- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD bulls seeking a test of 1.28 as oil bleeds out with a focus on Russian troops pulling back

USD/CAD bulls seeking a test of 1.28 as oil bleeds out with a focus on Russian troops pulling back

- USD/CAD bulls are making progress on a daily time frame for a test of 1.2800.

- Oil markets are vulnerable to the Russian premium dissolving.

- All eyes will turn to Canadian inflation with hawkish sentiment at BoC brewing.

USD/CAD has been trading between 1.27 the figure and 1.2774 on Tuesday, thrown around within the range on headlines related to the risk of a Russian invasion of Ukraine. initially, CAD rose against the greenback as fears eased that Russia would invade Ukraine. However, as noted in an article in Asia, USD/CAD traders turn to oil prices for direction, energy markets are in the driving seat.

A pullback in oil prices has dented the performance of the CAD after prices fell off seven-year highs early on Tuesday. In a signal that Russia may be open to a diplomatic solution in order to avert heavy economic sanctions it would otherwise suffer if it were to invade its neighbour, markets are relieved and the premium in oil is bleeding out.

West Texas Intermediate crude for March delivery was last seen down US$2.51 to US$92.95 per barrel, while April Brent crude, the global benchmark, was down US$2.28 to US$94.20.

Reuters reported, in relation to news in the Guardian, that ''after meetings in Moscow Monday between Russian President Vladimir Putin and German Chancellor Olaf Scholz, Russia said it is returning some troops station on the Ukrainian border to base. However, NATO Secretary-general Jens Stoltenberg told reporters on Tuesday that the alliance has yet to see any significant de-escalation from Moscow.''

As for the impact in the oil markets, nearly 5-million barrels per day of Russian oil exports are at stake. Russia could also weaponize its energy exports to prevent severe sanctions. This has led to a colossal bid in oil of late, sending prices to their highest since the autumn of 2014. However, as analysts at TD Securities argue, In turn, energy prices still appear tactically vulnerable to de-escalation in Russian-Ukrainian tensions.''

As for domestic data, Canadian Housing Starts fell 3% in January compared with the previous month. This was a weight for the currency ahead of Canada's inflation report for January, due on Wednesday. This is expected to

give more clues on the outlook for Bank of Canada interest rate hikes. The CAD has been befitting from prospects a rate hike next month, a move that will break the status quo that has been in place at the BoC since October 2018. Subsequently, in the anticipation of a more hawkish outlook at the central bank, Canadian government bond yields remain higher across the curve, tracking the move in US Treasuries. The 10-year was up 3.1 basis points at 1.937%, after touching on Friday its highest level in nearly three years at 1.961%.

USD/CAD technical analysis

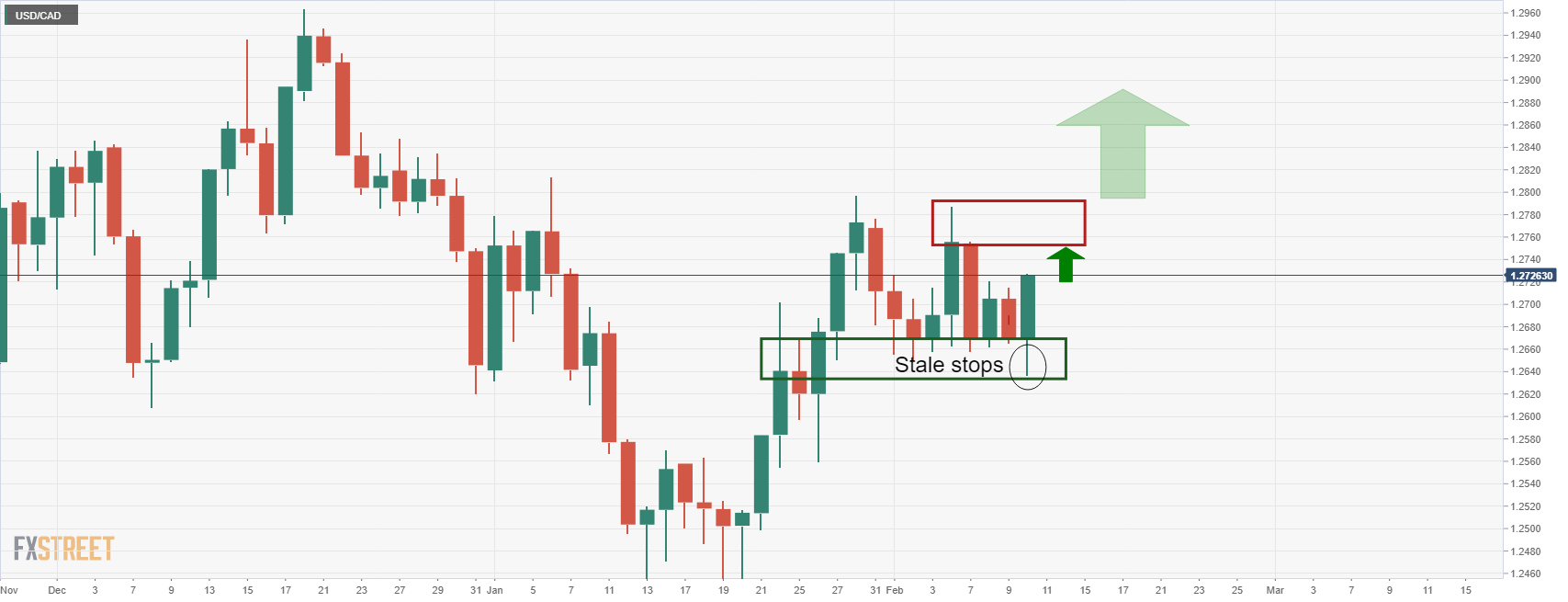

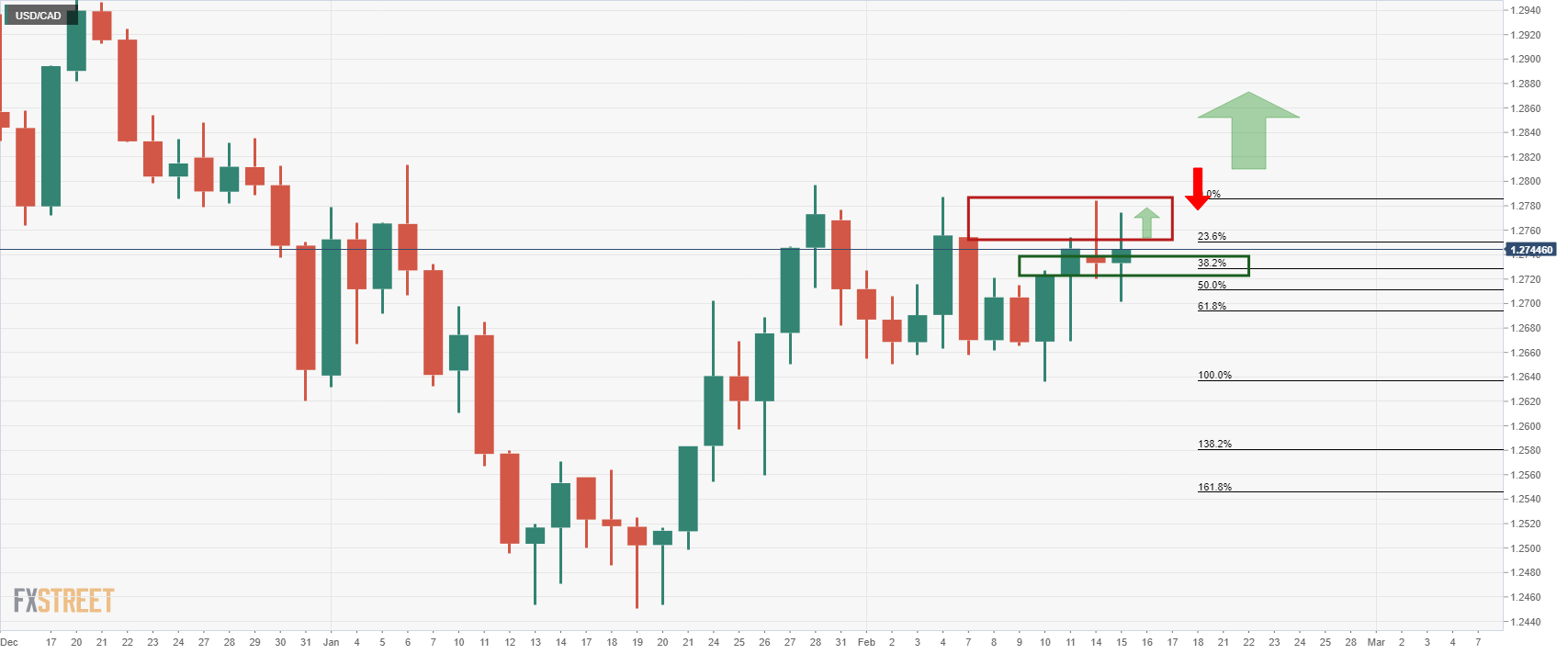

The outlook is bullish from an hourly perspective as follows:

The price has met a 50% mean reversion and is being held up at old resistance. This would be expected to lead to a fresh wave of demand to take the pair to fresh hourly highs.

From a more boarder perspective, as illustrated in the prior analysis as follows, the bulls still need to get over the line at 1.28 the figure:

USD/CAD bulls making progress

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.