- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- AUD/JPY Price Analysis: Bears in control, though, would face support around the 92.40-50 region

AUD/JPY Price Analysis: Bears in control, though, would face support around the 92.40-50 region

- The AUD/JPY recovered some ground as the Asian Pacific session began.

- The sentiment is still sour, with Asian futures poised to a lower open.

- AUD/JPY Price Forecast: In the near term might extend the pullback towards 92.40-50s before resuming the uptrend.

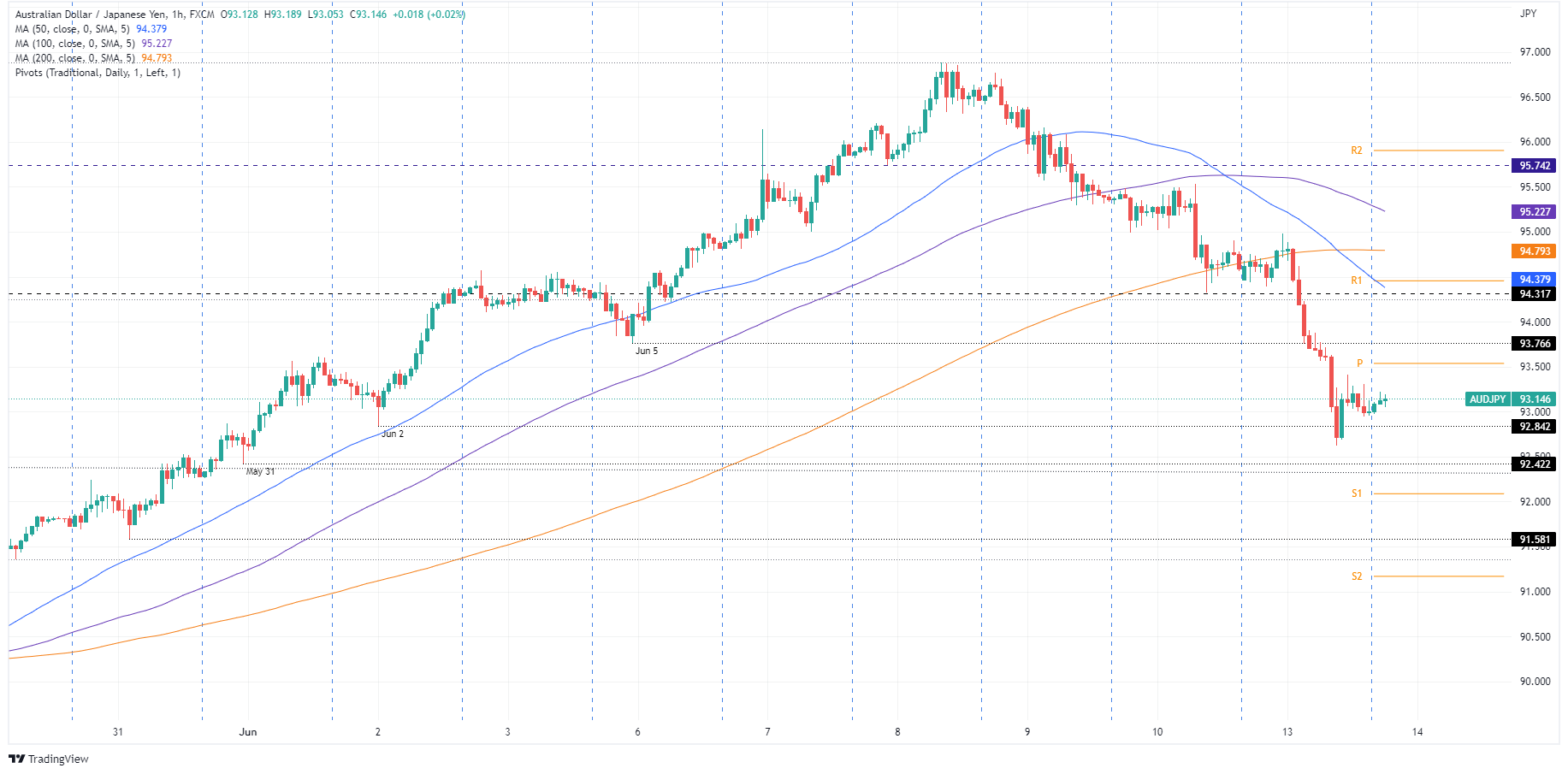

The AUD/JPY plunged 160 pips on Monday due to sour market sentiment, spurred by investors’ fears that the Federal Reserve could tighten monetary policy at a pace that the US economy might not survive a recession, as reflected by US Treasury yields, elevating to multi-year highs. At 93.14, the AUD/JPY records minimal gains of 0.16% as the Asian Pacific session begins.

Portraying the abovementioned were US equities registering huge losses. Asian futures are poised to a lower open, except for the Nikkei, which is up 0.09%. In the meantime, US Treasury yields, led by the 10-year benchmark note rate, finished at 3.362%, 11-year highs, up 20 bps in the day.

In the FX space, the greenback was the leading currency, except vs. the Japanese yen. On Friday, Japan’s government and the central bank said they were concerned by recent sharp falls in the yen in a rare joint statement, Reuters reported.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is hovering around the 93.00 figure, for the first time, since June 2. Nevertheless, albeit falling more than 150 pips on Monday, the cross-currency keeps trading above the daily moving averages (DMAs), which remain below the spot price, with the 50-DMA being the closest to the exchange rate at 92.35.

The AUD/JPY 1-hour chart depicts the pair as downward biased. The 1-hour simple moving averages (SMAs) reside above the spot price, with the 50-hour SMA below the long-time frame ones, around 94.31. Additionally, once AUD/JPY’s price action broke below the June 5 daily low at 93.76, it opened the door for further losses.

Therefore, the AUD/JPY first support would be the 93.00 figure. Once cleared, the following support would be June 2 low at 92.84. A breach of the latter, an area full of sell stops, would send the pair towards the May 31 low at 92.42 before resuming to the upside, aligned with the daily chart overall bias.

Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.