- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/TRY rose to 2-day highs near 14.80 post-CBRT

USD/TRY rose to 2-day highs near 14.80 post-CBRT

- USD/TRY picks up upside traction to the vicinity of 14.80.

- The CBRT kept the policy rate unchanged at its meeting.

- The central bank’s “liraization” strategy remains in place.

The Turkish lira sheds some ground and motivates USD/TRY to advance to 2-day peaks near 14.80 on Thursday.

USD/TRY up on steady CBRT

The lira surrenders part of the gains recorded in the last four sessions after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 14.00% at its event on Thursday, in line with market expectations.

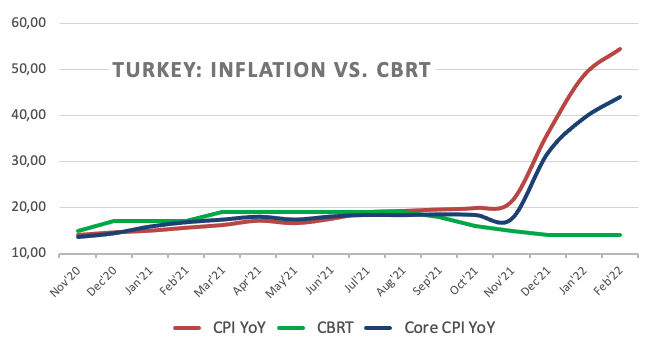

Indeed, the CBRT left no room for surprises at Thursday’s meeting despite the war in Ukraine put energy prices under further upside pressure against the domestic backdrop of an already rampant inflation.

It is worth recalling that inflation in Turkey rose beyond 50% in the year to February largely reflecting the collapse of the lira. However, soaring energy prices in the current context does nothing but exert extra pressure on consumer prices while undermining at the same time the morale among households.

In its statement, the CBRT reinforced the “liraization” strategy, all eventually aiming at achieving the medium-term inflation goal at a very optimistic 5%

What to look for around TRY

The lira regained some poise in past sessions and abandoned the area of YTD lows vs. the US dollar around the 15.00 zone (March 11). In the very near term, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the progress of the peace talks in the Russia-Ukraine front. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: CBRT Meeting (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 1.50% at 14.7950 and a drop below 14.5217 (weekly low Mar.15) would expose 13.7063 (low Feb.28) and finally 13.5091 (low Feb.18). On the other hand, the next up barrier lines up at 14.9889 (2022 high Mar.11) seconded by 18.2582 (all-time high Dec.20) and then 19.00 (round level).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.