- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD Price Analysis: Bears weighing the price of oil vs equities, 1.2640 eyed

USD/CAD Price Analysis: Bears weighing the price of oil vs equities, 1.2640 eyed

- The price has formed a weekly pennant and the rising wedge could be subject to a breakout.

- Russian invasion could occur within 48hrs according to the US, risk-off is hurting high beta currencies.

The Canadian dollar was trying to strengthen against its US counterpart on Wednesday as global financial markets started off calm in Asia. However, risk sentiment flipped on its head with investors waiting to see Russian President Vladimir Putin's next move after he sent troops into separatist regions of Ukraine.

The news fell in just after the opening on Wall Street that Ukraine had planned to declare a state of emergency after warnings from the US that Russia will invade within 48hrs. Further reports enhanced the risk-off moves that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier.

Additionally, the price of oil has rallied on the news that the US will sanction the company building Russia's Nord Stream 2 pipeline. This leaves the outlook for CAD uncertain considering the high beta status it holds to global equities, commodity prices and specifically to oil:

-637812367521912757.png)

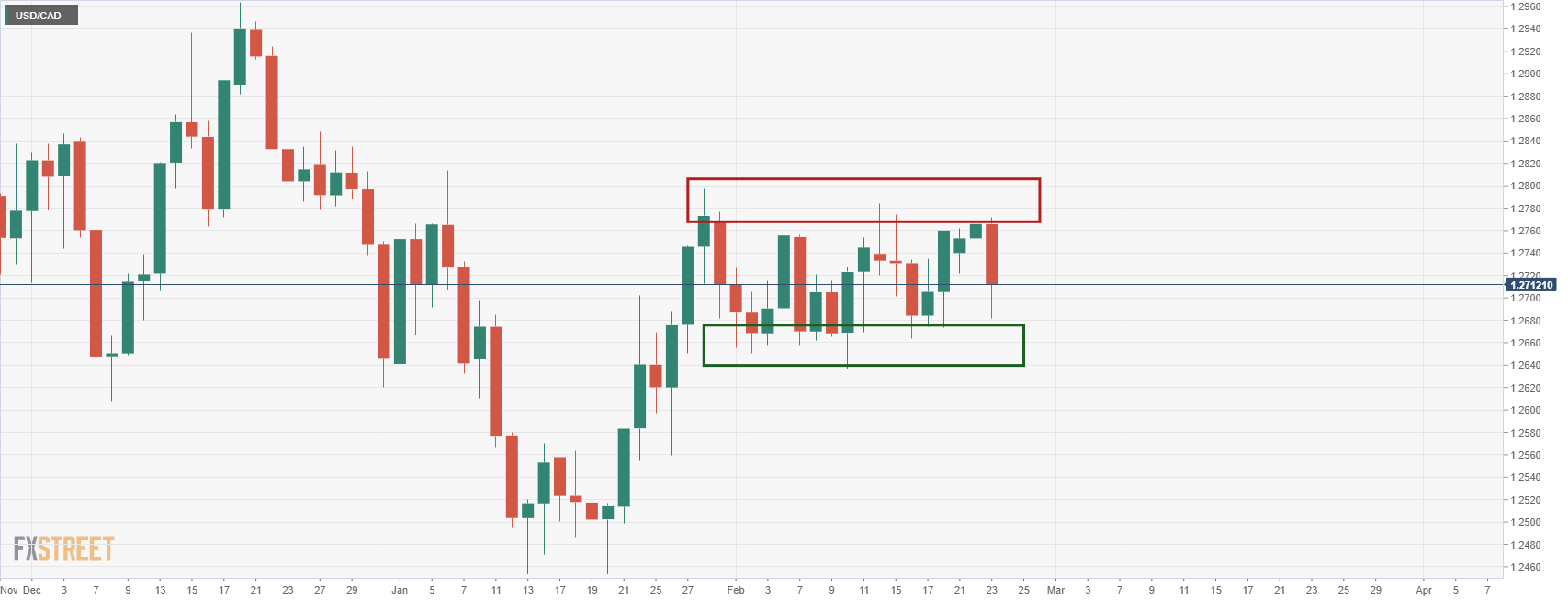

USD/CAD daily chart

From a technical perspective, the picture is no clearer given the price is stuck between a sideways daily channel as follows:

1.2640 is a key support level that guards a break of critical weekly structure.

USD/CAD weekly chart

However, the weekly chart may hold some clues:

The price has formed a pennant and given the current trajectory to the upside, the bias would be for a bullish breakout. However, when scaling out, the broader trend is bearish and the rising wedge could be subject to a breakout to target as low as 1.23 the figure:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.