- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/JPY Price Analysis: Bulls struggle below 93.00 after Aussie Q1 GDP, China PMI

AUD/JPY Price Analysis: Bulls struggle below 93.00 after Aussie Q1 GDP, China PMI

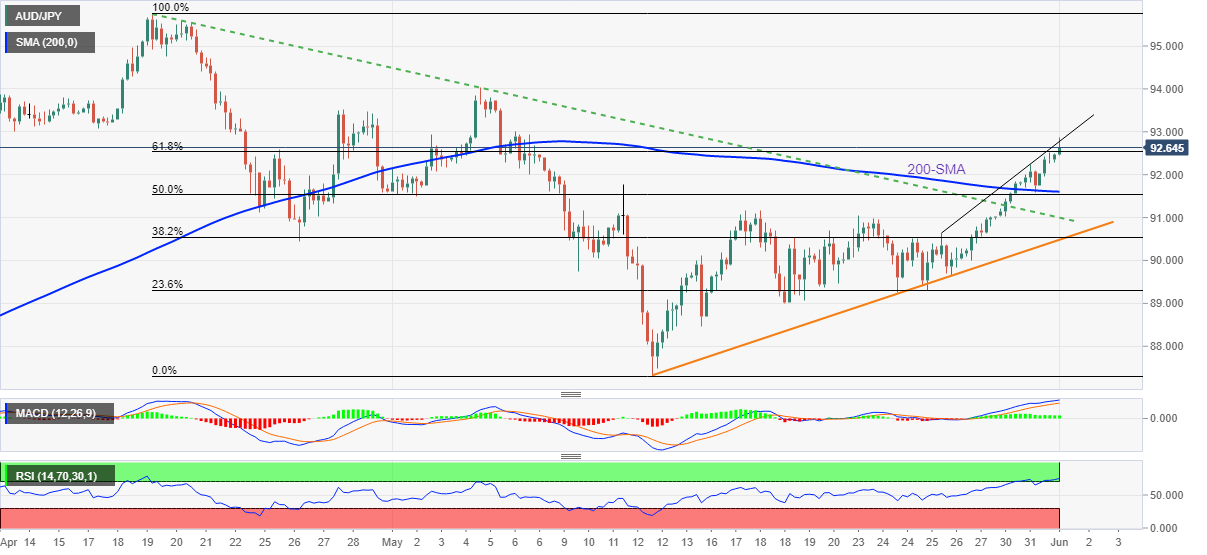

- AUD/JPY retreats from monthly high as buyers jostle with the 61.8% Fibonacci retracement level.

- Overbought RSI (14), weekly resistance line also challenge bulls.

- 200-SMA holds the key for bear’s entry but ascending trend line from mid-May appears important support.

AUD/JPY bulls take a breather around a one-month high, even as data from Australia and China came in better than expected during early Wednesday. That said, the cross-currency pair jostles with a one-week-old resistance around 92.80-75 by the press time.

Australia’s first quarter (Q1) Gross Domestic Product (GDP) rose by 0.8% versus 0.7% expected and 3.4% prior. The annualized GDP also increased 3.3% compared to 3.0% YoY market consensus and 4.2% previous readouts. Further, China’s Caixin Manufacturing PMI rose past 47.0 forecast and 46.0 prior readings to 48.1.

The AUD/JPY pair’s latest struggle could be linked to the overbought RSI conditions, as well as the one-week-old rising trend line, around 92.80.

However, the quote keeps the previous breakouts of the 200-SMA and a downward sloping trend line from late April, which in turn pushes back the sellers.

Hence, AUD/JPY bulls seem running out of fuel but not out of the game yet.

It’s worth noting that late April swing high around 93.50 and May’s peak of 94.03 are extra hurdles for the pair buyers if at all they manage to cross 92.80 immediate resistance.

On the contrary, a convergence of the 200-SMA and 50% Fibonacci retracement of April 20 to May 12 downside, around 91.60, limits short-term declines of the AUD/JPY pair.

Following that, the resistance-turned-support from April 20 and a three-week-old rising trend line, respectively around 91.00 and 90.50, will be in focus.

AUD/JPY: Four-hour chart

Trend: Pullback expected

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.