- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD looks offered near 1.0710 post-Payrolls

EUR/USD looks offered near 1.0710 post-Payrolls

- EUR/USD loses some ground and tests 1.0710 on Friday.

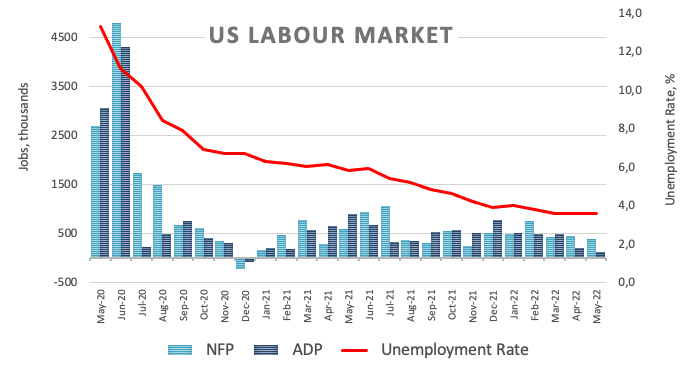

- US Non-farm Payrolls rose by 390K jobs in May.

- The unemployment stayed unchanged at 3.6%.

EUR/USD loses the grip further and revisits the low-1.0700s in the wake of the May’s Nonfarm Payrolls at the end of the week.

EUR/USD keeps targeting the 1.0800 area

EUR/USD corrects lower and gives aways some gains following Thursday’s strong advance after the US economy created 390K jobs during May, bettering expectations for a gain of 325K jobs. The April’s reading was revised to 436K (from 428K).

Further data showed the jobless rate stayed put at 3.6% and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.3% MoM and expanded 5.2% over the last twelve months. Another key gauge, the Participation Rate, improved a tad to 62.3%.

Later in the session, the final Services PMI is due seconded by the Non-Manufacturing PMI.

EUR/USD levels to watch

So far, spot is losing 0.27% at 1.0715 and a breach of 1.0627 (weekly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18). On the upside, the immediate up barrier lines up at 1.0786 (monthly high May 30) seconded by 1.0936 (weekly high April 21) and finally 1.0959 (100-day SMA).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.