- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- CFTC Positioning Report: EUR net longs dropped to multi-month lows

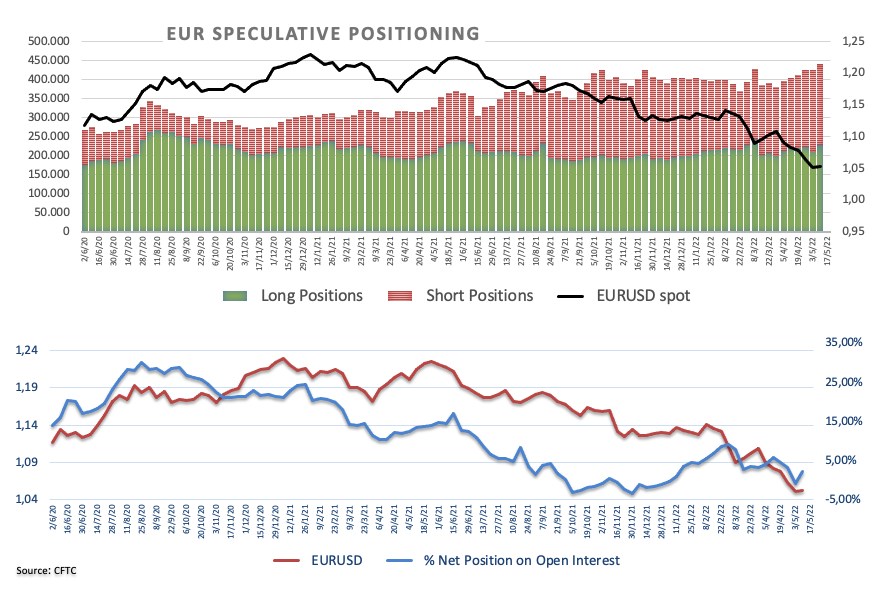

CFTC Positioning Report: EUR net longs dropped to multi-month lows

These are the main highlights of the CFTC Positioning Report for the week ended on May 10th:

- The speculative community reduced its net longs to the lowest level since early January, while the percentage of the net position on open interest also retreated to multi-month lows around 2.30%. The well-telegraphed 50 bps rate hike by the Federal Reserve coupled with the unabated march higher in US yields and the confirmation of a tight labour market (as per NFP results) kept the European currency and the rest of the risk-linked galaxy under further pressure amidst some range bound trading in EUR/USD just above 1.0500 the figure.

- Net longs in the dollar climbed to levels last seen in early March. Indeed, speculators added to their positive view in the buck following the move on rates by the Fed and the subsequent upside in US yields despite Chief Powell disregarded a 75 bps rate hike in the very near term at his press conference. In addition, another solid print from April’s Nonfarm Payrolls also lent extra legs to the greenback. The US Dollar Index (DXY) extended the move higher well north of the 103.00 mark, or fresh cycle tops.

- Net shorts in the British pound rose to an area last visited in later September 2019. The dovish hike by the BoE on May 5 coupled with a somewhat gloomy perspective for the UK economy in the medium term put the quid under extra pressure and dragged GBP/USD to fresh lows in the sub-1.2400 area.

- In the safe haven universe, net shorts in CHF climbed to levels last seen in early November 201, while USD/CHF kept the bullish stance unchanged and with the next target at the psychological 1.0000 mark. Net shorts in JPY increased to 4-week highs helped by the Fed’s move and higher yields, all motivating USD/JPY to edge higher and print new 2-decade tops past 131.30 (May 9).

- Speculators reduced the gross longs in the Aussie dollar and prompted net shorts to advance to 6-week peaks despite the start of the hiking cycle by the RBA at its May 3 event. The improvement in the sentiment surrounding the greenback deteriorated the price action in the commodity space and directly affected AUD, forcing AUD/USD to break below the psychological 0.7000 mark for the first time since January and record new lows for the year.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.