- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD resumes the upside above the 1.0500 yardstick

EUR/USD resumes the upside above the 1.0500 yardstick

- EUR/USD extends the rebound to the 1.0550 region.

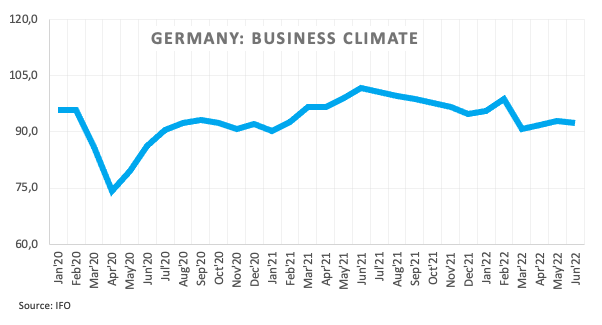

- The German Business Climate eased a tad in June.

- ECB’s Fernandez-Bollo, de Guindos next on tap.

The single currency regains the smile and lifts EUR/USD to the area of daily highs near 1.0550 on Friday.

EUR/USD up on dollar weakness, risk-on mood

EUR/USD quickly forgot about Thursday’s pullback and resumed the upside at the end of the week on the back of the renewed offered stance in the greenback and the tepid recovery attempt in yields in both the US and German money markets.

In the meantime, investors seem to have left behind Powell’s testimonies and continue to closely follow news surrounding the start of the hiking cycle by the ECB as well as any details regarding the bank’s plans to fight fragmentation.

In the domestic calendar, the German Business Climate tracked by the IFO institute missed estimates and deteriorated a tad to 92.3 in June (from 93.0) in what was the sole release in the euro area on Friday. Later in the session, ECB Board members P.Fernandez-Bollo and L. de Guindos are also due to speak.

In the US, the final Consumer Sentiment for the current month will grab all the attention seconded by May’s New Home Sales.

What to look for around EUR

EUR/USD regains composure and advances further north of the 1.0500 mark amidst the mild improvement in the risk appetite trend in a week marked by broad-based choppy trading.

In the meantime, the single currency continues to closely follow any developments surrounding the ECB and its plans to design a de-fragmentation tool in light of the upcoming start of the hiking cycle.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, persistent elevated inflation in the euro area and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany IFO Business Climate (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is gaining 0.25% at 1.0543 and a breakout of 1.0605 (weekly high June 22) would target 1.0623 (55-day SMA) en route to 1.0786 (monthly high May 30). On the other hand, the next support emerges at 1.0358 (monthly low June 15) followed by 1.0348 (2022 low May 13) and finally 1.0300 (psychological level).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.