- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

- Gold holds in a corrective territory on the daily chart as markets remain in anticipation of NFP.

- The US dollar has been pressured to start the week by a chorus of less hawkish Fed remarks.

At $1,800, gold, XAU/USD, is consolidating within a bullish correction on the daily chart after hitting a 38.% Fibonacci retracement level in Tuesday's trading. The yellow metal has benefitted from a switch in risk appetite and less hawkish rhetoric from a chorus of Federal reserve speakers since the Fed's governors uber hawkish tone.

Several US Federal Reserve officials are playing down the prospects of aggressive rate hikes coming imminently. For instance, although St. Louis Fed president Bullard (hawkish, voter) said that market pricing of 5 rate hikes this year is not a bad bet, he also said that a 50bp move probably is not helpful.

Over the weekend, Raphael Bostic reiterated that he is sticking to his prediction that three 25 bp hikes this year is the most likely outcome whilst warning that “Every option is on the table for every meeting.” Philadelphia Fed President Patrick Harker was equally cautious and he pushed back on a rate increase of half a percentage point in March, saying he would need to be convinced it was needed. Consequently, the dollar index eased to 96.235 (DXY) and off its recent 19-month high of 97.441.

Looking ahead, there will be a focus on the US jobs market in Nonfarm Payrolls. ''The recovery in employment was probably temporarily interrupted by the Omicron-led surge in COVID cases,'' analysts at TD Securities said.

''Many of the employees who had to isolate likely continued to be paid, and thus remained on payrolls, but many were likely not paid. The report will probably show continued strength in wage gains. The report will include the annual revision to the data.''

However, if there is a weak jobs print owing to the virus, it is unlikely to sway the Fed from its decisively hawkish tone. Traders could decide to look past recent weakness as being related to Omicron's fallout, analysts at TD Securities argued in a note on Tuesday.

''In this context, the data doesn't help to inform global macro participants on whether we are facing a new regime at the Fed, or whether they are jawboning to tame inflation expectations. We expect that the precious metals complex will struggle to attract capital in this context.''

''Given that Chinese demand overwhelmingly supported gold in recent weeks, a seasonal lull following Lunar New Year could mark the end of supportive Chinese demand, suggesting prices are vulnerable to a deeper consolidation in support of our tactical short gold position.

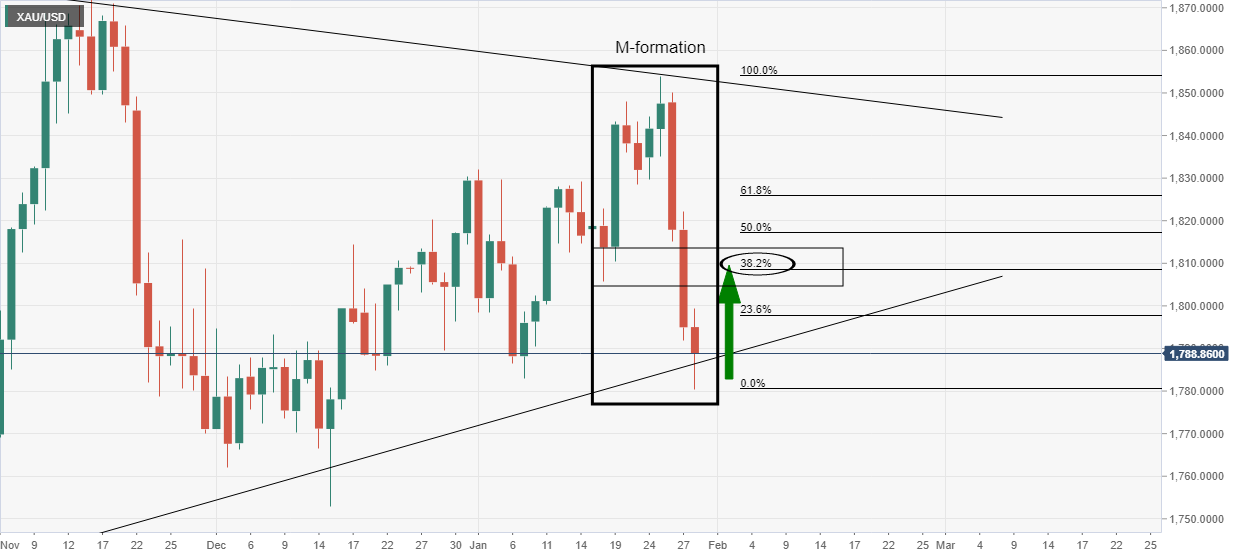

Gold daily chart

In a prior analysis, it was stated that ''considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play''...

The analysis noted that the M-formation is a reversion pattern. ''In the case above, the 38.2% Fibonacci retracement level near $1,810 has a confluence with prior structure as illustrated.''

''Should this playout,'' it was stated, ''and if the bears commit near to here, then additional supply could be straw that breaks the camelback for a sizeable continuation to crack the trendline support as follows:''

Gold live market

The price hot the target in Tuesday's trade and the bears will be now monitoring for a bearish structure in anticipation of a bearish continuation in the coming days:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.