- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD pivoting around critical $1,935 barrier ahead of NFP – Confluence Detector

Gold Price Forecast: XAU/USD pivoting around critical $1,935 barrier ahead of NFP – Confluence Detector

- Gold price is testing bearish commitments ahead of the critical US NFP.

- The US dollar firms further as Treasury yields rebound. Peace talks also eyed.

- Gold Price Analysis: XAU/USD flirts with a key daily 61.8% golden ratio.

Gold price has kicked off a new quarter on a positive note, consolidating the recent recovery ahead of the all-important US Nonfarm Payrolls release. This week’s corrective pullback in the US Treasury yields across the curve has boded well for the non-yielding gold, as the bond rout took a breather. Looking forward, it remains to be seen if gold price can sustain the upside, as investors await the US jobs data, which will likely seal in a 50bps May Fed rate hike. Also, in focus remains the Russia-Ukraine online peace talks due later this Friday.

Read: US March Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

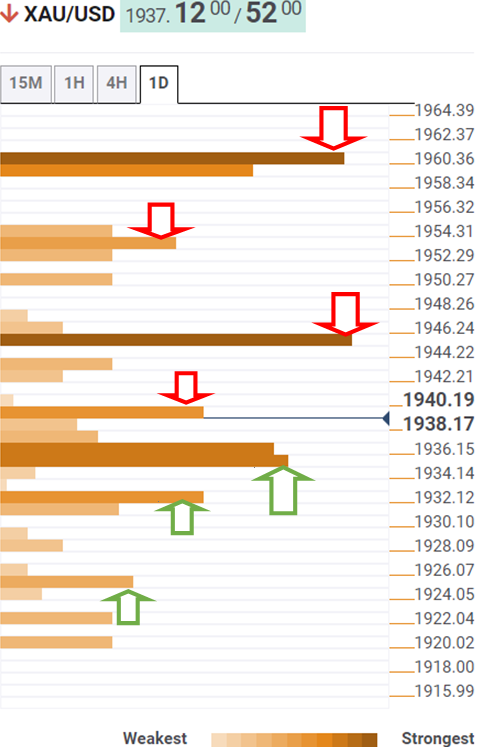

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price is testing the Fibonacci 38.2% one-day at $1,939, as it target the next upside target at $1,943 – the Fibonacci 23.6% one-day.

Gold bulls need to crack the $1,946, the Fibonacci 38.2% one-week, to accelerate the bullish moves towards $1,953. That level is the confluence of the Fibonacci 23.6% one-week, Bollinger Band one-day Middle and pivot point one-day R1.

The intersection of the previous year’s high and the Fibonacci 61.8% one-month at $1,960 will be the level to beat for gold buyers.

On the flip side, the immediate cushion is seen at $1,935, where the SMA5 one-day converges with the SMA200 four hour.

Acceptance below the latter will call for a test of the $1,931 demand area, the Fibonacci 61.8% one-week and one-day.

The next relevant downside cap is pegged at $1,925, which is the pivot point one-week S1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.