- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/JPY Price Analysis: Faces solid resistance around 154.60, braces to the 154.10s

GBP/JPY Price Analysis: Faces solid resistance around 154.60, braces to the 154.10s

- The British pound rally continues vs. the Japanese yen.

- Positive UK labor data and GDP further cement a BoE’s rate hike.

- GBP/JPY Price Forecast: Neutral-upward biased, but downside risks remain due to solid resistance around the 154.60-155.00.

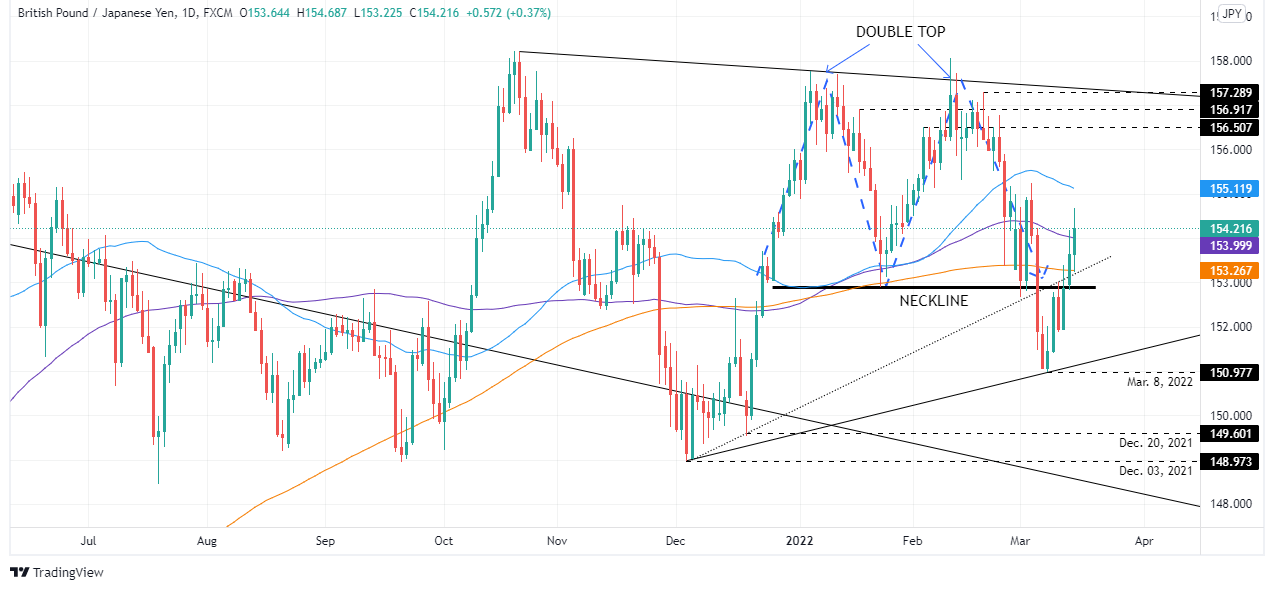

GBP/JPY extends its rally to three straight days, thus negating the double-top chart pattern, as the cross-currency pair turns bullish on a positive UK employment report amid a mixed market mood. At the time of writing, the GBP/JPY is trading at 154.21.

Late in the New York session, the market mood is “somewhat” positive, as portrayed by US equities trading with gains. In the FX space, safe-haven peers trade softer as the trading day progresses.

Goodish UK data and a “hawkish” BoE to lift the pound

Data-wise, the UK reported employment figures, which beat expectations, thus raising the prospects of the GBP. Along with last Friday’s solid GDP data, those figures and the Bank of England (BoE) third rate hike on Thursday would keep the GBP buoyant against the JPY.

Overnight, the GBP/JPY climbed near the 154.50 area but plunged 100-pips, though recovered on risk-appetite near the 154.50 area, which is a strong resistance level, difficult to break for GBP/JPY bulls.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is neutral-upward biased. The longer time-frame daily moving averages (DMAs) like the 100 and the 200-DMAs reside below the spot price, a sign of bullishness in the pair. Contrarily the 50-DMA is at 155.11, above the spot price, and due to the last couple of candles, the 154.60-155.00 area would be a solid resistance area to overcome.

Upwards, the GBP/JPY first resistance would be March 15 high at 154.68. Breach of the latter would expose the 155.00 mark but beware of a possible consolidation in the 154.60-155.00 range. Nevertheless, a decisive break of the former would expose 156.00.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.