payrolls jobs data and US ISM numbers.

''More regional surveys for January will be released early next week, so expectations could change, but the surveys already released point to declines in both ISM indexes,'' analysts at TD Securities said, ''Weakening can likely be explained in large part by temporary fallout from Omicron, but a fading of the boost from fiscal stimulus is probably causing some slowing as well.''

With regards to the jobs data, the analysts explained, ''the recovery in employment was probably temporarily interrupted by the Omicron-led surge in COVID cases. Many of the employees who had to isolate likely continued to be paid, and thus remained on payrolls, but many were likely not paid. The report will probably show continued strength in wage gains. The report will include the annual revision to the data.''

Gold technical analysis

Analysts at ANZ Bank argued that gold looks vulnerable for further losses, having broken below its key moving averages to trade below $1,800/oz.

-

Gold, Chart of the Week: Supply flooded the market in $1,850's, USD bulls hold the reins

With that being said, the price could be on the verge of a significant upside correction for the sessions ahead considering the price has run into a wall of support as illustrated above near $1,780. The 21 and 50-day EMAs coincide with a 38.2% ratio and a 50% mean reversion thereafter which could draw in the price towards $1,810/820.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.