- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD regains the smile, advances near 1.1350 ahead of EMU data

EUR/USD regains the smile, advances near 1.1350 ahead of EMU data

- EUR/USD picks up pace on alleviated geopolitical jitters.

- The dollar loses some shine on Russia-Ukraine headlines.

- EMU Flash Q4 GDP, ZEW Economic Sentiment next on tap.

Fresh headlines citing Russian troops are now expected to return to their base lend much-needed oxygen to EUR/USD and lifts it to fresh tops in the mid-1.1300s on Tuesday.

EUR/USD up on risk-on mood

EUR/USD reverses the recent weakness and manages to regain upside traction and reclaim the area beyond the 1.1300 barrier on Tuesday.

The current uptick in spot comes on the back of mitigating concerns around the Russia-Ukraine conflict, which at the same time have removed tailwinds from the greenback and the rest of the safe haven universe.

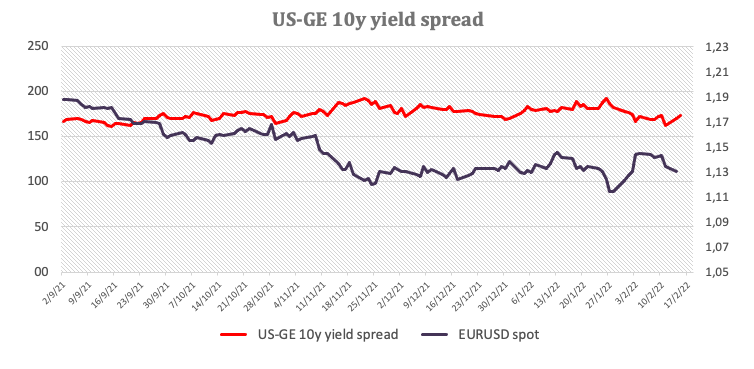

The recovery in the pair is also accompanied by another uptick in yields of the German 10y Bund, this time retaking the 0.30% region and approaching the recent area of more than 3-year highs recorded on February 10. In the US money markets, the appetite for riskier assets also lifts US yields to the area of recent peaks across the curve.

It will be an interesting day data wise in Euroland, where the ZEW survey is due in Germany and the bloc seconded by another revision of the Q4 GDP in the euro area. Across the Atlantic, Producer Prices, the NY Empire State Index and TIC Flows are all due later in the NA session.

What to look for around EUR

EUR/USD could not sustain the post-US CPI raise to the vicinity of the 1.1500 barrier, sparking a corrective move to the sub-1.1300 area on the back of the renewed and quite strong bias towards the US dollar. Despite the ongoing knee-jerk, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: Advanced EMU Q4 GDP, EMU/Germany ZEW Economic Sentiment (Tuesday) – EMU Industrial Production (Wednesday) – Flash EMU Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is advancing 0.34% at 1.1344 and faces the next up barrier at 1.1388 (10-day SMA) followed by 1.1491 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1279 (weekly low Feb.14) would target 1.1186 (monthly low Nov.24 2021) en route to 1.1121 (2022 low Jan.28).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.