- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EUR/USD: Bears face paramount hurdle at parity

EUR/USD: Bears face paramount hurdle at parity

- EUR/USD remains offered and challenges parity.

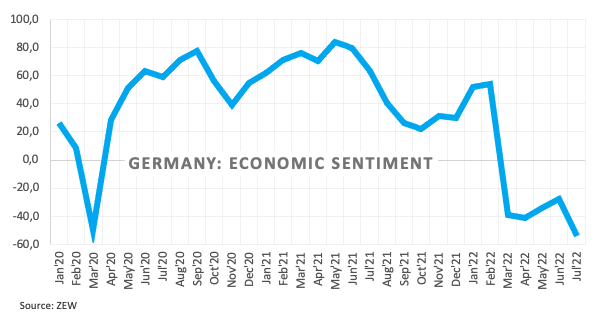

- Germany Economic Sentiment plunges in July.

- German 10y Bund yields drop to 3-day lows near 1.12%.

Sellers remain well in control of the sentiment around the European currency and prompt EUR/USD to struggle around the parity level on Tuesday.

EUR/USD in nearly 2-decade lows

EUR/USD sheds ground for the second session in a row and flirts with the crucial parity level for the first time since December 2002, as the sour mood persists among market participants.

Indeed, market chatter around the likelihood of a recession in the euro area appears reinforced on Tuesday after the Economic Sentiment tracked by the ZEW Institute in both Germany and the broader Euroland deteriorated beyond estimates for the month of July.

In addition, the risk aversion continues to swell in the global markets, adding an extra layer of weakness to the single currency and the rest of the risk galaxy.

There are no more data releases in the euro area on Tuesday, whereas the IBD/TIPP Economic Optimism index and the NFIB Business Optimism Index along with the speech by Richmond Fed T.Barkin are all due later in the NA session.

What to look for around EUR

Bears maintain the EUR/USD under heavy pressure and the acceleration of the downside opens the door to a probable visit to the parity level any time soon.

In the meantime, the price action around the single currency continues to follow increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: Germany, EMU ZEW Economic Sentiment (Tuesday) – Germany Final Inflation Rate, EMU Industrial Production (Wednesday) – EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is down 0.33% at 1.0005 and faces the next contention at 1.0000 (2022 low July 12) seconded by 0.9859 (low December 2002) and finally 0.9685 (low October 2002). On the upside, a breakout of 1.0515 (55-day SMA) would target 1.0615 (weekly high June 27) en route to 1.0773 (monthly high June 9).

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.