- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD is faded as the US dollar finds solace on hawkish Fed member statements

NZD/USD is faded as the US dollar finds solace on hawkish Fed member statements

- NZD/USD pressured as Fed speakers play up the hawkish outlook following hot US CPI.

- NZD/USD bulls meet a wall of resistance and suffer heavy supply.

- The bears could be encouraged to move in for a test of critical support on the daily time frame.

NZD/USD traders were taken on a ride of volatility on Thursday as the markets positioned for macro inflationary pressures which flows made their way through every facet of the forex space. The commodity complex was bid on the inflation hedge play which initially supported the kiwi after the knee-jerk bid in the greenback before it was met with heavy supply again in midday trade.

At 0.6685 during the time of writing, NZD/USD is around flat on the day after travelling between a low of 0.6652 and a high of 0.6732 in the final hours of Wall Street's trade. The bird spiked lower after the Federal Reserve James Bullard spoke out over the hot US inflation data, commenting that the central bank could be considering meeting rate hikes. He has said that he favours a 50bp hike in March and 10bps by July.

''Volatility remains the order of the day. Higher US yields are battling things like higher commodity prices for attention; while rates have had less of an influence on FX of late, the knee-jerk reaction to higher US bond yields tends to be NZD-negative,'' analysts at ANZ Bank explained.

NZD/USD technical analysis

As per the prior analysis, whereby it ws noted:

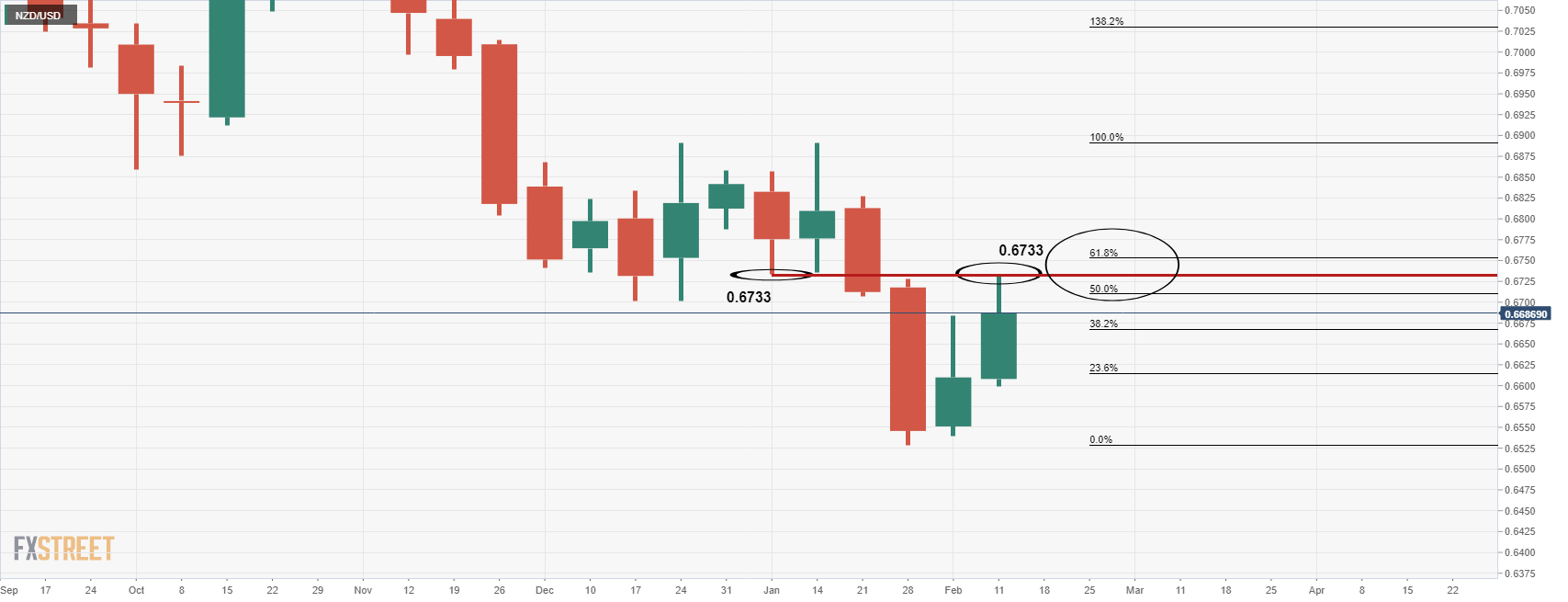

The ''NZD/USD bulls are taking charge in a significant correction,'' that was moving ''in on old lows near 0.67 the figure and towards the neckline of the M-formation near 0.6733,'' the price reache dthe target on Thursday.

This resided between the 50% mean reversion and the 61.8% ratio as follows:

NZD/USD prior and live analysis

NZD/USD daily chart

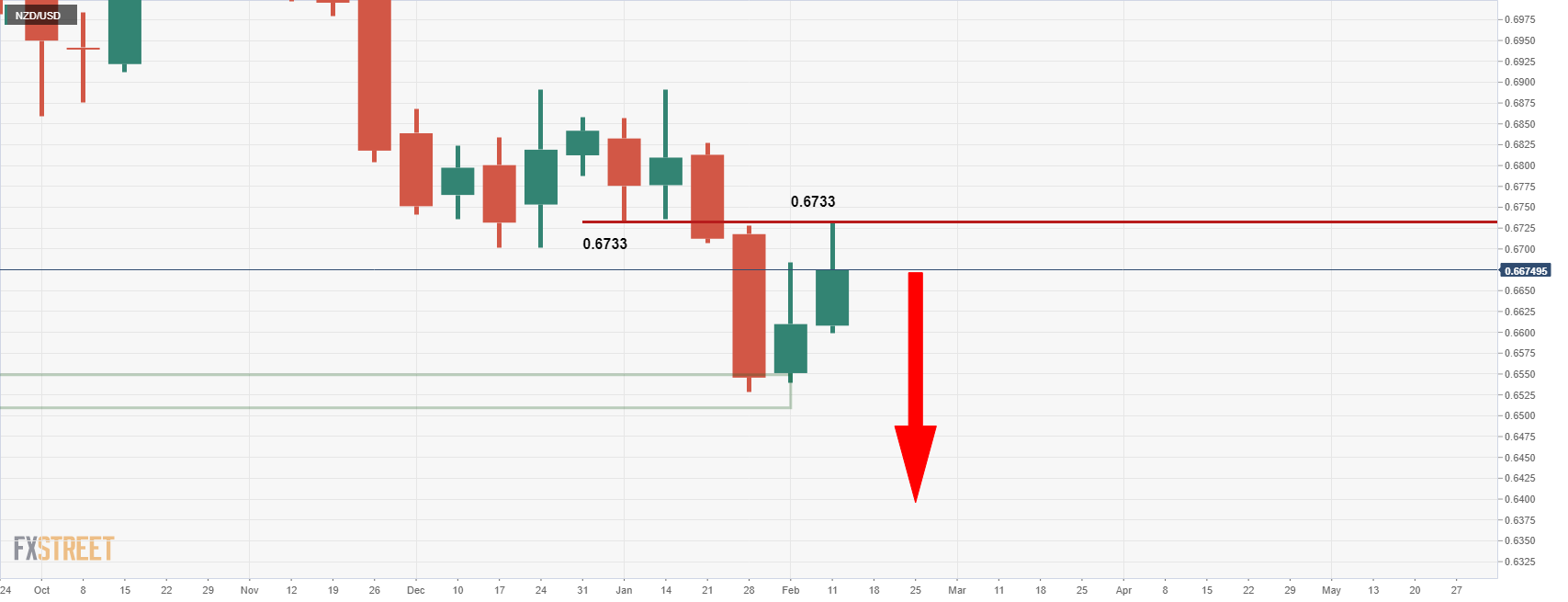

The Doji candle, if followed by a bearish close on Friday, could set case for a downside continuation for next week's business:

NZD/USD weekly chart

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.