- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD tanks from daily highs and trades below the 200-DMA at around $1820s

Gold Price Forecast: XAU/USD tanks from daily highs and trades below the 200-DMA at around $1820s

- Friday’s US hot inflation reading triggered a flight to safe-haven currencies like the greenback, and precious metals fell.

- The 2s-10s US Treasury yield curve inverted during the day as a recessionary scenario looms.

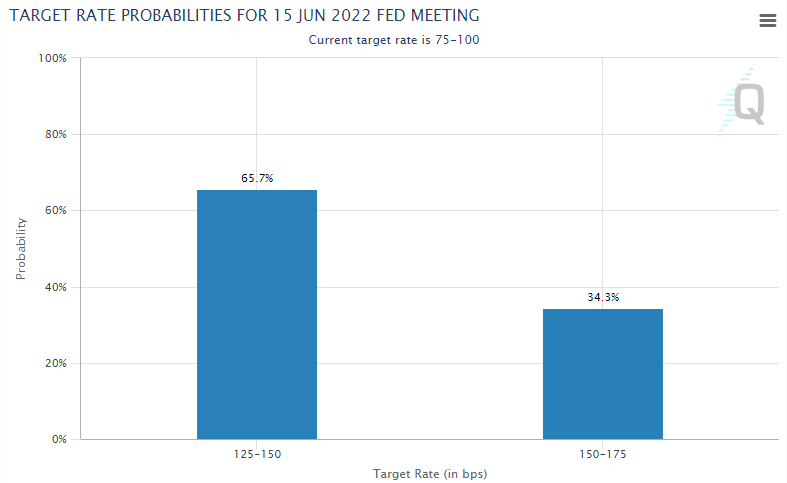

- The CME FedWatch Tool shows that the odds of a 75 bps increase in the June meeting lie around 34%.

- Gold Price Forecast (XAU/USD): A daily close at around $1820 to open the door towards $1800.

Gold spot (XAU/USD) slides to a new monthly low near the $1820 figure on Monday, as US Treasury yields skyrocket, propelled by Friday’s hotter than expected US inflation numbers, ahead of the US Federal Reserve June meeting, in which investors have priced in a 50 bps increase. At the time of writing, XAU/USD is trading at $1826.60, down near 2.20%.

Pessimistic sentiment triggered a flight to safe-haven assets, except Gold

Risk-aversion dominates Monday’s session. European and US equities are plunging as a recession looms, spurred by global central banks, which forecasted inflation as transitory, falling behind the curve. Market participants are flying toward safe-haven assets, as reflected by the greenback. The US Dollar Index, a measure of the greenback’s value vs. six currencies, advances 0.80%, trading at fresh 2-decade highs around 105.027.

In the meantime, Gold remains trading heavy after reaching a daily high near $1880, weighed by higher US Treasury yields. The 10-year benchmark note rate jumped to multiyear-highs, to levels last seen in 2011, at around the 3.314% threshold, up by 15 bps.

Meanwhile, the short-end of the yield curve, the 2s-10s, inverted during the day on concerns that a higher Federal Funds Rate (FFR) might trigger a recession, as the US central bank battles inflation readings near 9%, not seen since 1981.

Elsewhere, some commercial banks around the globe begin to price in a 75 bps rate hike on Wednesday, like Barclays. However, most analysts expect the Fed to hike 50 bps as they aim to keep its credibility intact, though it could open the door for higher rate increases in July and September.

The CME FedWatcht Tool shows the odds of a 75 bps rate hike at 34.3% while fully pricing in a 50 bps increase.

With no data in the US economic docket to be released, all eyes are set on the Fed monetary policy decision and Chair Jerome Powell’s post-meeting press conference. Traders must know that the Summary of Economic Projections (SEP) will also be unveiled. Expectations are mounting that officials would update inflation estimations to the upside and growth to the downside.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD is trading below the 200-DMA, for the second time, in the last couple of trading sessions. In fact, it also broke a 4-year-old upslope trendline that, if confirmed by a daily close, would pave the way for further losses. Therefore, in the short term, XAU/USD is headed to the downside.

Gold’s first support would be May’s 18 low at $1807.23. A breach of the latter would expose the $1800 figure, which, once cleared, could send XAU/USD tumbling towards the YTD low at $1780.18.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.