- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Breaking: RBA ends QE and holds rates at 0.1%, AUD/USD falls 50 pips on knee-jerk

Breaking: RBA ends QE and holds rates at 0.1%, AUD/USD falls 50 pips on knee-jerk

- RBA keeps the Cash Rate at 0.10%, as expected.

- RBA to discontinue the bond-buying programme. No surprises there.

- AUD/USD drops 50 pips on the knee-jerk.

The Reserve Bank of Australia's highly anticipated event has just occurred whereby the RBA was expected to end its pandemic-related bond-buying program.

Market participants had speculated that policymakers would bring forward rate hikes’ guidance, potentially offering fresh incentives for AUD traders. The conundrum for the markets was how much of such an outcome has already been priced in and whether Governor Lowe would push back at market expectations of progressive rate hikes this year.

Key takeaways from the RBA, so far

- RBA keeps the Cash Rate at 0.10%, as expected.

- RBA to discontinue the bond-buying programme. No surprises there.

- AUD/USD drops 50 pips on the knee-jerk.

- Sees underlying inflation rising to around 3.25%.

- Sees underlying inflation falling to around 2.75% over 2023.

- Economy to grow 4.25% over 2022, 2% over 2023.

- Omicron outbreak hasn't derailed economic recovery.

- RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band. (That's DOVISH, AUD heavy).

Taking these points into consideration, traders can conclude that RBA is in no hurry to raise rates and will not do so until inflation is sustainably within target, adding it will be "patient" on rising prices.

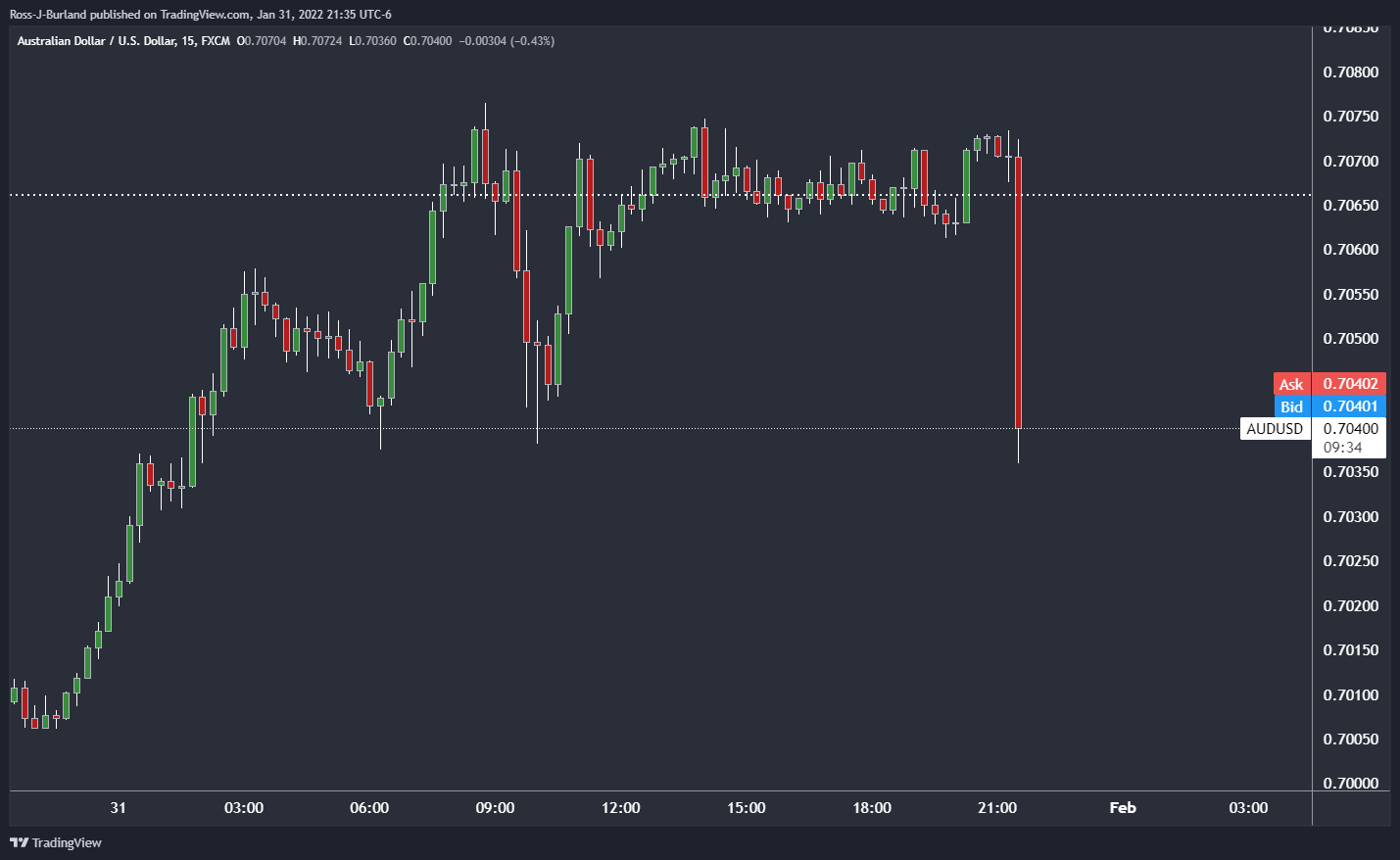

AUD/USD knee-jerk reaction

(15-min chart)

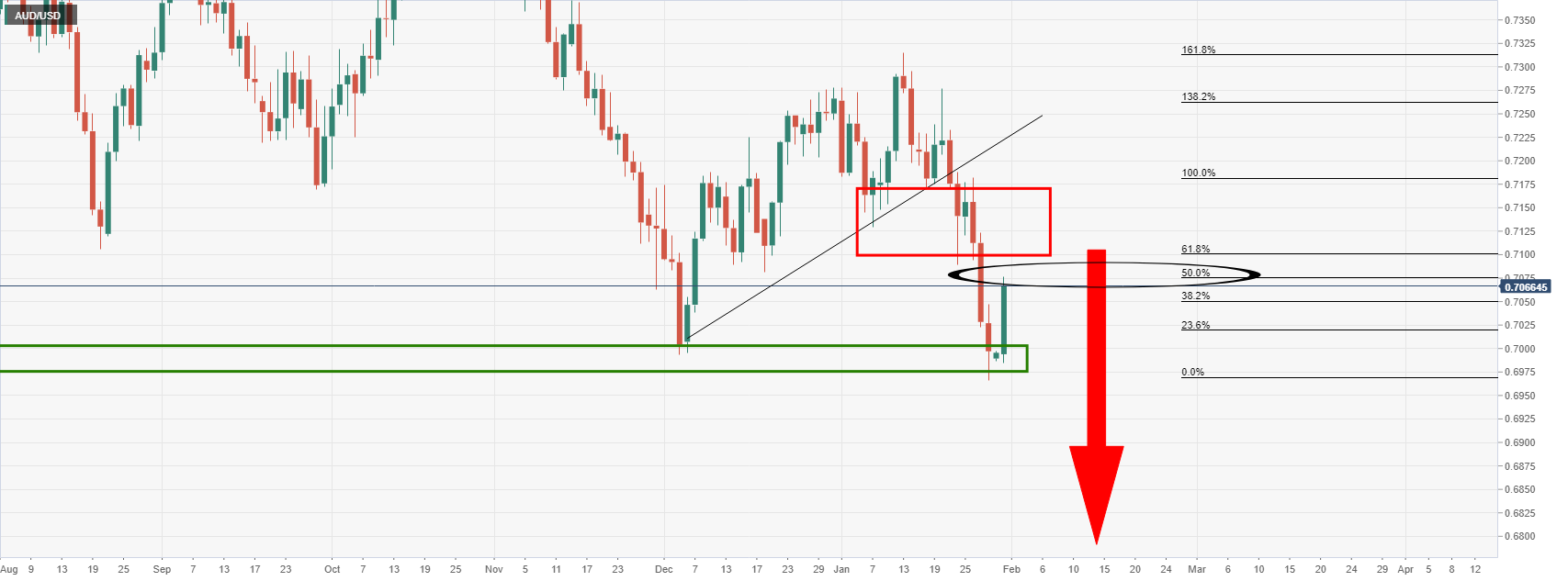

Prior to the event, the following analysis acknowledged the upside correction in the Aussie in the wake of US dollar weakness: AUD/USD Price Analysis: Bulls move in on a critical liquidity zone

As illustrated, the price had moved in on the forecasted target zone, but more to come from the bulls in the days to come prior to the next test of the 0.6950s was anticipated.

The market reaction, however, could be merely part of the deceleration of the bullish correction, forming structure along the way:

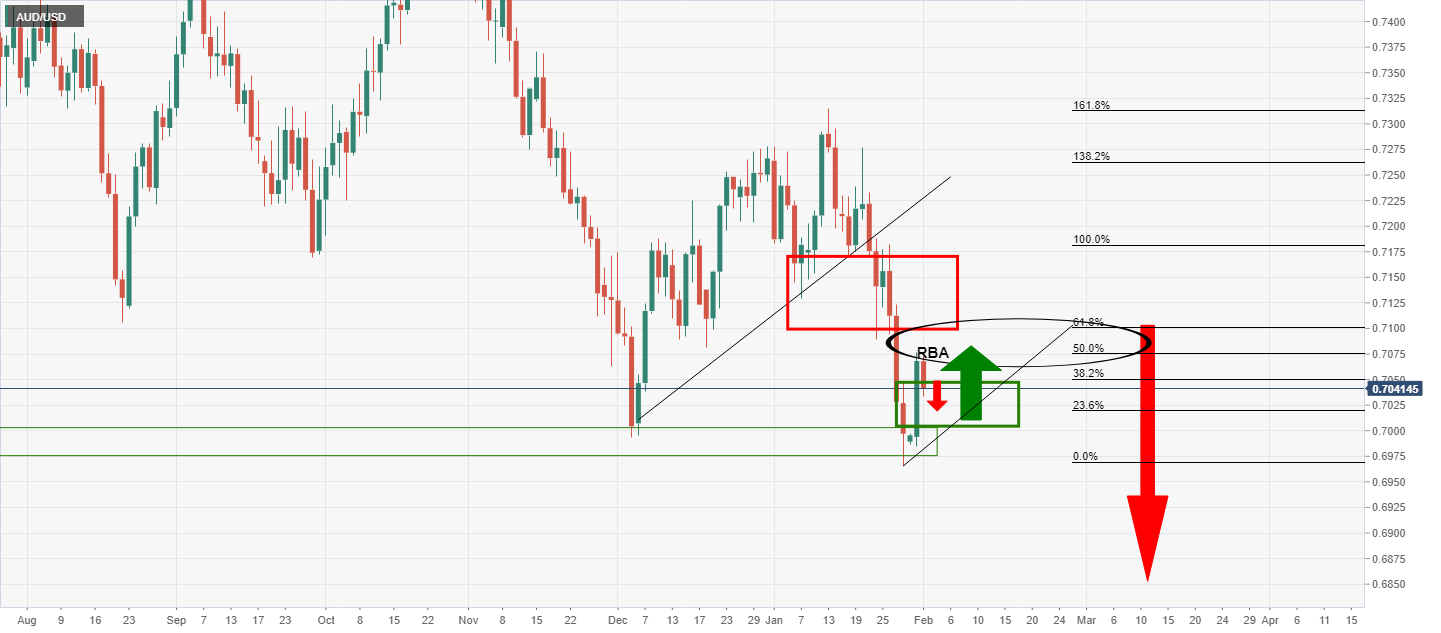

Meanwhile, the intraday traders could be encouraged by the dovishness of the RBA to target 0.70 the figure for the sessions ahead:

(AUD/USD H1 chart)

About the RBA meeting

RBA Interest Rate Decision is announced by the Reserve Bank of Australia. If the RBA is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the AUD. Likewise, if the RBA has a dovish view on the Australian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Decisions regarding this interest rate are made by the Reserve Bank Board, and are explained in a media release which announces the decision at 2.30 pm after each Board meeting.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.