- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US 2s-10s Treasury Yield curve inverts, as recession fears build up

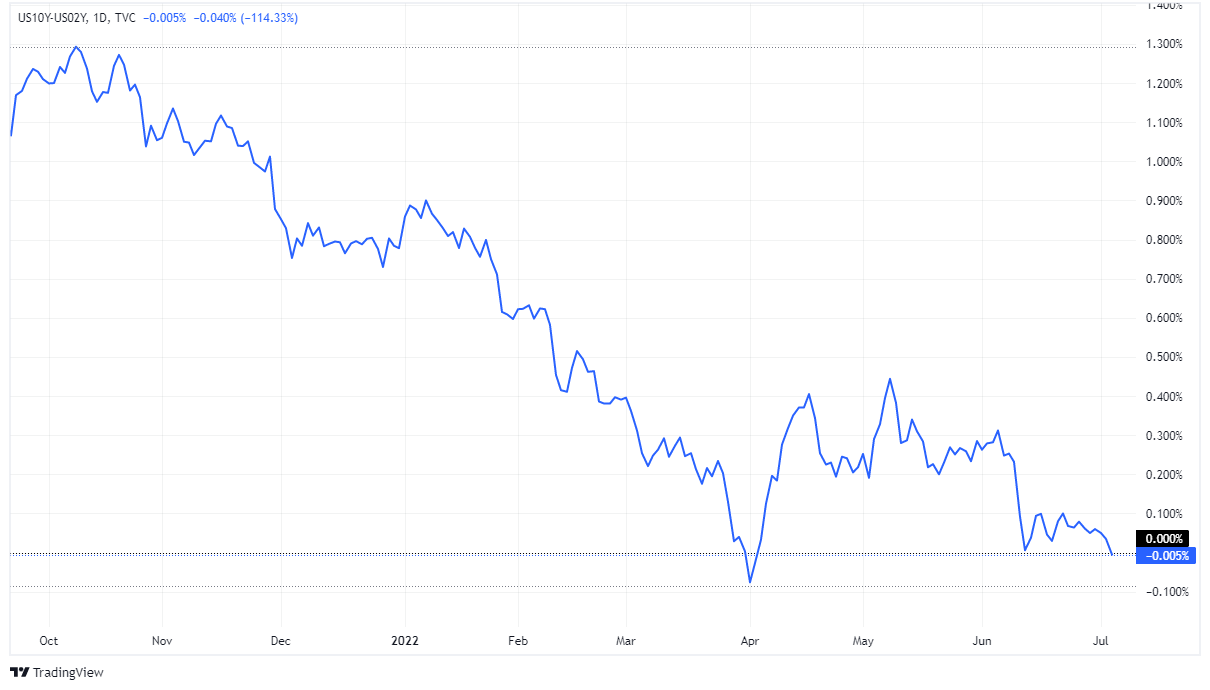

US 2s-10s Treasury Yield curve inverts, as recession fears build up

- US Treasury yields plunged on Tuesday on what is seen as a “recession trade” by financial analysts.

- The US Q1 GDP on its final reading contracted by -1.6%.

- The US Federal Reserve Chair Jerome Powell committed to bringing inflation downs, even if the US economy slows down.

Fears of recession and elevated prices sent US Treasury bond yields nosediving, inverting the US 2s-10s yield curve, one of the most popular “leading indicators” of a recession, sitting at -0.006%, on Tuesday amidst a hopeless market sentiment as reflected by US equities registering losses between 0.28% and 0.91%. At the time of writing, the US 2-year Treasury bill rate sits at 2.822%, six basis points higher than the US 10-year Treasury note, which yields 2.816%.

Given that the US inflation has remained stubbornly higher at around 8.6%, the US Federal Reserve hiked rates by 150 bps since March 2022. That has been felt in the economy, as the US Q1 final GDP dropped by -1.6%, while also showing that consumer spending has softened and inventories remained higher than reported in May.

Meanwhile, US Fed chair Jerome Powell acknowledged that growth risks are skewed to the downside. Last Wednesday, he said that the Fed would not let the economy get into a “higher inflation regime,” even if it puts growth at risk. He reiterated that while “there is a risk” that the Fed might get the US economy into a recession, he pledged that its biggest commitment is to “restore price stability.”

In the meantime, sources quoted by Bloomberg said, “We’re not in (a recession) one right now, but the markets are a discounting mechanism, and I think the markets see the economy potentially going into one or getting closer to being one.”

Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, continues advancing, despite retracing from YTD highs around 106.792 toward 106.534, up 1.30%.

US Dollar Index Daily chart

US Dollar Index Key Levels

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.