- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- When is the RBA and how will it affect AUD/USD?

When is the RBA and how will it affect AUD/USD?

- RBA is expected to leave the target cash rate at 0.10%.

- AUD risks are skewed higher if the outcome leans more hawkish than dovish.

The Reserve Bank of Australia is slated for 0330 GMT today where, although no changes to policy settings are expected with the target cash rate staying at 0.10%, the focus will be the rhetoric concerning the timing of the tightening cycle.

The fourth quarter '21 wages were in line with its forecasts and this likely means that the central bank will reiterate that it can be 'patient'.

''The Q4'21 wages outcome makes a Jun'22 hike less likely. It's more likely the RBA shifts to a hawkish stance at that meeting and delivers a hike in Aug as we expect,'' analysts at TD Securities said.

How might the decision affect AUD/USD?

AUD risks are skewed higher if the outcome leans more hawkish than dovish, reflecting well-populated short positions which edged slightly lower according to the past Commitment of Traders report. The Aussie has been taking its cues from the external forces, such as higher inflation prospects, commodity prices and the Ukraine crisis. Risk has been mixed which has enabled the Aussie to chase higher levels at times of a recovery in the global stock markets.

Overall, the outcome would be expected to support AUD the Bank has just announced a move away from pandemic policy OMO settings. Moreover, Federal Reserve watchers have marked down their expectations of a 50bps hike at the forthcoming meeting which would be expected to keep a lid on the US dollar.

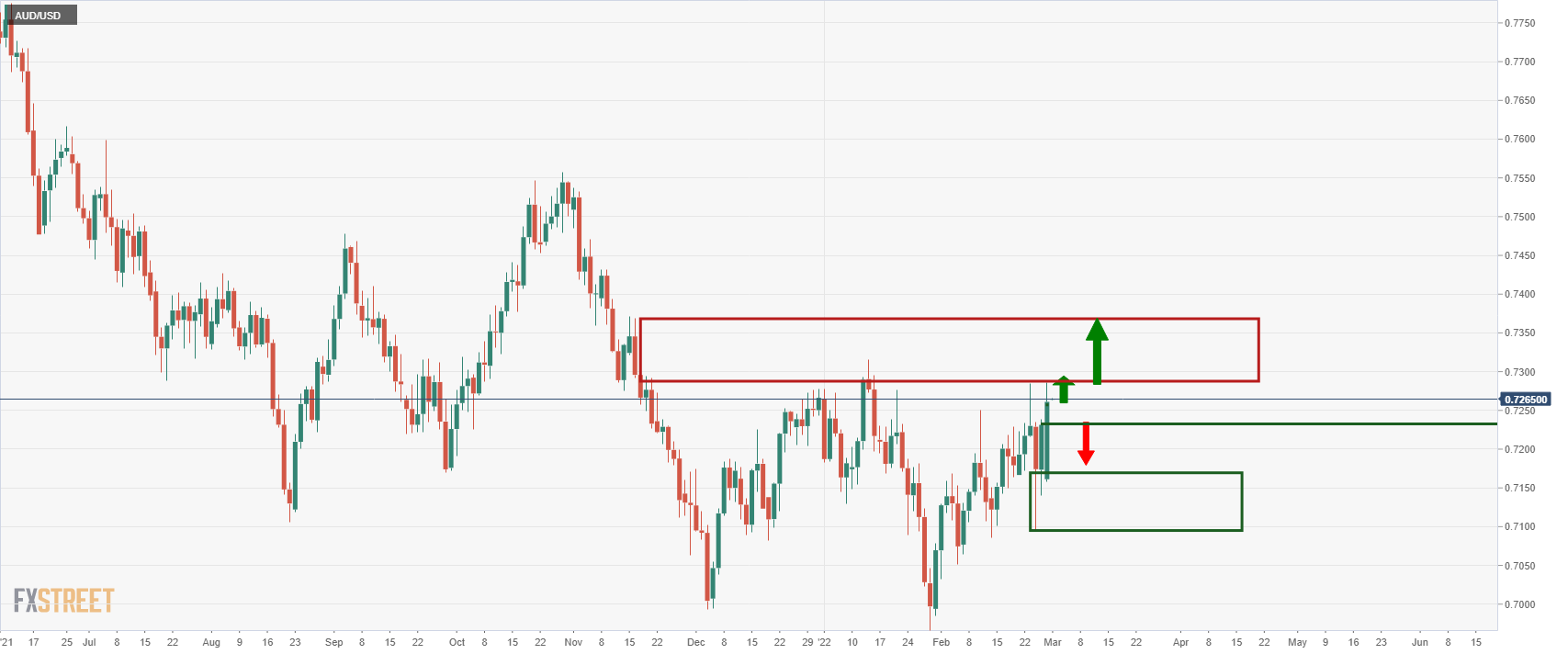

On the 15-min chart below, we can see that there is scope for a move into the 0.7280s to mitigate the imbalance of price and likely higher from there...

AUD/USD daily chart's prospects are bullish at this juncture with the 0.7350s eyed. However, a drop below 0.7230 will put the barton in the bear's hands again.

About the RBA

Decisions regarding this interest rate are made by the Reserve Bank Board, and are explained in a media release which announces the decision at 2.30 pm after each Board meeting.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.