- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US dollar sits firm below the freshly scored 20-year high

US dollar sits firm below the freshly scored 20-year high

- The US dollar sits just below its 20-year high.

- The Fed sentiment and global growth concerns are underpinning safe-haven US dollars.

The US dollar reached a new 20-year high as traders moved out of risk assets due to ongoing worries over global growth following further poor Chinese data.

The concerns over the Federal Reserve's ability to combat high inflation boosted the greenback's safe-haven appeal as well. Also contributing to the defensive tone was the ongoing war in Ukraine and concerns about rising COVID-19 cases in China.

The dollar index (DXY) slipped to a low of 103.392 after touching 104.19, its highest level since December 2002 as equities remained under heavy selling pressure as concern about inflation and the demand outlook weighed.

US equities did not perform well with the S&P 500 ending below 4,000 for the first time since March 2021 and the Nasdaq dropped more than 4% in a selloff led by mega-cap growth shares as investors grew more concerned about rising interest rates. The yield on the US 10-year note eased 6.3bps to 3.063% despite the expectations the Fed will be aggressive in attempting to tamp down inflation.

On Monday, Minneapolis Fed President Neel Kashkari said the US central bank may not get as much aid from easing supply chains as it is hoping for in helping to cool inflation.

Atlanta Fed President Raphael Bostic said he already sees signs of peaking supply pressures and that should give the Fed room to hike at half-percentage-point interest rate increments for the next two to three policy meetings, but nothing bigger.

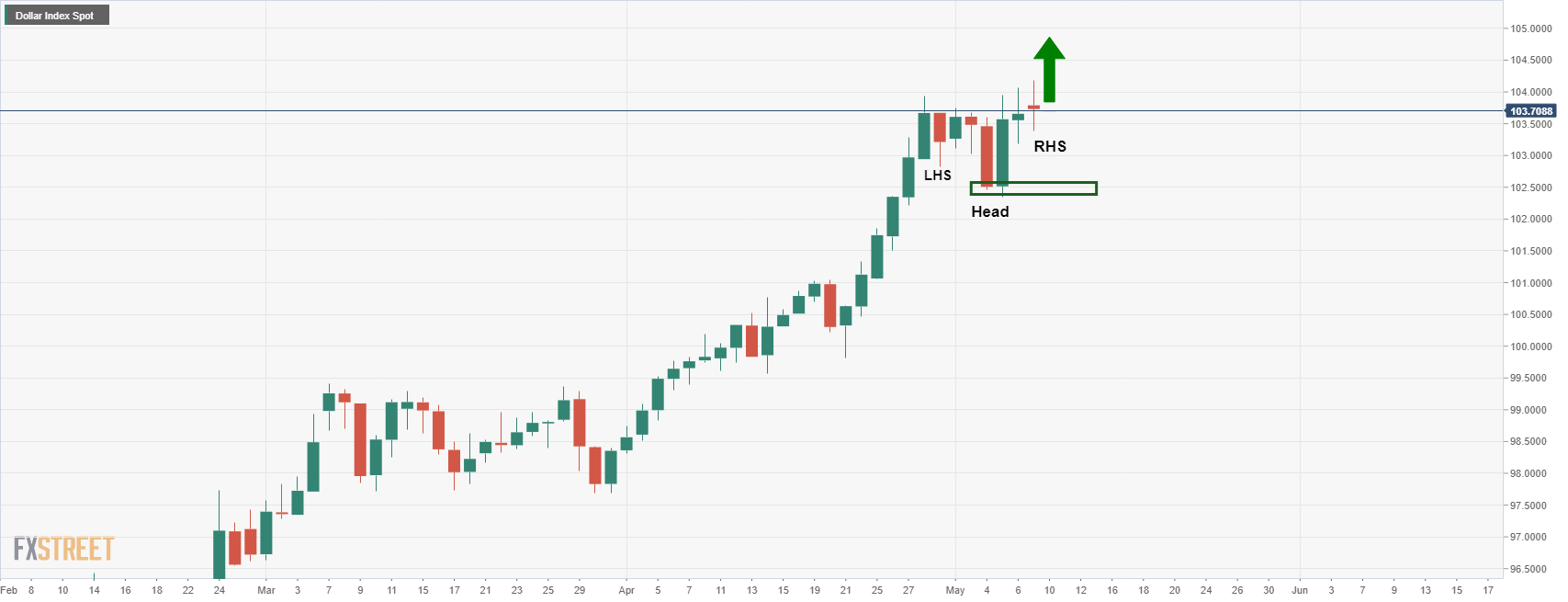

US dollar technical analysis

The price is forming a bullish inverse head and shoulders on the daily chart.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.