- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/USD plummets and reaches a fresh monthly low at 0.7235 on dismal sentiment and Fed commentary

AUD/USD plummets and reaches a fresh monthly low at 0.7235 on dismal sentiment and Fed commentary

- The Australian dollar plunged more than 100-pips amid a risk-off market mood.

- Fed Chief Jerome Powell spooked investors as he said that a 50-bps increase in May is “on the table.”

- AUD/USD Price Forecast: A tweezers-top in the daily chart exacerbated a move towards the 0.7200 region.

The AUD/USD extends Thursday’s losses and plummets 130-pips as market mood deteriorates. Fed policymakers continued telegraphing a 50-bps rate hike in the May meeting, while some investment banks expect even 75-bps increases. At the time of writing, the AUD/USD is trading at 0.7248

US equities reflect the abovementioned mood in the market, recording losses. The US 10-year Treasury yield records modest losses of one basis point, currently at 2.903%, while the greenback remains buoyant as shown by the US Dollar Index, gaining 0.55%, which was last seen at 101.180.

Fed Chief Jerome Powell put 50-bps increases in May “on the table”

In the week, some Fed officials expressed that the US central bank needed to move “expeditiously” towards neutral and emphasized that 50-bps hikes to the Federal Funds Rates (FFR) might be required. Even St. Louis Fed President Bullard stated that a 75-bps rate hike had to be considered. However, the words that resounded were made by Fed Chair Powell, who commented that a 50-bps rate hike in the May meeting “is on the table,” spooking investors as bond yields rose while US equities tumbled on Friday, their worst loss in the week.

Meanwhile, Nomura was in the headlines with a prediction that after a 50 bps rate hike in May, the Fed would follow up with two 75 bps rate hikes in June and July.

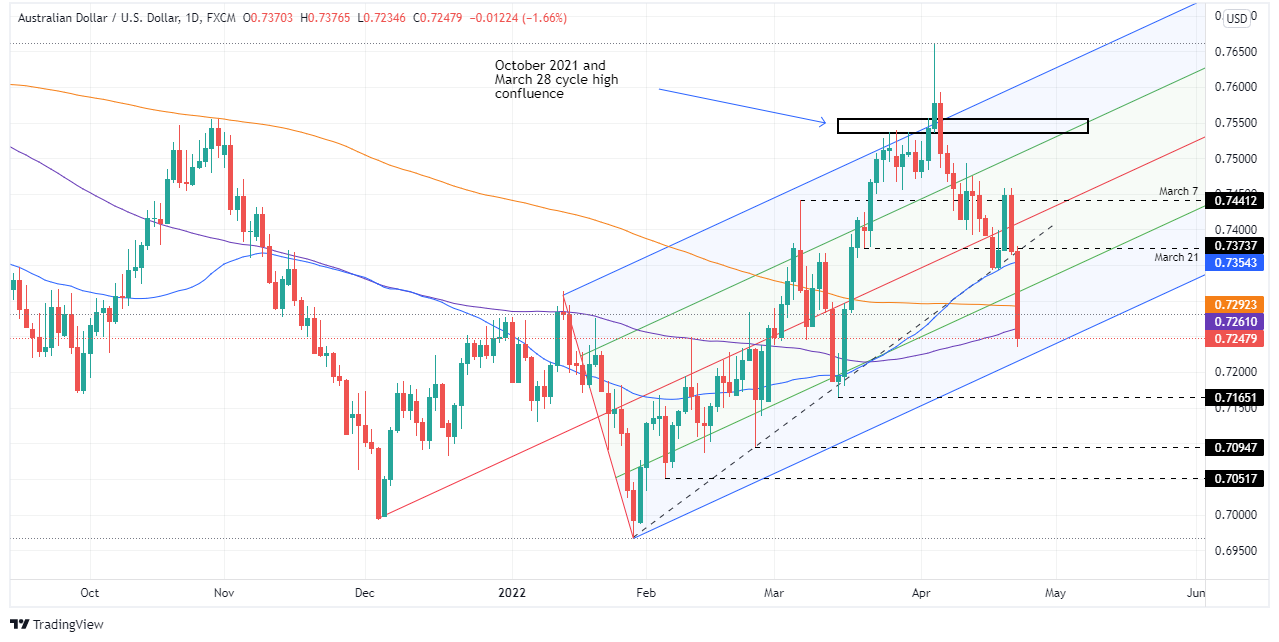

AUD/USD Price Forecast: Technical outlook

In Thursday’s article, I mentioned that “Thursday’s price action reversed Wednesday’s gains forming a tweezers top candle chart pattern,” a signal which means that selling pressure overtook buyers, “threatening to push prices further down.”

That’s what happened on Friday. The AUD/USD is 20-pips below the 100-day moving average (DMA) after plummeting 130-pips and leaving the 50 and the 200-DMA above the exchange rate, meaning that the AUD/USD could shift bearish if certain conditions are met.

If the AUD/USD Friday close is below the 100-DMA, that will exacerbate a move towards 0.7000; however, there would be some hurdles on its way down. If that scenario plays out, the AUD/USD first support would be 0.7200. Break below would expose March’s 15 cycle low at 0.7165, followed by February 24 swing low at 0.7094, and then February’s 4 pivot low at 0.7051, short of the 0.7000.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.