- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US Dollar Index retreats from recent peaks, back below 107.00

US Dollar Index retreats from recent peaks, back below 107.00

- DXY comes under some selling pressure in the sub-107.00 area.

- The risk complex regains some composure following the recent sell-off.

- Weekly Claims, Trade Balance next of relevance in the US calendar.

The greenback, when tracked by the US Dollar Index (DXY), faces some selling bias following Wednesday’s tops in levels last seen back in October 2002 past 107.00.

US Dollar Index looks to risk trends, recession talks

The index loses some ground following four consecutive daily advances, including new cycle highs north of the 107.00 hurdle on July 6.

The so far corrective move in the greenback comes in response to the mild recovery in the risk complex and the mixed performance in US yields, which sees further upside in the belly and the long end of the curve, while the short end drops marginally.

In the meantime, recession talks and prospects for further tightening remain in centre stage, particularly after the release of the FOMC Minutes on Wednesday noted that participants prioritized price stability and acknowledged that a more restrictive policy could be on the table in the next periods. In addition, members favoured a 50 bps-75 bps rate hike at the next meeting.

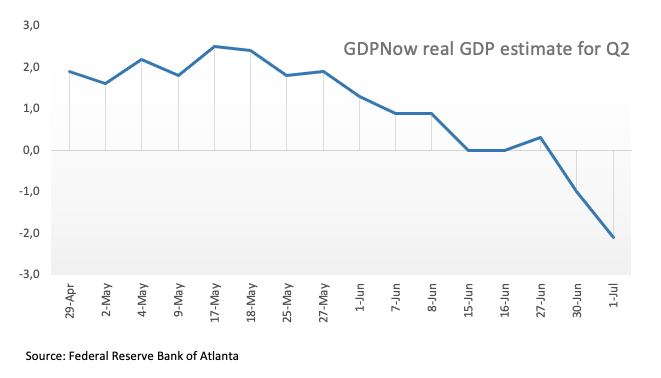

Regarding the likelihood of a US recession, Atlanta Fed’s GDPNow tool sees the economy contracting 2.1% in Q2, which means that the economy is already in a technical recession following the 1.6% contraction of the January-March period.

In the US data space, Balance of Trade for the month of May are due seconded by the usual weekly Claims in the week to July 2.

What to look for around USD

The index rose to nearly 2-decade peaks close to 107.30 amidst the sharp deterioration in prospects for the risk-linked assets.

Further support for the dollar is expected to come from the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors. On the flip side, chatter of US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Initial Claims, Balance of Trade (Thursday) – Non-farm Payrolls, Unemployment Rate, Wholesale Inventories, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 0.09% at 106.94 and faces the next support at 103.67 (weekly low June 27) seconded by 103.41 (weekly low June 16) and finally 101.29 (monthly low May 30). On the other hand, a break above 107.26 (2022 high July 6) would expose 107.31 (monthly high December 2002) and then 108.74 (monthly high October 2002).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.