- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bulls likely to target $1,966 resistance – Confluence Detector

Gold Price Forecast: XAU/USD bulls likely to target $1,966 resistance – Confluence Detector

- Gold scaled higher through the early European session and shot to a two-week high on Monday.

- The Ukraine crisis, worries about rising inflation continued acting as a tailwind for the commodity.

- The Fed’s hawkish outlook, surging US bond yields might cap gains ahead of the US CPI on Tuesday.

Gold attracted some follow-through buying on Monday and shot to a two-week high during the early part of the European session. Investors remain concerned about the potential economic fallout from the war in Ukraine, which was evident from a generally weaker tone around the equity markets. This, in turn, continued benefitting traditional safe-haven assets and pushed spot prices higher, taking along some short-term trading stops near the $1,950 level. Apart from this, worries that the recent surge in commodity prices will put upward pressure on the already high consumer prices further bolstered the commodity's appeal as a hedge against rising costs. That said, expectations that the Fed would tighten its monetary policy at a faster pace to combat stubbornly high inflation could act as a headwind for the non-yielding yellow metal. Hence, the market focus will remain glued to the latest US CPI report, due for release on Tuesday.

Gold: Key levels to watch

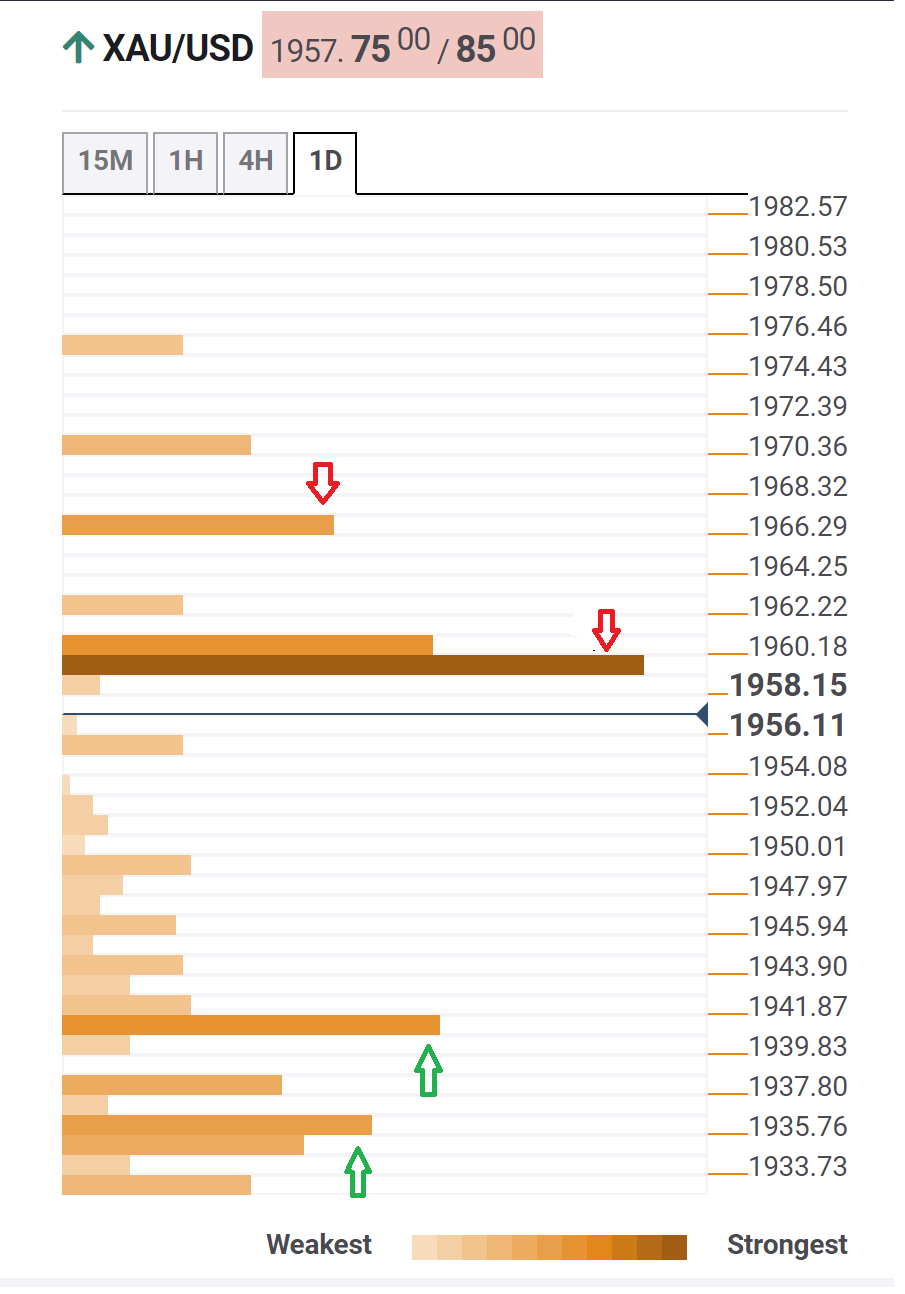

The Technical Confluences Detector shows that spot gold price was flirting with its immediate upside barrier near the $1,958-$1960 region. The said resistance is the convergence of the Fibonacci 61.8% one-month, Bollinger Band one-day Upper and Pivot Point one-week R1. The next relevant hurdle is pegged near the $1,966 zone, or the March 23 high, which if cleared should pave the way for additional near-term gains.

On the flip side, immediate support is pegged near the $1,940 area, comprising of the Fibonacci 38.2% one day and the Fibonacci 23.6% one week. This is closely followed by the Bollinger Band one-day Middle, around the $1,934 region, which if broken decisively could negate prospects for any further near-term appreciating move.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.