- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD flying towards 0.67 the figure despite Russia angst

NZD/USD flying towards 0.67 the figure despite Russia angst

- NZD/USD soars above the hawks of the FOMC and the US dollar is under pressure.

- Ears are to the ground for headlines surrounding Russia and NATO diplomacy.

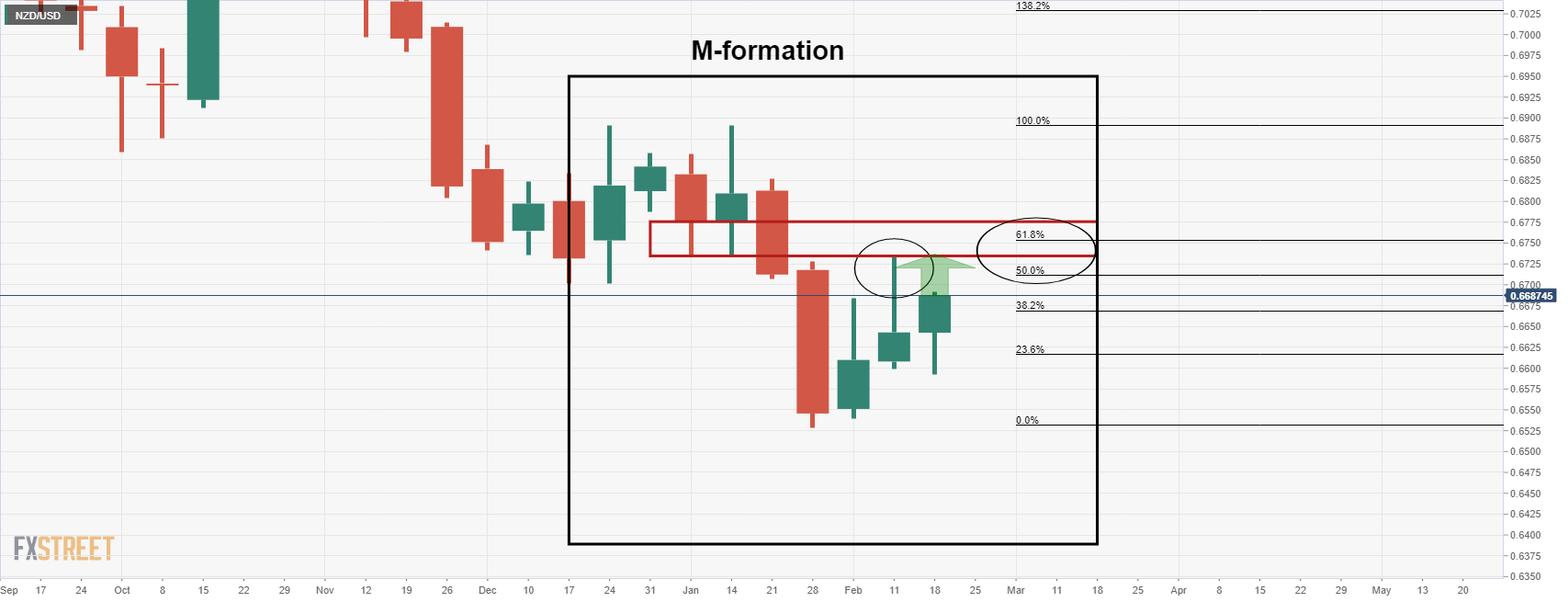

- Bulls target the 50% mean reversion level through 0.67 the figure and the 61.8% golden ratio is sat near 0.6750.

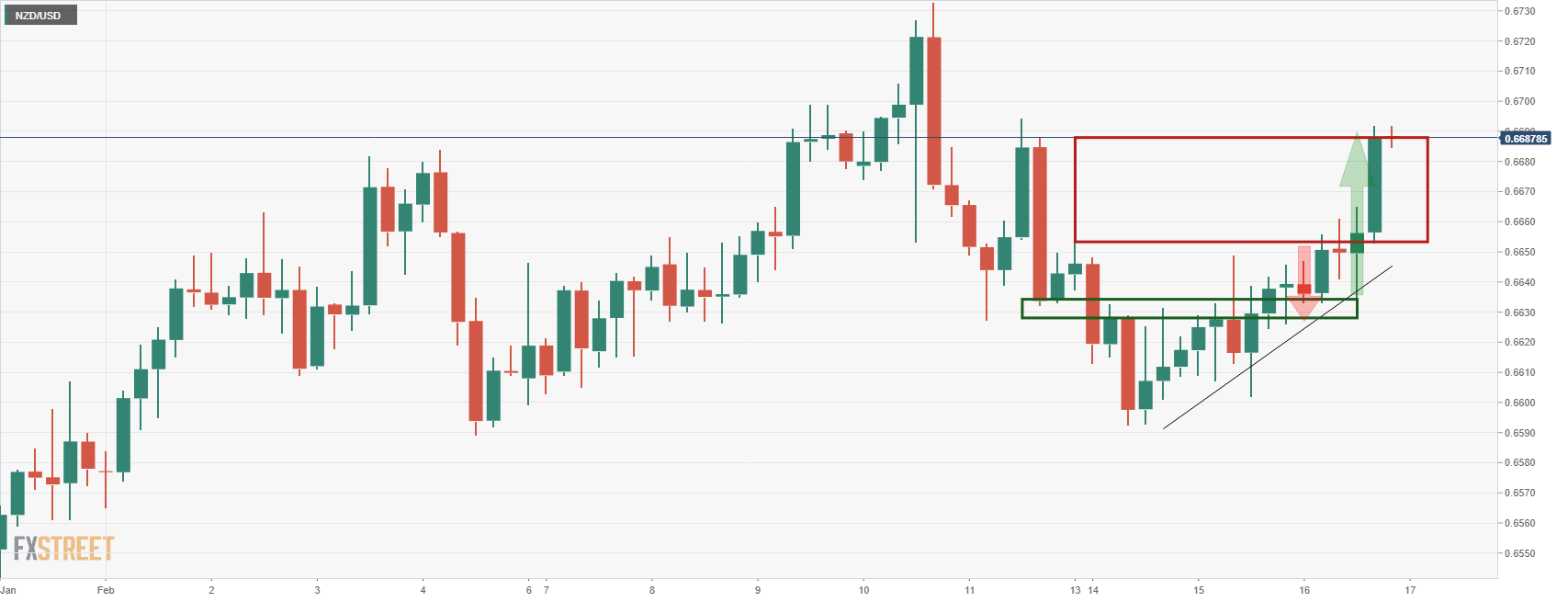

NZD/USD is reaching fresh corrective highs in the pursuit of the weekly wick as illustrated below. The kiwi is printing a high of 0.6691 following a rally from the lows of 0.6633.

The US dollar is bleeding out some of the 50bps rate hike premium that speculators had drilled into the markets in anticipation of the Federal Reserve's March meeting. This has followed a less than satisfying set of Federal Open Market Committee minutes released on Wednesday mid-afternoon, clipping the wings of the hawks that have been circling over the Fed March meeting.

The FOMC minutes from the January meeting noted that inflation was high and policy tightening was warranted soon, adding:” Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate”.

On Fed's holdings of bonds: ”The Committee expects that reducing the size of the Federal Reserve's balance sheet will commence after the process of increasing the target range for the federal funds rate has begun”. However, there was no confirmation that a 50 basis point hike was being considered and that was disappointing enough to derail the US dollar further.

The greenback has already been suffering from a steadier risk tone in financial markets despite the contracting sentiment surrounding Russian troops at the border of Ukraine. Instead, markets are clinging t hopes of diplomacy and the newswires that are creating hopes that the Ukraine situation will be de-escalated. Meanwhile, there is no local data for New Zealand today, so it will be all ears to the ground for further news related to the Russian/NATO standoff.

NZD/USD technical analysis

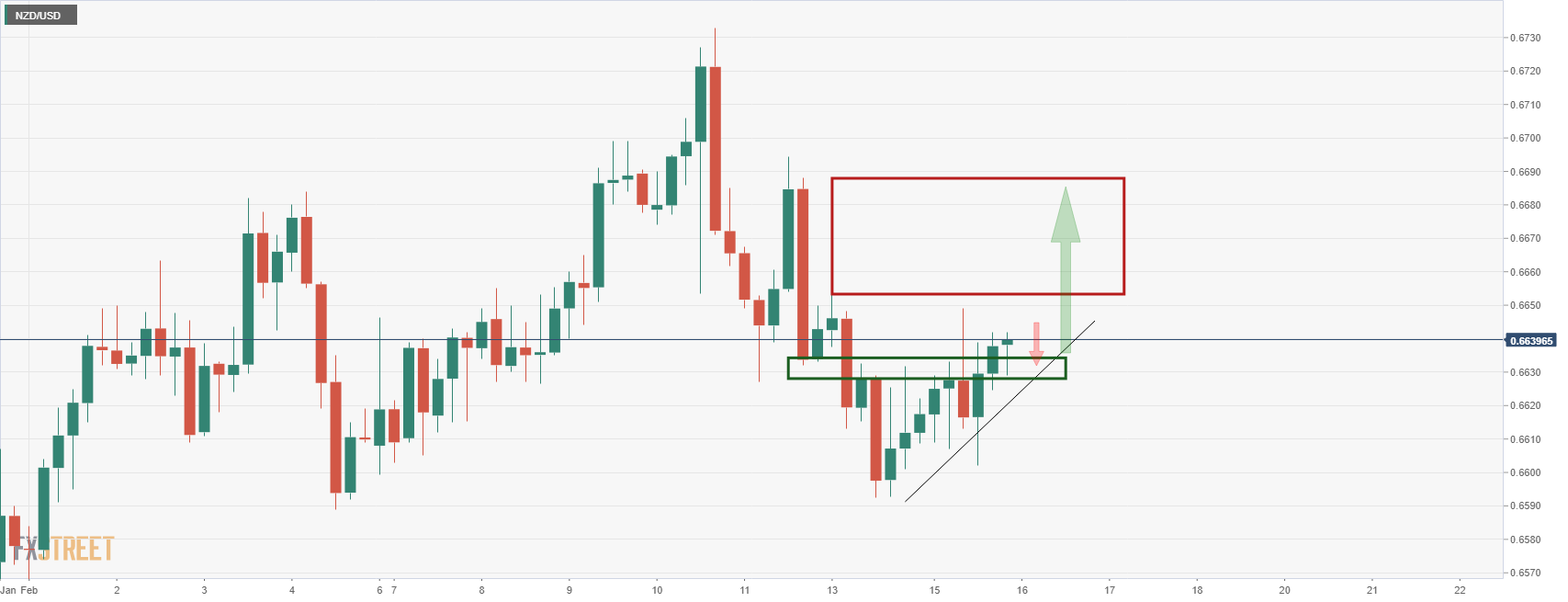

As per the prior analysis, NZD/USD bulls eye the 0.6650's and 6690's on Russia's withdrawal of troops, the price has reached the 0.6690's target in Wall Street's trade on Wednesday:

It was noted that ''the price had been creeping in on the old support turned to resistance but the prospects of a downside continuation were thwarted in New York's trade when the price broke to fresh corrective highs:

This leaves the bulls in play and there are prospects of a surge into the imbalance left between 0.6690's and the 0.6650's for the days ahead.''

NZD/USD live market

As illustrated, the price has continued in the forecasted trajectory. However, noting the weekly wick, there are prospects for higher still, as follows:

NZD/USD weekly chart

The price could now be destined to fill in the prior week's wick, mitigating the price imbalances on lower time frames and in turn completing a correction to the M-formation's neckline. Moreover, the price would be expected to retrace to a 50% mean reversion level through 0.67 the figure if not embark on a full retracement to the 61.8% golden ratio near 0.6750.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.