- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/CAD is firm at the start of the week, bulls eye significant correction

USD/CAD is firm at the start of the week, bulls eye significant correction

- USD/CAD is firm in the opeb, bulls eye 1.26 the figure for the days ahead.

- Fed and solid US dollar with weakening oil are helping to lift the pair.

USD/CAD is starting out the week on the front foot as the US dollar picks up a bid following Friday's Nonfarm Payrolls mixed data. The positive revisions and a dip in the Unemployment Rate have fortified the speculation of a hawkish Federal Reserve, underpinning the greenback.

At 1.2522, USD/CAD is trading 0.11% higher after popping from a low of 1.1511 to a session high of 1.2526 so far. The greenback starts the week off higher, helped by robust US job growth numbers for March and in anticipation that the Federal Reserve will increase the pace of interest rate hikes in an effort to blunt rising inflation.

431,000 new jobs were added. While the headline was below the estimates of 490,000, data for February job increases were revised higher. Additionally, the Unemployment rate fell to 3.6%, the lowest since February 2020. Hourly earnings for February were revised back to 0.1%, which along with the March figure, indicates the heat may be coming off the US labour market. Nevertheless, the DXY was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested.

Meanwhile, commodity markets ended the week lower, driven by a sharp fall across energy markets as supply shortages eased. Concerns about weak economic activity in China also weighed on sentiment. Overall, the CAD trades as a proxy for commodities and as such, it is underperforming alongside the drop in oil. Crude made further losses on Friday as the market comes to terms with the massive release of oil from the US strategic reserve, analysts at ANZ Bank explained.

''The announcement earlier in the week that the US would release as much as 180mbbls of oil over six months saw Brent crude and WTI fall more than 10%. US President Joe Biden said he expects the IEA members will add another 30-50mbbls to their efforts.'' However, the analysts explained, ''even so, this may not be enough. Amos Hochstein, US State Department’s senior energy security advisor, said that the market is short about 2mb/d, if not more.''

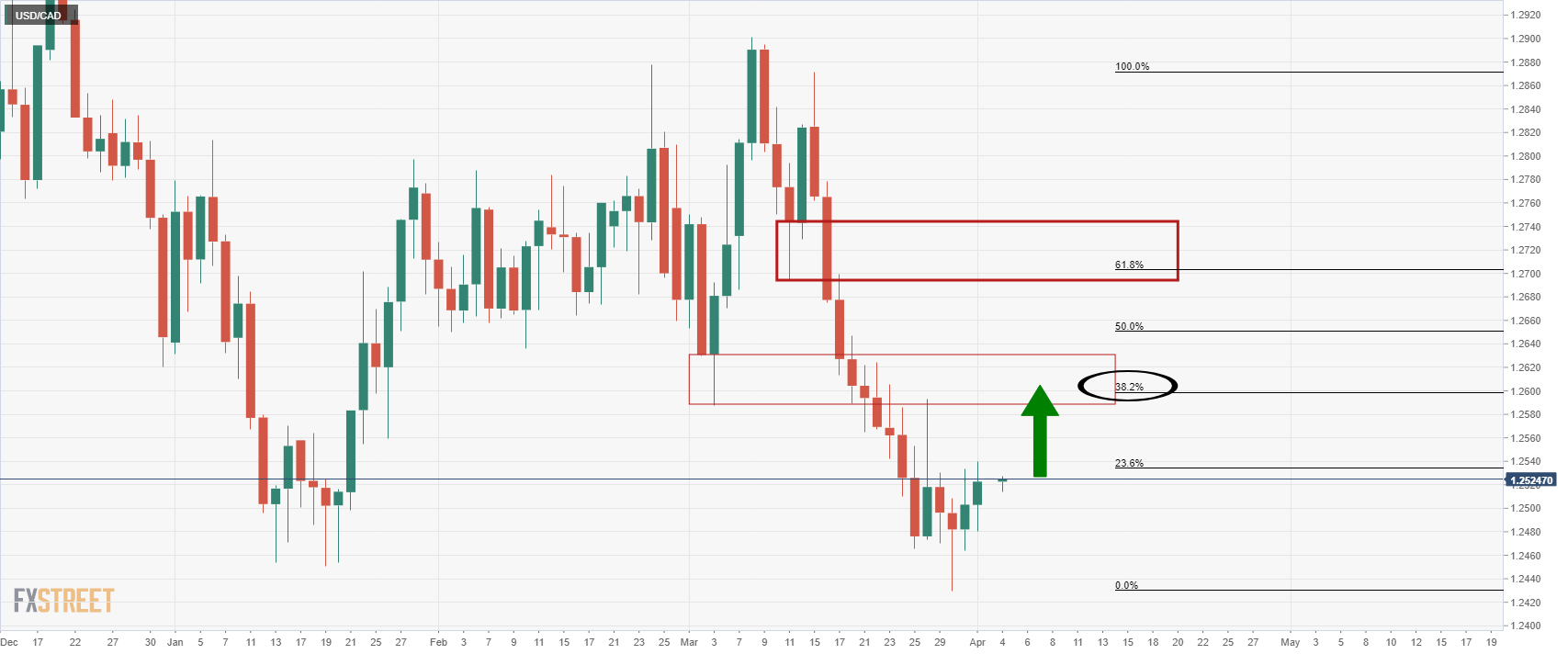

USD/CAD technical analysis

The M-formation is a reversion pattern and the price would be expected to revert to the 38.2% Fibonacci retracement level near 1.26 the figure in the coming days.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.