- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- PBOC leaves its MLF rate unchanged, Chinese stocks selling off to lowest levels since 2016

PBOC leaves its MLF rate unchanged, Chinese stocks selling off to lowest levels since 2016

The Peoples Bank of China has left its MLF rate unchanged which has weighed on Chinese stocks in the open as a 5 to 10 basis point cut was priced in.

China's central bank was expected to roll over maturing medium-term policy loans and cut borrowing costs for the second time this year, a Reuters poll showed on Monday, as the a fresh wave of coronavirus infections weighs on the broader economy.

Reuters reported that twenty-nine out of the 49 traders and analysts, or 59% of all participants, predicted a reduction to the interest rate on one-year medium-term lending facility (MLF) when the central bank is set to renew 100 billion yuan ($15.75 billion) worth of such loans on Tuesday.

Meanwhile, China’s government has ordered a province of 24 million people into lockdown as it tries to contain the new outbreak that has spread to multiple locations. The risk to markets is that the lockdowns could trigger shock waves across global supply chains.

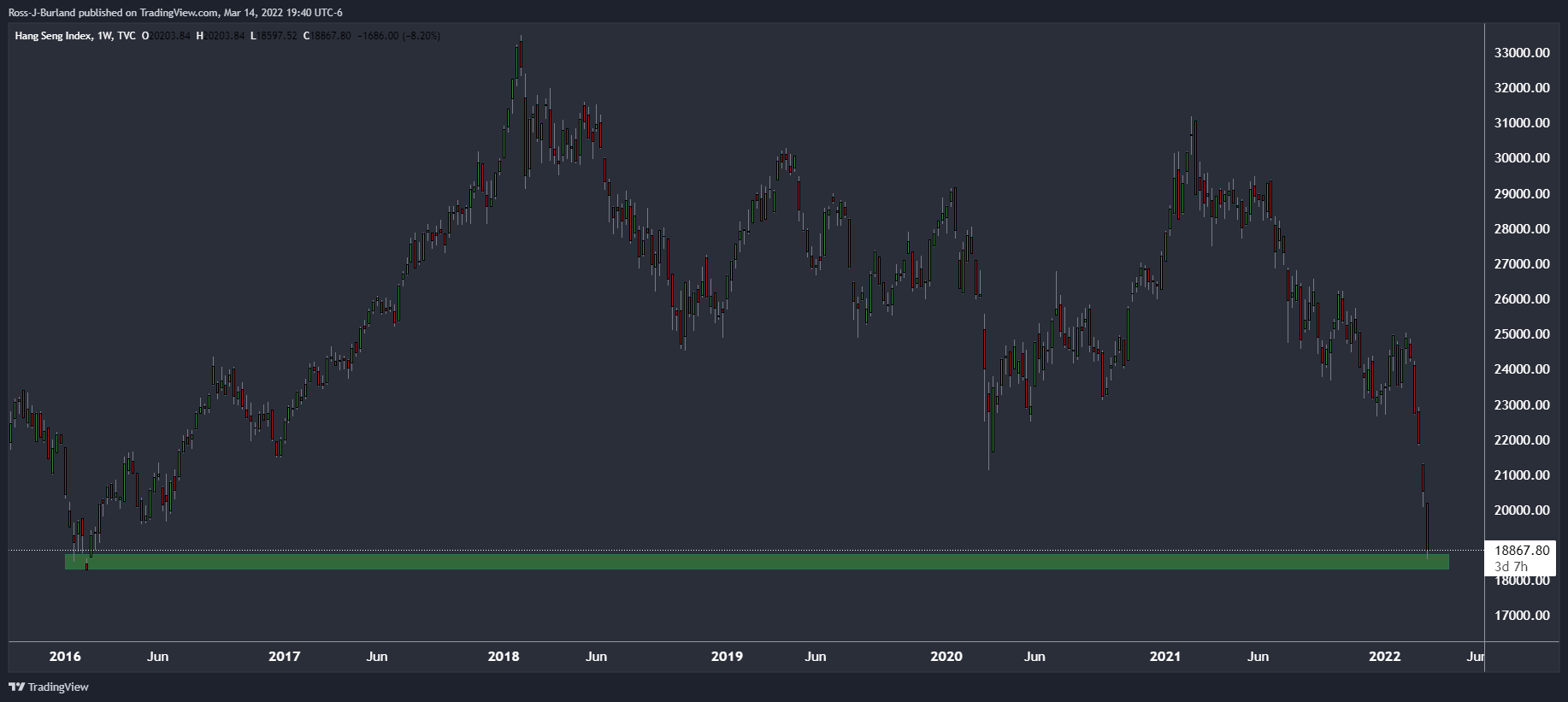

At the time of writing, the Hang Seng Index is down 3.82%, marking the lest levels since 2016:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.