- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Watch live, Fed's Chair Powell WSJ questions, US dollar to find support on hawkish rehtoric?

Watch live, Fed's Chair Powell WSJ questions, US dollar to find support on hawkish rehtoric?

The US dollar is crumbling, this week as investors survey the landscape of the global economy, not just in the US. The greenback has fallen victim to improved risk sentiment, helping the likes of the euro that has been extending its rebound from a five-year low touched last week, and putting more distance between the common currency and parity with the US dollar.

However, in what could throw the US dollar bulls a lifeline, the Federal Reserve Chairman Jerome Powell is taking the Wall Street Journal's questions on the US economic outlook and its implications for the labour market, inflation and central-bank policies.

Watch live

Key notes

- We know this is a time for fed to be tightly focused on getting inflation down.

- We have tools and resolve to get inflation back down.

- No on should doubt our resolve - wall street journal interview.

- We need to see inflation coming down in convincing way.

- Ongoing rate increases appropriate.

- Broad support on fomc for having on table 50 bps at next two meetings.

- That is short of a prediction though.

- That said, if economy performs as we expect will be on the table.

- Very difficult to think about giving forward guidance.

- Economy very uncertain, as are outside events.

- Markets are pricing in a series of rate hikes.

- We like to work through expectations.

- It's been good to see markets reacting to what we are saying.

- Financial conditions overall have tightened significantly.

- What we need is to see growth moving down from high levels.

- We need supply side to have chance to catch up.

- We need to see growth moving down to a level that's still positive.

- By standards of central bank practice, we moving as fast as we have in several decades.

- We need to see clear and convincing evidence inflation is coming down.

- If we don't see that, we'll have to move more aggressively.

- We need to see clear convincing evidence that inflation is coming down.

- If we do, can slow pace of hikes.

- Underlying strength of US economy is really good right now.

- Labor market extremely strong.

- Growth this year is still at very healthy leveles.

- Consumer balance sheets are healthy.

- It is well positioned to withstand tighter policy.

- We are raising rates expeditiously to more normal level.

- We'll probably reach that in Q4 this year.

- That's not a stopping point though.

- We are raising rates expeditiously to a more normal level, will reach in 4th quarter.

- We don't know where neutral is, or where tight is.

- We're going to be looking meeting by meeting at financial conditions, economic health.

- We are going to look meeting by meeting, data by data, at financial conditions and economy.

- We will be looking at our actions impact on the economy.

- We really need to see clear and convincing evidence inflation coming down.

- If we have to go past neutral, we won't hesitate.

- If need to move past neutral, we wont' hesitate.

- We will continue raising rates until we see inflation coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- There will be no hesitation about that.

- We will go until we are at a place where financial conditions are appropriate, inflation is coming down.

- Financial conditions haven't tightened so quickly in a very long time.

- It would have been better to raise rates earlier with hindsight.

- Inflation is way too high.

- We need to bring it down.

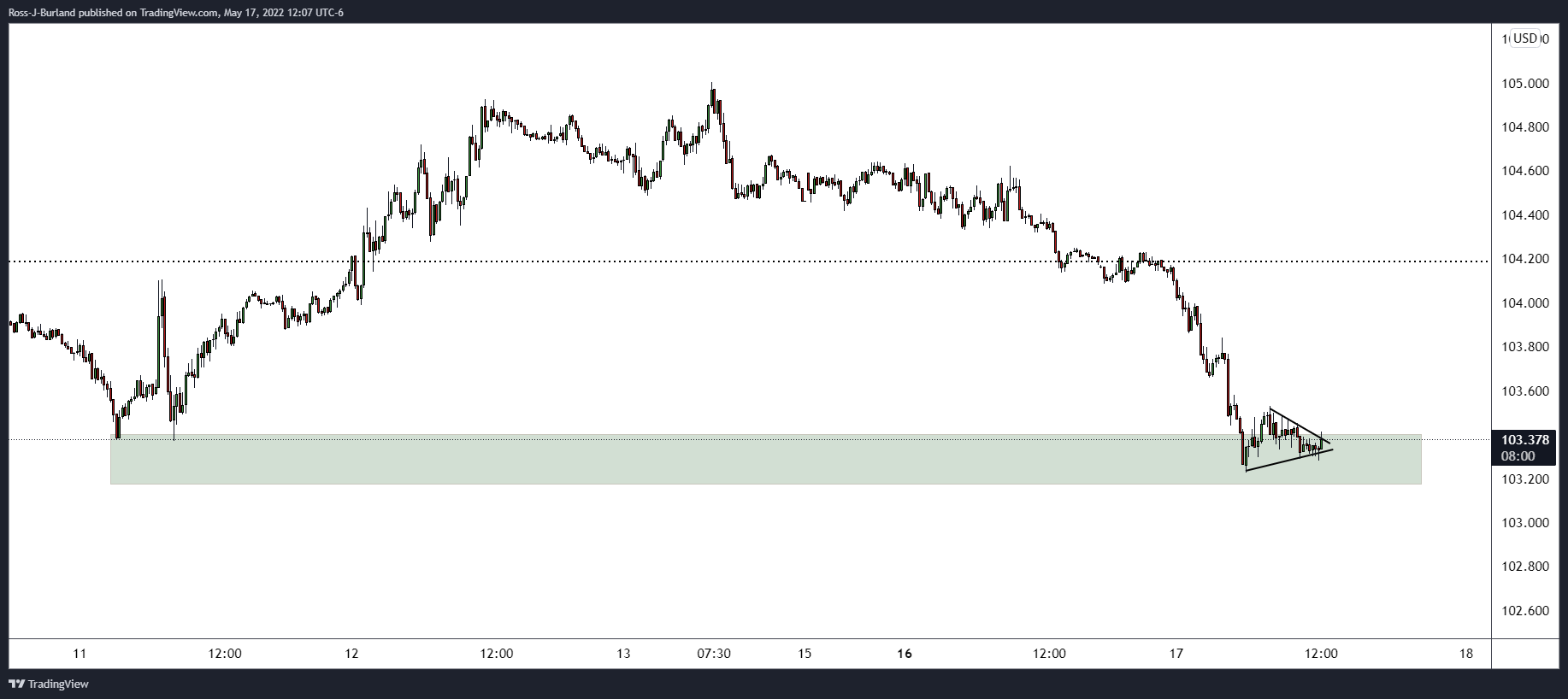

US dollar chart

The US dollar was testing the resistance of the wedge formation on the 15-min chart ahead of the event.

The US dollar is now picking up a bid during the interview:

About Fed chair Powell

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.