- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD advances further and approaches 1.1400

EUR/USD advances further and approaches 1.1400

- EUR/USD moves higher and trades closer to the 1.1400 mark.

- The relief-rally keeps propping up the rebound in the pair.

- EMU Industrial Production, US Retail Sales next on tap.

The optimism around the European currency remains well and sound and now lifts EUR/USD to the vicinity of the 1.1400 barrier.

EUR/USD up on risk trends, focuses on data, FOMC

EUR/USD advances for the second session in a row on Wednesday underpinned by the continuation of the relief rally in response to alleviating geopolitical concerns.

However, and despite the de-escalation of tensions in past hours, the situation in the Russia-Ukraine front remains delicate and is expected to keep driving the sentiment in the global markets for the time being.

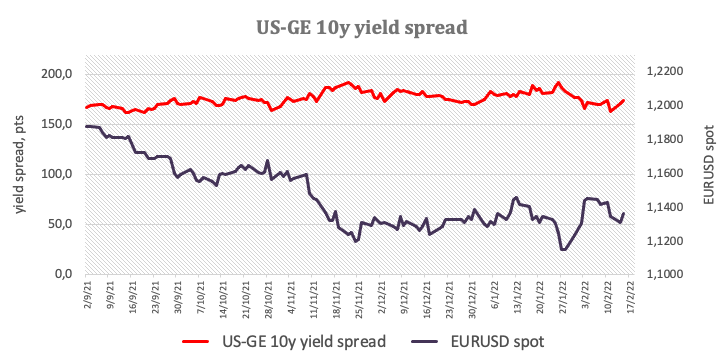

Closer to home, the selloff in the German bond market lifts yields of the key 10y Bund to new tops above 0.33%, an area last visited back in December 2018. The uptick in German yields comes in contrast with the mild downside pressure in their US peers, resulting in a narrow yield spread and morphing into extra support for the pair.

In the domestic calendar, Industrial Production in the euro bloc comes next ahead of Retail Sales and the FOMC Minutes due later in the NA session.

What to look for around EUR

EUR/USD continues to reclaim ground lost in past sessions on the back of the geopolitics-led relief rally. Looking at the broader scenario, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: EMU Industrial Production (Wednesday) – Flash EMU Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is advancing 0.18% at 1.1378 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1491 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1326 (55-day SMA) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.