- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold Price Forecast: XAU/USD bears extending the bear cycle ahead of critical US CPI

Gold Price Forecast: XAU/USD bears extending the bear cycle ahead of critical US CPI

- Gold is under pressure as the greemback contiunues to pick up the bids.

- The US CPI event is stacking up to be critical for markets this week.

Gold is back under pressure and establishing fresh lows for the week within the bearish cycle as markets flip risk-off in the latter part of the New York session with the Dow printing fresh lows and down 1% at the time of writing. In turn, the US dollar is climbing the board in a correction as per the DXY index. At $1,725.00, gold is down 0.5% while DXY is moving back towards a flat position for the day at 108.15.

The US dollar's strength comes ahead of this week's key US inflation data, both of which are headwinds for the US stock market during the earnings season. Should the US dollar continue on its bullish trajectory, this will be a headwind for the company's results and in turn, the recession fears would be expected to continue supporting the greenback and pressuring gold.

The event to watch will be Wednesday's Consumer Price Index report which is expected to show the largest jump since 1981, to 8.8% YoY. The expectations have led to a massive liquidation in the gold market. ''While the steepest outflows from broad commodity funds since the Covid-19 crisis sparked a cascade of selling, including from CTA funds, another strong inflation print could still fuel additional downside,'' analysts at TD Securities said.

''Indeed, the coming data could be particularly concerning for gold prices given the still extremely bloated length remaining in gold markets from proprietary traders. We have previously cautioned that the substantial size accumulated by this cohort during the pandemic appears complacent in the face of a steadfastly hawkish Fed. In a liquidation vacuum, these positions are now vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold technical analysis

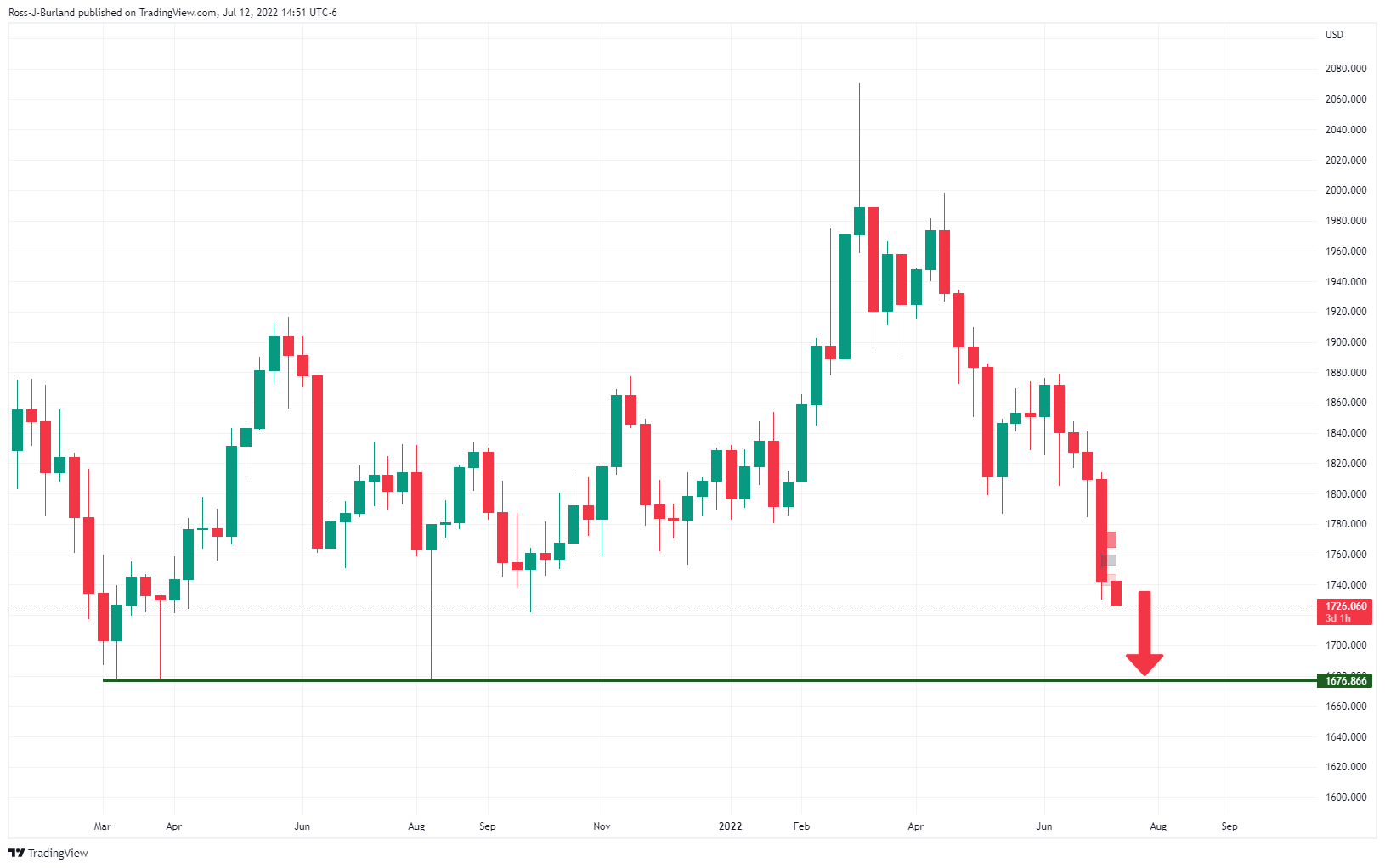

The consolidation is being drawn out but could well be turning into a breakout of redistribution indicating lower prices to come for the foreseeable future. In prior analysis, a potential spring in a phase of possible accumulation was identified on the 4-hour chart which has now been invalidated with lower closes:

As illustrated, the price has deteriorated into fresh lows which pits the emphasis on the downside, although does not completely invalidate the prospects of continued sideways action.

There is still the possibility of a move higher if the bulls commit but the likelyhood is gearing up to be a move lower in an extension of supply following the bullish correction:

This will put the focus on the weekly lows from a longer term perspective:

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.