- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD bulls correcting to the 38.2% Fibo, traders are in anticipation of US CPI

USD/CAD bulls correcting to the 38.2% Fibo, traders are in anticipation of US CPI

- USD/CAD bulls on control and testing a critical Fib ratio in its correction of Wednesday's bear trend.

- The US CPI will now be critical for the trajectory of USD/CAD.

USD/CAD is flat at the start of what could be a busy day for the dollar bloc currencies as market participants will roll up their sleeves when it comes to the US inflation data in the morning of the New York session. At the time of writing, USD/CAD is trading between 1.2668 and 1.2678, steady in the anticipation of today's key US event.

On Wednesday, the Bank of Canada reiterated that interest rate hikes are coming. The Bank of Canada's governor, Tiff Macklem, was hawkish when speaking live to the Canadian chamber of commerce. He said the global supply chain problems may have peaked, which he blames for higher inflation and that Canadians should expect a rising path of interest rates. Consequently, the loonie rallied 0.3% to test just below 1.2670 vs the US dollar and then stabilised before starting to correct higher for the rest of the New York day.

The money markets have priced in a rate hike from the BoC next month for the first time since October 2018 and so long as global oil prices remain elevated, the loonie stands to benefit from high-value sales of one of Canada's major exports.

However, analysts at TD Securities warn that the energy supply risk premium is vulnerable to a tactical retreat. ''Considering nascent signs of normalizing production in Libya, Nigeria, Venezuela and in other OPEC+ nations, the operational risks that have sustainably driven energy supply risks higher are now easing. Meanwhile, signs that the Iran file is marching towards a deal are also becoming increasingly apparent, with diplomats suggesting talks to are on the finish line.''

US CPI will be key

The focus now turns to the US calendar. US January CPI could show that the ''price pressures are set to persist in January, holding the CPI at near 40-year highs'', analysts at Westpac mentioned in a note on Thursday.

''US CPI data tonight is important and will help settle the debate as to whether the Fed will lift off with a 25bp or 50bp hike. But it’s not clear the latter would actually benefit the USD,'' the analysts at ANZ Bank explained.

On a more optimistic outlook for the greenback, ''if those readings come in hot, it could be the trigger for the next leg higher in U.S. yields and likely push the 10-year above 2% for the first time since August 2019,'' analysts at Brown Brothers Harriman warned. ''Fed tightening expectations would also pick up and likely push the short end of the US curve higher, which would support the dollar.''

USD/CAD technical analysis

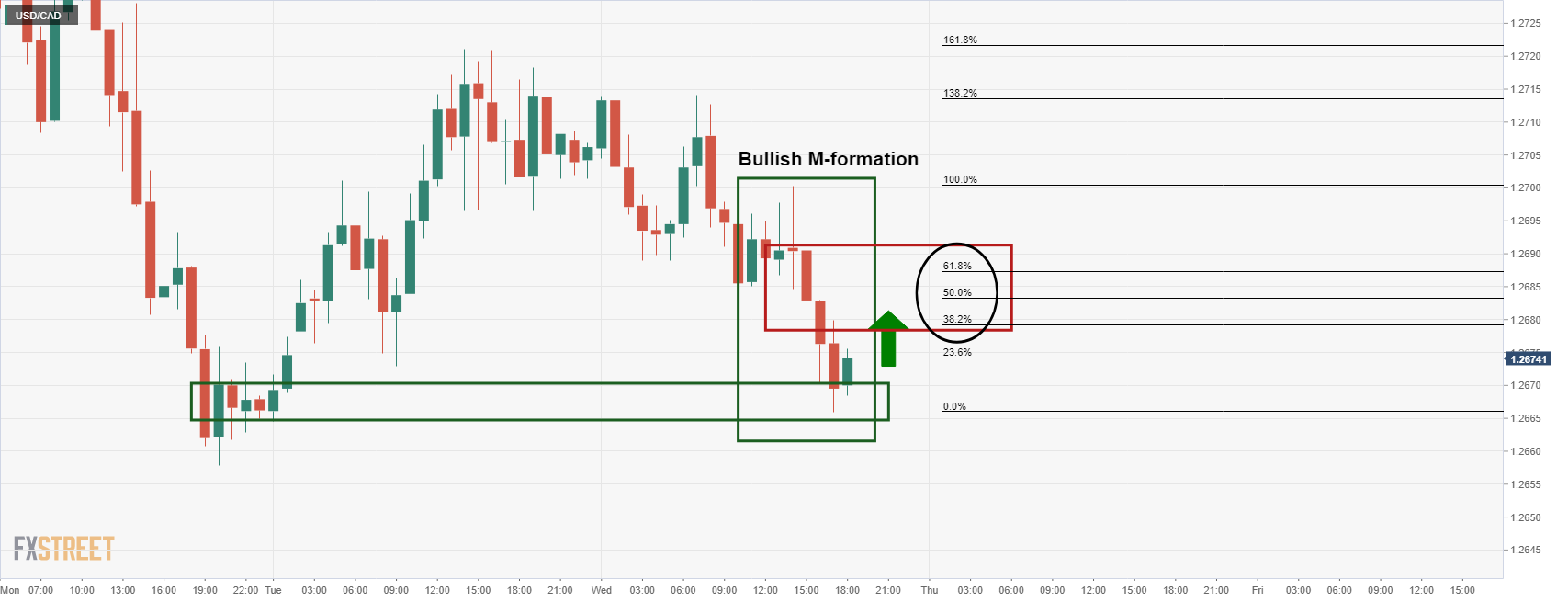

As per the prior analysis from the New York session, USD/CAD Price Analysis: Bulls are moving in at critical H1 support, the price has indeed corrected towards the target area:

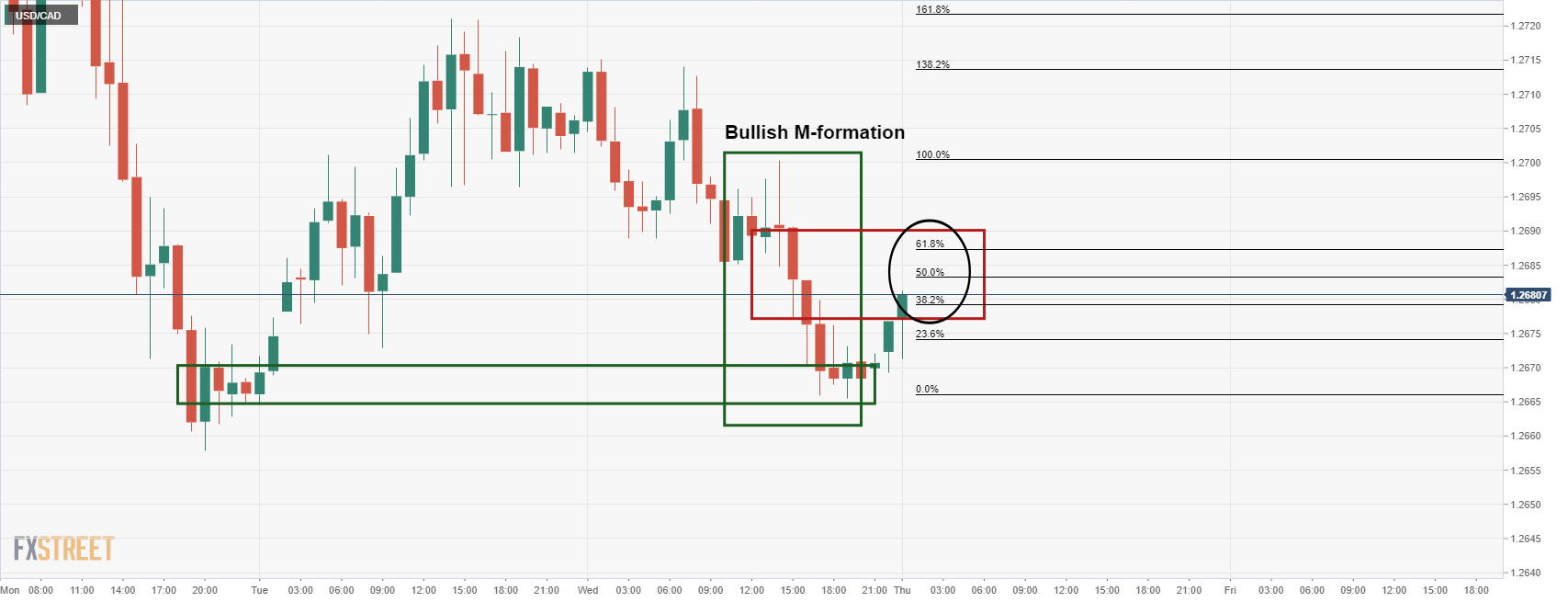

From a short-term perspective, the price is printing an overextended M-formation on the hourly chart:

USD/CAD H1 chart

It was stated that ''the bulls are moving in as profits are taken off the table before the close of the North America session as traders will be keen to be square in the run-up to the critical US Consumer Price Index event in Thursday's morning New York trade. This raises prospects of a correction into the neckline of the M-formation where bulls can target the 1.2680's, namely the 38.2%, 50% and 61.8% ratios.''

USD/CAD live market

The price is moving in on the 38.2% ratio.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.