- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index remains under pressure below 96.00 ahead of data, FOMC

US Dollar Index remains under pressure below 96.00 ahead of data, FOMC

- DXY stays on the defensive in the sub-96.00 zone.

- US yields correct a tad lower from recent peaks.

- The release of the FOMC Minutes will be in the limelight.

The greenback, in terms of the US Dollar Index (DXY), extends Tuesday’s pullback to the area below the 96.00 yardstick so far on Wednesday.

US Dollar Index focuses on FOMC, risk trends

The index retreats for the second session in a row and keeps challenging the 96.00 zone on the back of persistent appetite for the risk complex as well as the knee-jerk in US yields, all ahead of the opening bell in Euroland midweek.

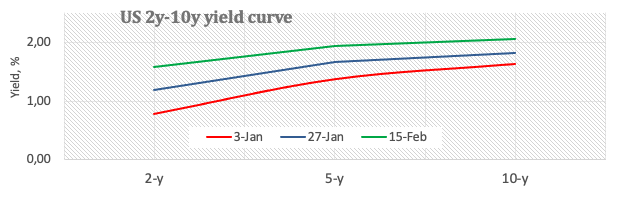

Indeed, US yields come under some mild downside pressure, although they maintain the upper end of the range close to recent tops across the curve.

The dollar, in the meantime, continues to suffer positive news from the Russia-Ukraine front, although not without rising cautiousness, which has been sustaining the pick-up in the risk-on trade in past hours.

In the US calendar, the publication of the FOMC Minutes will take centre stage later in the NA session, although Retail Sales will also grab attention along with the weekly MBA Mortgage Applications.

What to look for around USD

The resumption of the appetite for riskier assets weighed on the greenback and forced DXY to recede from recent tops. However, the ongoing corrective downside is seen as temporary only, as the positive stance in the buck remains underpinned by the current elevated inflation narrative as well as the probability (bigger now) of a 50 bps rate hike by the Fed (instead of the more conventional 25 bps move) at the March gathering. Looking at the longer run, and while the constructive outlook for the greenback appears well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: MBA Mortgage Applications, Retail Sales, Industrial Production, NAHB Index, FOMC Minutes (Wednesday) – Building Permits, Housing Starts, Initial Claims, Philly Fed Manufacturing Index (Thursday) – CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue.

US Dollar Index relevant levels

Now, the index is losing 0.15% at 95.84 and a break above 96.43 (weekly high Feb.14) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.17 (weekly low Feb.10) followed by 95.13 (weekly low Feb.4) and then 94.62 (2022 low Jan.14).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.