- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD eyes further losses towards $1,800 ahead of US PMIs, Fedspeak

Gold Price Forecast: XAU/USD eyes further losses towards $1,800 ahead of US PMIs, Fedspeak

- Gold renews fortnight low, extends downside break of 200-DMA.

- Yields underpin US dollar rebound, policymakers’ praise to Fed’s tightening adds to the greenback’s strength.

- US ISM PMIs for May, Fedspeak may entertain traders during NFP week, risk catalysts are also important for clear directions.

- Gold Price Forecast: XAUUSD extends slump to fresh weekly lows

Gold (XAU/USD) pares intraday losses around $1,835, despite keeping the previous day’s bearish move, as the US dollar remains firmer during Wednesday’s initial Asian session.

The yellow metal dropped the most in three weeks on Tuesday on the greenback’s rebound from its monthly low. That said, the quote’s latest weakness could be linked to comments from US Treasury Secretary Janet Yellen and Atlanta Fed President Raphael Bostic, suggesting further tightening of policies at the Fed.

“US Treasury Secretary Janet Yellen said on Tuesday that she was wrong in the past about the path inflation would take, but said taming price hikes is President Joe Biden's top priority and he supports the Federal Reserve's actions to achieve that,” said Reuters. On the other hand, Fed’s Bostic crossed wires during an interview with MarketWatch as he said that his suggestion that the central bank takes a September “pause” in its push to raise interest rates should not be construed in any way as a “Fed put,” or belief that the central bank would come to the rescue of markets.

Also weighing on the gold prices could be comments from US President Joe Biden as he said, “If Russia does not pay a heavy price for its actions, it will send a message to other would-be aggressors that they too can seize territory and subjugate other countries,” per The New York Times.

On Tuesday, hawkish Fedspeak and upbeat US data favored the US dollar to recover from the multi-day low. Fed Board of Governors member Christopher Waller said that he supports lifting interest rates by another 50 bps at the next several Fed meetings and that the policy rate should be above neutral by the end of the year to reduce demand, reported Reuters. On the other hand, the US Chicago Purchasing Managers’ Index and CB Consumer Confidence both rose past forecasts for May whereas the Dallas Fed Manufacturing Business Index dropped to the lowest levels in two years.

That said, the market sentiment remains mixed and the US Treasury yields underpin the US dollar rebound, up two basis points to 2.86% by the press time. However, the S&P 500 Futures rise half a percent near 4,150 and probe gold sellers.

Moving on, the US ISM Manufacturing PMI for May, expected 54.5 versus 55.4 prior, will decorate the calendar while Fedspeak and other risk catalysts to direct short-term gold move.

Technical analysis

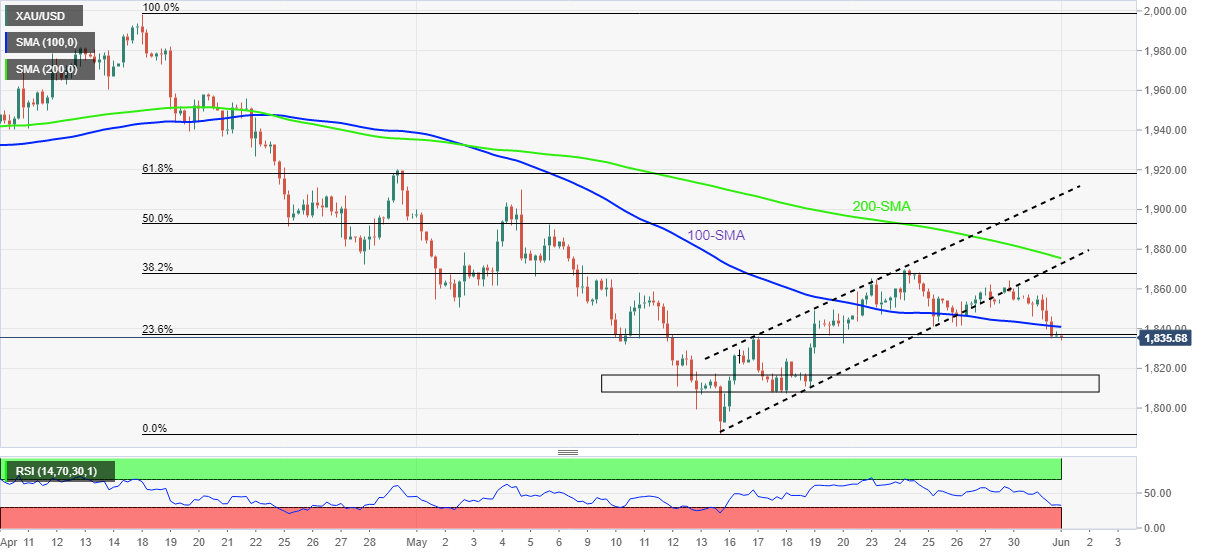

Gold prices remain on the back foot, justifying the first daily closing below the 200-DMA, as well as sustained trading below the 100-SMA and bullish channel breakdown on the four-hour (4H) play.

Gold: Daily chart

Trend: Further weakness expected

Although the RSI and MACD signals back the metal’s further declines, multiple supports surrounding the $1,815-10 region join nearly oversold RSI on 4H to challenge the bears.

Gold: Four-hour chart

Trend: On the back foot

However, a clear downside break of $1,810 won’t hesitate to direct XAU/USD towards May’s low of $1,786.

Alternatively, the 100-SMA on 4H joins the 200-DMA to highlight $1,840 as the key immediate hurdle on the upside.

Following that, a monthly resistance line on D1 and the 200-SMA on the four-hour play, respectively near $1,864 and $1,875, could lure the gold buyers.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.