- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index extends the upside to the 99.00 area

US Dollar Index extends the upside to the 99.00 area

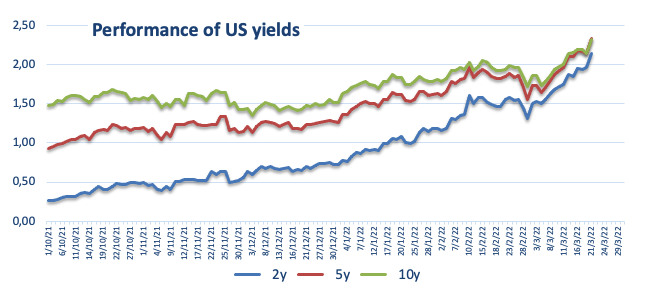

- DXY advances further and approaches 99.00.

- US yields pushes higher to new cycle tops.

- Fedspeak, Richmond Fed index next in the docket.

The US Dollar Index (DXY), which measures the greenback vs. a bundle of its main competitors, maintains the bid bias unchanged near the 99.00 region on Tuesday.

US Dollar Index stronger on yields, risk-off

The index extends the march north for the third session in a row on Tuesday and trades at shouting distance from the 99.00 barrier as market participants keep adjusting to the recent hawkish message from Chief Powell, the move higher in US yields and the persistent uncertainty surrounding the war in Ukraine.

Indeed, US yields across the curve move further up after Chair Powell expressed his concerns over the elevated inflation and opened the door to a faster pace of the Fed’s tightening cycle. On this, Powell even considered the probability of a 50 bps rate hike in May.

Currently, and according to CME Group’s FedWatch Tool, the probability of a 50 bps interest rate hike at the May 4 meeting is at almost 64%, up from around 50% just a week ago.

In the US data space, the Richmond Fed Index will be the sole release along with speeches by NY Fed J.Williams (permanent voter, centrist), San Francisco Fed M.Daly (2024 voter, hawkish) and Cleveland Fed L.Mester (voter, hawkish).

What to look for around USD

The index extends further the bounce off last week’s lows in the sub-98.00 area following the start of the tightening cycle by the Federal Reserve at its meeting on March 16. Concerns surrounding the geopolitical landscape prop up further the demand for the buck in combination with the offered stance in the risk-associated complex. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should underpin inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains well supported by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed and the solid performance of the US economy.

Key events in the US this week: MBA Mortgage Applications, Fed Powell, New Home Sales (Wednesday) – Initial Claims, Durable Goods Orders, Flash PMIs (Thursday) – Final Consumer Sentiment, Pending Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.26% at 98.73 and a break above 98.96 (weekly high March 22) would open the door to 99.29 (high March 14) and finally 99.41 (2022 high March 7). On the flip side, the next down barrier emerges at 97.72 (weekly low March 17) followed by 97.71 (weekly low March10) and then 97.44 (monthly high January 28).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.