- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- USD/JPY retraces from weekly highs, and slips below 136.00 on safe-haven flows

USD/JPY retraces from weekly highs, and slips below 136.00 on safe-haven flows

- Risk-off impulse dominates the last trading day of June, boosting safe-haven peers.

- The USD/JPY falls from 137.00 below the 136.00 mark, weighted by the drop in US Treasury yields.

- The US Federal Reserve’s favorite inflation gauge, the core PCE came lower than the previous reading, signaling the effects of higher rates begin to feel.

The USD/JPY slides on Thursday, following a lower-than-expected inflation report, which could deter the US Federal Reserve from tightening at a faster pace amidst odds increasing of recession, keeping investors uneasy. At 135.85, the USD/JPY retreats from daily highs shy of 137.00, back below the 136.00 mark.

Negative sentiment and falling yields, a headwind for the USD/JPY

Risk aversion dominates the markets, as half/quarter/month-end flows bolstered the greenback. US equities remain heavy; the greenback rises shown by the US Dollar Index up by 0.04%, at 105.135, while US Treasury yields drop, led by the 10-year T-note rate at 3.00%, diving nine bps.

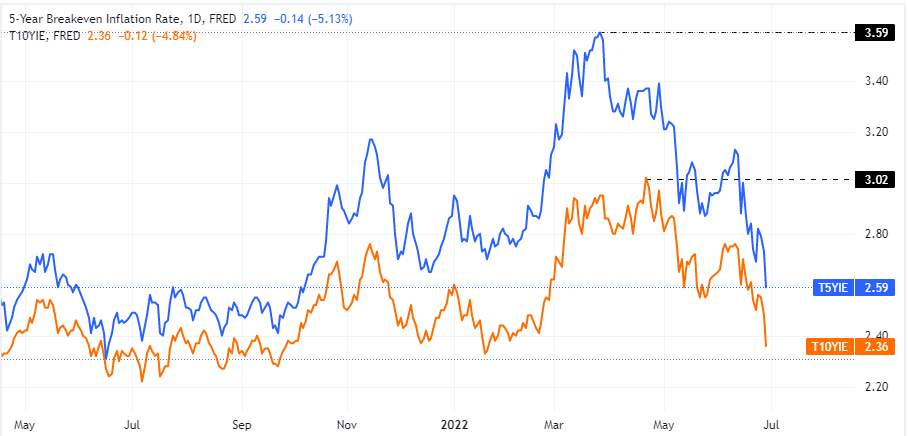

Besides that, fears of a recession as global growth stagnated, alongside high inflation, spurred a flight to safe-haven. Particularly in the USD/JPY, the yen remains bid, boosted by the fall in US Treasury yields, weighed by falling US inflation expectations, as illustrated by the five and 10-year break-even inflation rates, easing from YTD highs around 3.59% and 3.02% each, down to 2.59% and 2.36%, respectively.

Source: Tradingview/St. Louis FRED

In the meantime, US inflation, as measured by the Personal Consumption Expenditure (PCE), rose by 6.3% YoY, unchanged in May, the US Bureau of Economic Analysis reported. Meanwhile, the Fed’s favorite gauge of inflation, the core PCE, which excludes volatile items, grew 4.7%, YoY, lower than the 4.9% in April.

On the Japanese front, the docket revealed Industrial Production, which shrank faster than expected -1.3% MoM to -7.2%. Annually based, recovered some ground but stayed negatively at -2.8%, from a previous reading at -4.9%.

USD/JPY Key Technical Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.