- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD running higher as US dollar slides to test day's lows

GBP/USD running higher as US dollar slides to test day's lows

- GBP/USD bulls step up the pace in the hint for the 1.3160s.

- The US dollar bleeds as the focus remains on a breakthrough in peace talks Russia/ Ukraine.

GBP/USD is trading around 1.3110 and near the highs of the day as the US dollar slides. Sterling underperformed, returning to around 1.3100, net flat overnight, although the pair is picking up a bid in Asian markets ahead of the European open as Asia shares joined a global rally on Wednesday.

The hope for a negotiated end to the Ukraine conflict is keeping spirits alive and adding riskier currencies, such as the pound. The bond markets have signalled concern that aggressive rate hikes could damage the US economy after 10-year yields briefly dipped below two-year rates, but markets are shrugging this off.

The focus is on Russia and Ukraine whereby the Russians have promised to scale down military operations around Ukraine's capital and north, while Kyiv proposed Ukraine join the EU while adopting neutral status by not joining NATO. The peace talks are taking place in an Istanbul palace more than a month into the largest attack on a European nation since World War II.

''Talks successful enough for a possible meeting between Putin and Zelensky, says Ukrainian presidential advisor Mykhailo Podolyak. “We have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

European currencies have generally been under pressure vs. the USD in the spot market given concerns about energy security and/or the economic impact of higher prices for gas and oil. However, the energy sector has tailed off in the hopes of a breakthrough in peace talks and a potential ceasefire. Net short GBP positions increased noticeably for a third week as concerns rise as to the cost of living crisis in the UK, so any signs of relief there are bound to support the pound in the spot market as inflation concerns abate.

Meanwhile, the Old Lady's Governor Andrew Bailey acknowledged that the Bank of England softened its guidance on rate hikes this month to reflect the high level of economic uncertainty. ''At the March 17 decision, the bank said that further tightening of policy “might be” appropriate in the coming months vs. the forward guidance in February, when such a move was seen as “likely.” Bailey said that while it’s been appropriate for the BoE to tighten policy under current circumstances, forward guidance should reflect the current heightened uncertainty,'' analysts at Brown Brothers explained.

''WIRP suggests a hike at the next meeting May 5 is fully priced in, with around 30% odds of a 50 bp move then vs. 50% before Bailey’s comments. Swaps market now sees the policy rate peaking near 2.25% over the next 24 months, down from 2.5% before Bailey’s comments but still up from 2.0% at the start of last week.''

Key data events

Looking ahead for the week, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

GBP/USD technical analysis

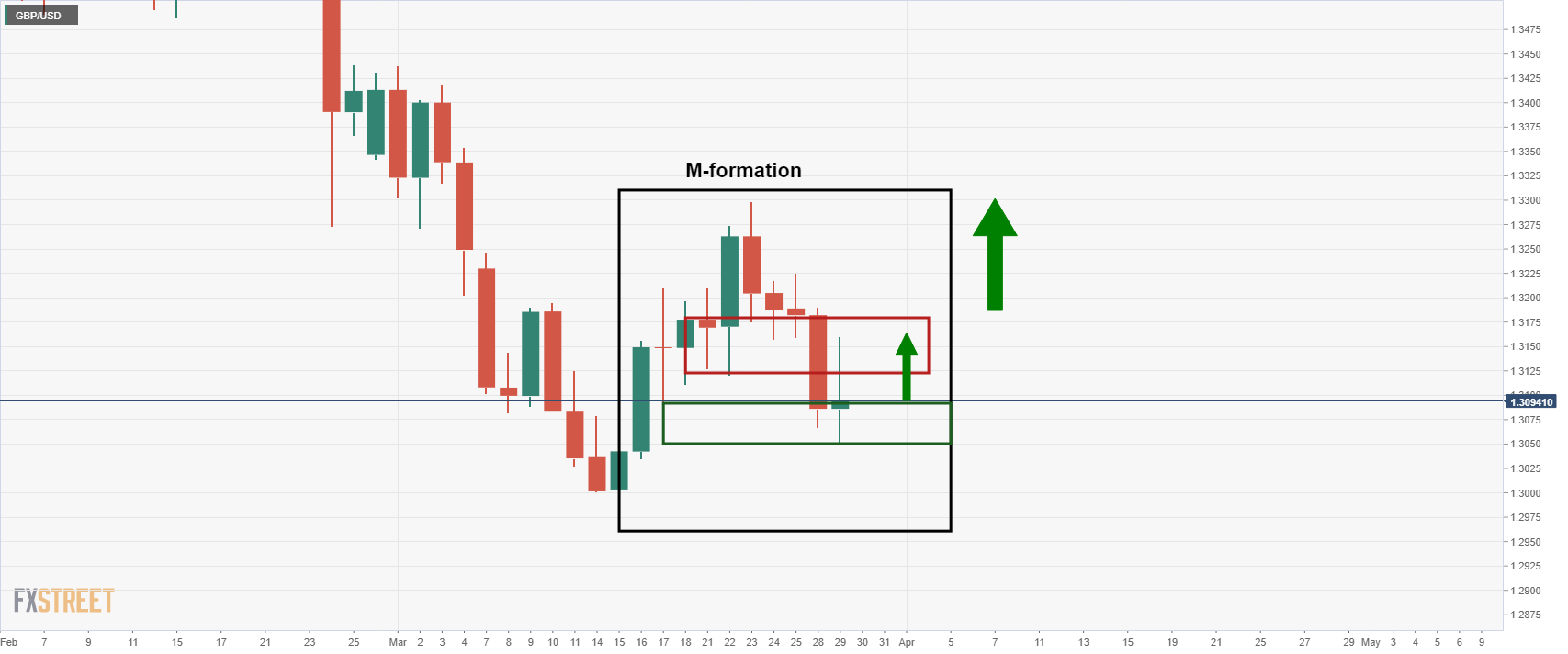

The following illustrates the pound's bullish trajectory on the daily chart in an M-formation:

GBP/USD daily chart

The chart above was from the prior day's close. The price is now higher in Asia as it attempts to recover towards the neckline of the formation:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.