- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU runs to fresh daily highs in risk-off themes

Gold Price Forecast: XAU runs to fresh daily highs in risk-off themes

- Gold moves higher for a fresh daily high on Wednesday.

- Risk-off is the theme and safe-haven flows are benefitting the gold price.

The price of gold is higher in mid-week trading as US stocks fell sharply following Moscow's plans to switch its natural gas sales to some countries to roubles. This has sent oil prices and tensions higher in global financial markets. At the time of writing, the gold price is trading near the highs of the day at $1,947.25. The yellow metal rallied from a low of $1,915.64 earlier in the day and is set on a fresh daily high and a bullish close.

Responding to Western sanctions that have hit Russia's economy hard, President Vladimir Putin said Moscow will seek payment in roubles for gas sales from "unfriendly" countries, while its forces bombed areas of the Ukrainian capital Kyiv a month into their assault

Prices for commodities such as oil and wheat have climbed as tensions in Ukraine have escalated, putting additional upward pressure on already high inflation due to supply chain bottlenecks. Rising inflation has led many central banks, including the US Federal Reserve, to take measures to rein in prices, such as by raising interest rates. However, gold can also benefit from the safe-haven flows amid the uncertainties surrounding the war.

''Market participants are keenly watching US 10-year rates as they approach a trend-channel that has served multi-decade-long resistance. In this context, gold prices have remained incredibly resilient despite the explosive price action in rates markets following Chair Powell's comments,'' analysts at TD Securities explained.

US 10-year yield trend channel

The above chart illustrates the trend channel as the 10-year yield move sin towards 2.5%.

''While rates markets are now pencilling in higher odds for a 50bp hike in May, gold markets could be reflecting a growing cohort of participants interpreting the Fed's hiking path as being behind the curve on inflation, as the Fed moves too slowly and cautiously to tame inflation,'' the analysts at TD Securities said

''In this context, gold prices once again narrowly avoided catalyzing a massive CTA liquidation program last session, but the margin of safety remains low. Such a liquidation event would raise risks that safe-haven buyers could offload length in a vacuum concurrently with massive CTA liquidations. Fortunately, Shanghai traders have seemingly ended a period of liquidations and have meaningfully added to their gold in recent trading sessions.''

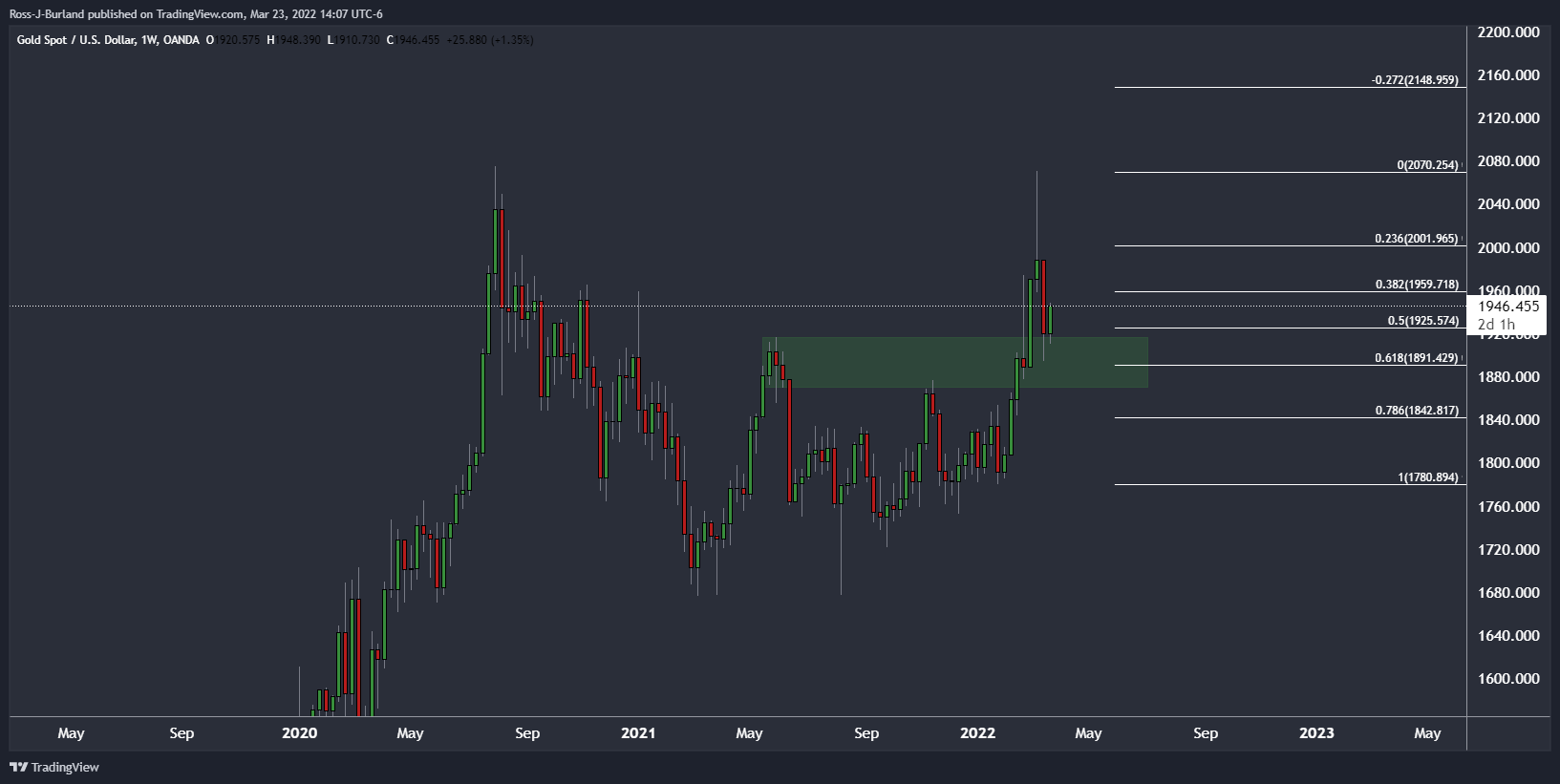

Gold technical analysis

The price is completing a 50% mean reversion of the monthly bullish impulse, as illustrated on the weekly chart where the price meets the prior highs and support block. This could see demand move in again and an extension of the upside in the comings weeks.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.