- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD bulls run into a wall of resistance, eyes turn to 0.73 the figure

AUD/USD bulls run into a wall of resistance, eyes turn to 0.73 the figure

- AUD/USD is meeting resistance and the focus is back to the downside towards 0.73 the figure.

- Ukraine crisis and commodities are in focus, driving the price.

AUD/USD is firm in the late US session as bulls step in to slow down the bearish correction on the hourly chart. However, there are prospects for further resistance as illustrated in the technical analysis below. Meanwhile, the Australian dollar sped to the highest level since November 2021 vs the US dollar as monster gains in commodity prices looked set to shower Australian exporters in cash.

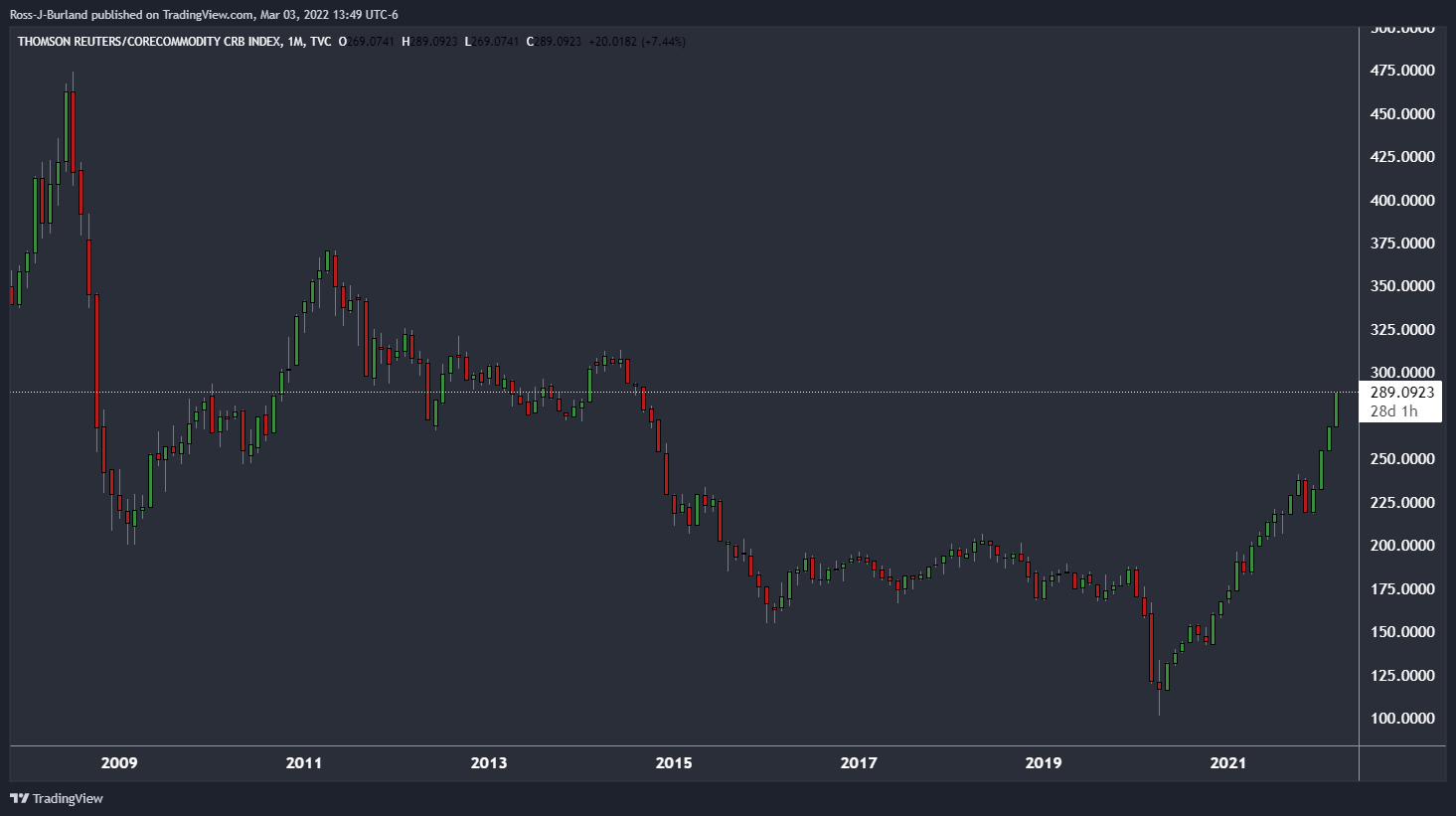

Commodities have taken off, as illustrated in the CRB Index below:

Ever-tightening sanctions on Russia have markets fearing major shortages in oil and energy, metals and wheat.

''Coal contracts rose between 25% and 50% on Wednesday as buyers sought to replace Russian supplies. The Australian government said it was helping countries connect with local coal producers to fill the gap,'' Reuters reported.

This brings us to Australia's surplus that was reported earlier in the week which ballooned to A$12.9 billion ($9.39 billion) on higher coal and iron ore earnings. This was the largest surplus on record and well above market forecasts of A$9 billion,'' Reuters explained and there is more in the pipeline according to Taylor Nugent, an economist at NAB. "Records will be broken in coming months if prices are sustained." Bigger earnings mean bigger flows out of the greenback into the Aussie as US dollar earnings are converted.

Meanwhile, as of yet, Russian troops have not made it to the Ukraine capital Kyiv as the invasion of Ukraine entered its eighth day Thursday. However, the mayor of Kherson said the strategic port city in Ukraine's south had been "captured" by Russian forces. The apparent capture of Kherson, situated on the Dnieper River, marks the first major city to fall into Russian hands as Ukrainians continue to defend key hubs across their country.

The focus has remained on a number of strategic cities, including the capital, Kyiv, Ukraine's second-biggest city, Kharkiv, and another key port city, Mariupol. In more positive news, Russia and Ukraine are agreeing to a ceasefire in heavily embattled areas where humanitarian corridors will be developed to allow the evacuation of its citizens from the bombed cities.

AUD/USD technical analysis

The price is stalling on the bid and following another failed attempt to rally, meeting the 61.8% Fibonacci level, the focus is back to the downside towards 0.73 the figure.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.