- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAUUSD eyes $1,798 and $1,794 as next downside targets – Confluence Detector

Gold Price Forecast: XAUUSD eyes $1,798 and $1,794 as next downside targets – Confluence Detector

- Gold Price returns to the red zone despite weaker US Treasury yields.

- Markets remain cautious ahead of the Fed Minutes and an impending death cross.

- XAUUSD could resume sell-off below $1,800 amid light trading conditions.

Gold Price is resuming its downside momentum at the start of a fresh week, having witnessed an impressive rebound on Friday. The US dollar is consolidating the minor rebound amid the renewed downtick in the Treasury yields and falling S&P 500 futures. The mixed market mood and holiday-thinned trading have kept gold bulls at bay. A death cross lurking on the daily chart is offering the much-needed boost to XAUUSD sellers. Attention now turns towards Wednesday’s FOMC June meeting’s minutes for the next price direction in the bright metal. In the meantime, the Fed rate hike expectations and recession fears will continue to dominate markets and influence the dynamics of the bullion price.

Also read: Gold Price Forecast: Death cross to ring knell for XAUUSD, as eyes turn to Fed Minutes

Gold Price: Key levels to watch

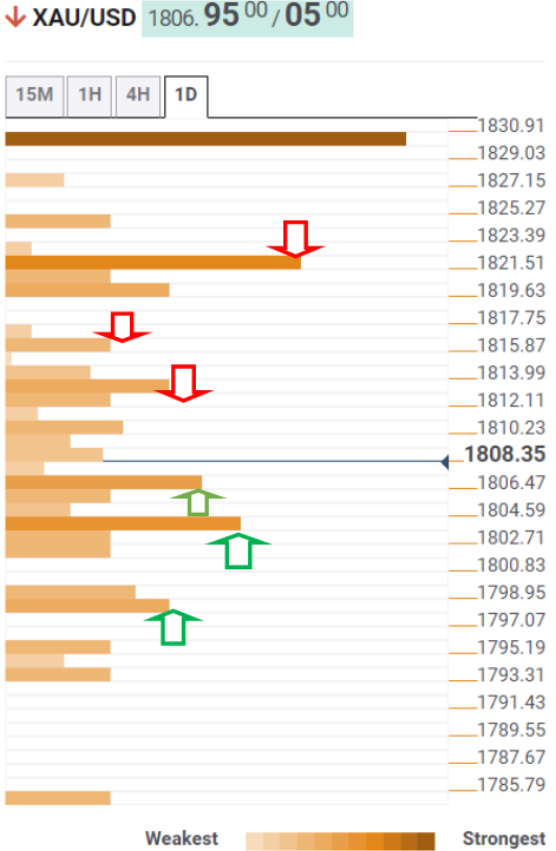

The Technical Confluence Detector shows that Gold Price is testing support at the Fibonacci 38.2% one-week at $1,806, below which the next downside target is aligned at the previous month’s low of $1,803.

The confluence support of the Fibonacci 23.6% one-week and Bollinger Band one-day Lower at $1,798 will then come to XAU buyers’ rescue. The last line of defense for gold bulls is seen around $1,794, the convergence of the Fibonacci 61.8% one-day and the pivot point one-day S1.

On the flip side, Friday’s high of $1,812 will lure byers, above which they will need to recapture the SMA5 one-day at $1,816. The intersection of the Fibonacci 23.6% one-month, SMA50 four-hour and the pivot point one-day R1 at $1,820 will be a tough nut to crack for bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.