- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- GBP/USD bears are on the prowl into hourly support, eye a break to 1.2980

GBP/USD bears are on the prowl into hourly support, eye a break to 1.2980

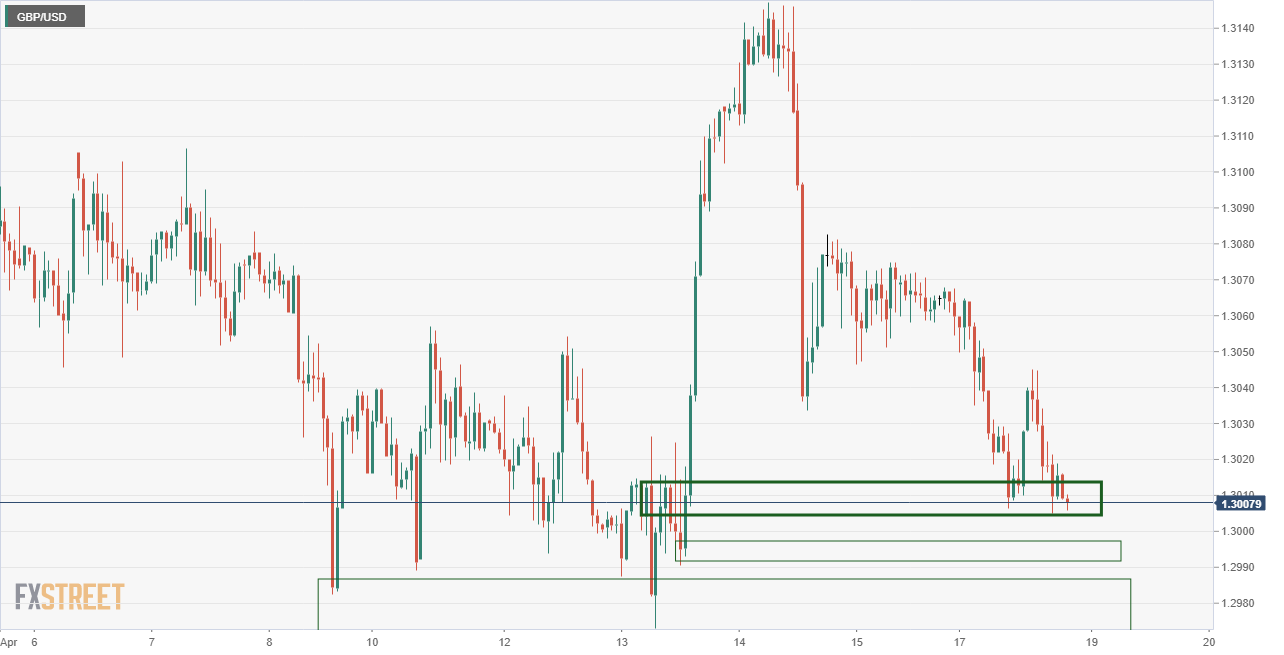

- GBP/USD is sliding into hourly support on the back of a strong US dollar in holiday thin trading.

- Traders will focus on the Fed and BoE speakers this week.

GBP/USD is on the back foot, falling from a high of 1.3064 to a low of 1.3004, down some 0.37% at the time of writing. There were no UK data releases scheduled for Monday and markets have been closed for the Easter Monday Bank holidays.

Instead, the focus has been on the US dollar which has been firmer against its major trading partners ahead of a light data schedule. The week's data highlights include home construction on Tuesday, Existing Home Sales on Wednesday, and Weekly Initial Jobless Claims on Thursday. The Federal Reserve will release its Beige Book summary of economic conditions on Wednesday. Before then, St. Louis Fed President James Bullard speaks at 4:00 pm ET today on the economic and policy outlook.

Meanwhile, the minutes of the March 15-16 Federal Open Market Committee meeting released last week point to a more hawkish Fed. The greenback is supported by firm rates in the US in expectation of a 50 bps rate hike at next month's meeting, May 3-4 meeting. Therefore, the comments from Bullard today will be important before the observed quiet period begins on Saturday.

Similarly, traders will be on the lookout for commentary from the Bank of England's Governor Andrew Bailey who speaks twice on the economy this week. This will offer a strong platform to discuss his dovish views on the BoE's policy stance. ''Thursday's discussion at PIIE is likely to be the most important, but he'll address inflation on an IMF panel on Friday as well. External MPC member Mann speaks on decision-making under uncertainty earlier Thursday as well,'' analysts at TD Securities explained.

GBP/USD technical analysis

The price is reaching hourly support but a break here opens the risk of mitigation of the price imbalance between here and 1.2990/80.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.