- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- NZD/USD Price Analysis: Surrenders RBNZ-inspired gains to multi-week high, near 38.2% Fibo.

NZD/USD Price Analysis: Surrenders RBNZ-inspired gains to multi-week high, near 38.2% Fibo.

- NZD/USD shot to a fresh multi-week high in reaction to the RBNZ’s hawkish outlook.

- Recession fears capped gains for the risk-sensitive kiwi amid resurgent USD demand.

- Bulls might now wait for a move beyond the 38.2% Fibo. before placing fresh bets.

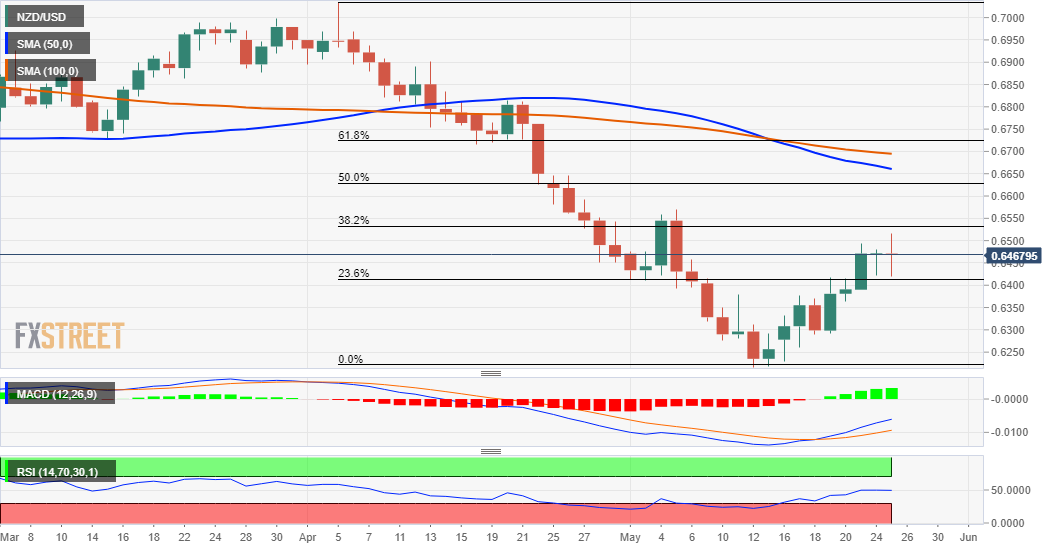

The NZD/USD pair caught aggressive bids near the 0.6420-0.6415 region on Wednesday after the Reserve Bank of New Zealand hinted at even higher rates going forward. Spot prices rallied around 100 pips from the daily low and shot to a nearly three-week high, though bulls struggled to capitalize on the move.

The market sentiment remains fragile amid the worsening global economic outlook and recession fears. Apart from this, a solid US dollar rebound from the monthly low touched overnight kept a lid on any further gains for the risk-sensitive kiwi and attracted some selling near the 0.6515-0.6520 region.

From a technical perspective, the post-RBNZ strong move up faltered just ahead of the 38.2% Fibonacci retracement level of the 0.7035-0.6217 downfall. This should now act as a key pivotal point, which if cleared will set the stage for an extension of a near two-week-old recovery move from the YTD low.

Bulls might then aim back to reclaim the 0.6600 round-figure mark and lift the NZD/USD pair further towards the 50% Fibo. level, around the 0.6625 zone. The next relevant hurdle is pegged near the 0.6655 area (50-day SMA) ahead of the very important 200-day SMA, around the 0.6700 round-figure mark.

On the flip side, the daily swing low, around the 0.6420-0.6415 region, coincides with 23.6% Fibo. level and should protect the immediate downside. A convincing break below will shift the bias in favour of bearish traders and make the NZD/USD pair vulnerable to testing sub-0.6300 levels in the near term.

NZD/USD daily chart

Key levels to watch

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.