- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD regains the smile and advances beyond 1.0900

EUR/USD regains the smile and advances beyond 1.0900

- EUR/USD reverses the recent weakness and retakes 1.0900.

- Risk appetite shows some improvement on Tuesday.

- EMU flash Q4 GDP next of note in the calendar.

Finally, some respite for the European currency. In fact, the so far better mood in the risk complex lends support to the upside in EUR/USD to levels beyond 1.0900 the figure on turnaround Tuesday.

EUR/USD still under pressure on geopolitics

EUR/USD prints decent gains and manages to leave behind six consecutive sessions with losses, as market participants appear to favour the risk-associated galaxy early in the European morning.

Indeed, the better tone in the risk complex re-emerged in response to news citing the EU could be planning a massive joint bond sales to fund energy and defence spending against the backdrop of the current instability sparked in the wake of the Russian invasion of Ukraine.

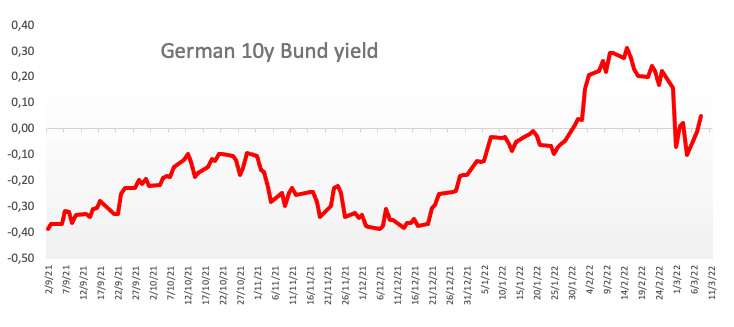

The daily recovery in the pair is also underpinned by the rebound in yields of the German 10y Bund back to the positive territory around 0.05%.

In the domestic calendar, German Industrial Production expanded at a monthly 2.7% in January. Later in the session, another revision of EMU GDP for the October-December period will take centre stage. In the US data space, Trade Balance and Wholesale Inventories are also to be published later in the NA session.

What to look for around EUR

EUR/USD collapsed to levels last seen in May 2020 near the 1.0800 yardstick on Monday, just to regain some composure afterwards. The European currency is expected to remain under heavy pressure for as long as the Russia-Ukraine conflict lasts along with the persistent risk aversion, altogether bolstering the “flight-to-safety” environment. In the longer run, occasional strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region.

Key events in the euro area this week: EMU Flash Q4 GDP (Tuesday) – ECB interest rate decision (Thursday) – Germany Final CPI.

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.40% at 1.0896 and faces the next up barrier at 1.1096 (10-day SMA) followed by 1.1293 (55-day SMA) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.0805 (2022 low Mar.7) would target 1.0766 (monthly low May 7 2020) en route to 1.0727 (monthly low Apr. 24 2020).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.