- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index comes under pressure south of 104.00 ahead of key CPI

US Dollar Index comes under pressure south of 104.00 ahead of key CPI

- DXY reverses part of the recent uptrend and retest 103.60.

- US yields look to extend the move lower on Wednesday.

- US Inflation gauged by the CPI will be the salient event later.

The greenback, in terms of the US Dollar Index (DXY), looks offered and trades in the lower end of the range near 103.60 on Wednesday.

US Dollar Index focuses on CPI data

The index loses ground for the first time after four consecutive daily advances midweek amidst the improvement in the risk-linked galaxy and the continuation of the downtrend in US yields.

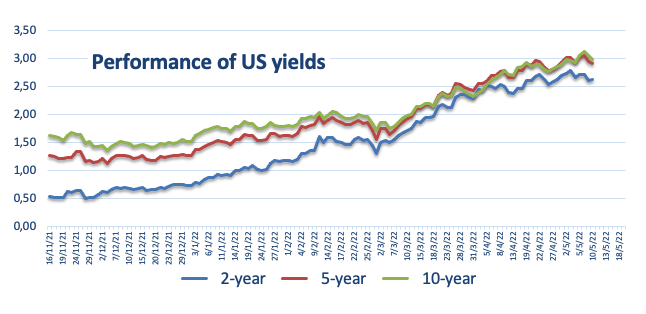

On the latter, yields in the short end of the curve have returned to the 2.60% area, while the belly has slipped back to the sub-3.00% region and the long end has broken below the 3.10% yardstick.

In the meantime, most of FOMC governors fall in line with Chief Powell regarding the likelihood that extra 50 bps rate hikes remain well in store in the next meetings, while a 75 bps rate hike seems to have lost some appeal as of late. All in all, the size of the next interest rate hikes remains data dependent in a context where inflation could have peaked in March/April and the labour market remains tight.

Later in the NA session, MBA Mortgage Applications is due, while all the attention is expected to be on the publication of the Inflation Rate measured by the CPI for the month of April.

What to look for around USD

The dollar sparked a corrective knee-jerk following new highs beyond the 104.00 mark on Monday, as investors’ expectations for a tighter rate path by the Federal Reserve have been nothing but reinforced by the FOMC event last week. The constructive stance in the dollar is also underpinned by the current elevated inflation narrative and the solid health of the labour market as well as bouts of geopolitical tensions and higher US yields.

Key events in the US this week: MBA Mortgage Applications, Inflation/Core Inflation Rate (Wednesday) – Producer Prices, Initial Claims (Thursday) – Flash Consumer Sentiment (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.28% at 103.63 and faces immediate contention at 102.35 (low May 5) seconded by 99.81 (weekly low April 21) and then 99.57 (weekly low April 14). On the upside, the breakout of 104.18 (2022 high May 9) would open the door to 105.00 (round level) and finally 105.63 (high December 11 2002).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.