- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: Traders await RBA volatility to decipher the code in the market structure

NZD/USD Price Analysis: Traders await RBA volatility to decipher the code in the market structure

- NZD/USD traders await key events to take place this week.

- The technical outlook is bullish while buyers move in to correct the dominant bearish trend.

It is quite out there in terms of volatility in Asia due to the holidays in the region. However, on a bigger scale, NZD/USD is poised for higher levels in its correction of the daily bearish trend as follows:

NZD/USD daily chart

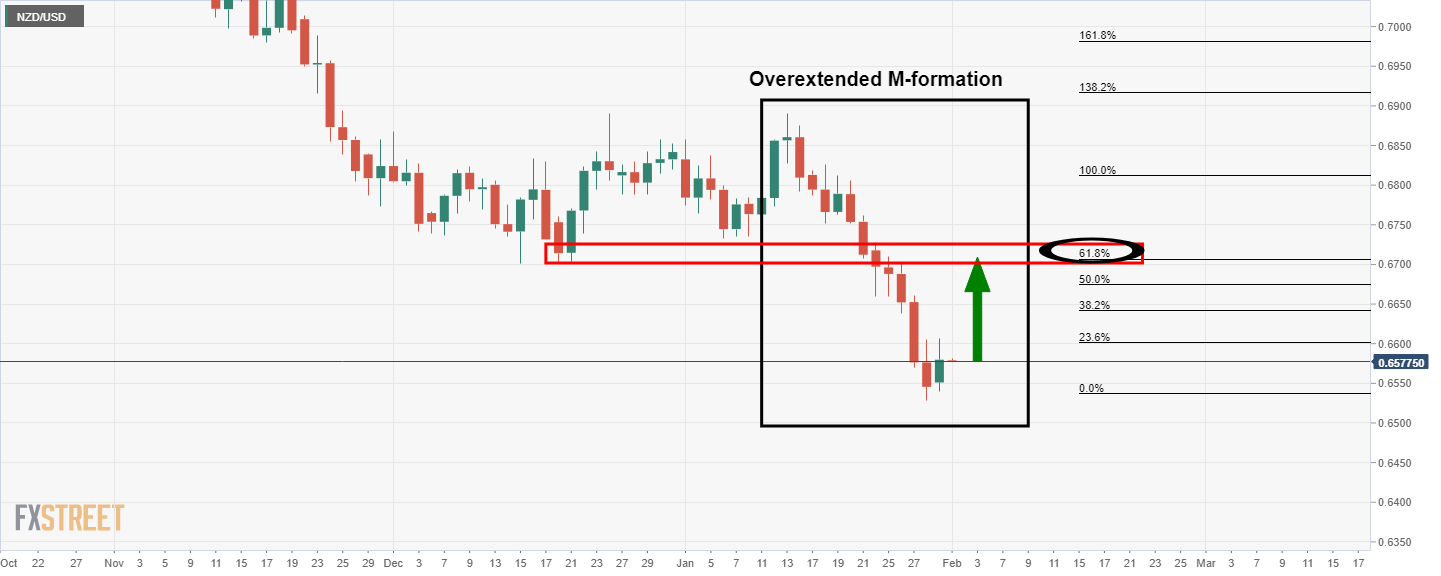

The M-formation is overextended, but it is a reversion pattern nevertheless and the price would be expected to correct towards the 61.8% Fibonacci retracement level over the course of the comings days.

However, given the number of critical events this week, including the Reserve Bank of Australia at the top of the hour, traders would be prudent to allow these to play out (the cause) in order to decipher the code within the market structures subsequent of the price action (the effect).

The RBA could be the catalyst, on a hawkish outcome, to send the kiwi on the coattails of a rally in the Aussie up to test the 38.2% Fibo near 0.6640 for the day ahead. From a 4-hour basis, the structure is ripe for a run to test the resistance on the way there:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.