- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold price remains subdued around $1710 amidst a buoyant US dollar

Gold price remains subdued around $1710 amidst a buoyant US dollar

- Gold price is stationary amidst the lack of a catalyst ahead of Fed’s July meeting.

- The US Dollar Index bounces off weekly lows, a headwind for precious metals.

- US housing data begins to show the impact of higher interest rates.

- XAUUSD to remain sideways, eyeing a YTD low around $1680, and to the upside $1750.

Gold price seesaws around the $1700 area, failing to break upwards/downwards as traders prepare for the Federal Reserve July meeting in the next week, amidst a mixed sentiment on Wednesday trading session. Ahead in the week, two central banks’ monetary policy meetings loom, namely the ECB and the BoJ, with the former to follow suit with other banks, with its first hike in 11 years, while the latter is the outlier, pledged to its dovish stance. At the time of writing, XAUUSD is trading at $1708.61.

Gold remains subdued, weighed by a buoyant US dollar

Global equities are mixed, augmenting demand for safe-haven assets. The greenback finally showed signs of life, a headwind for gold prices, with the US Dollar Index barely recovering some ground, up 0.11% at 106.788. Contrarily are US Treasury yields, tumbling across the curve. The US 10-year benchmark note rate is at 3.004%, drops two and a half bps, as traders seek safety towards cash and US Treasuries.

Also read: Gold Price Forecast: XAUUSD remains stuck in a range above $1,700, bearish potential intact

US housing data weighed by higher rates

Fed to hike 75 bps in July

Since Wednesday, the US housing market has begun to feel the pain of higher rates. On Wednesday, Housing starts shrank 2% in June, to their lowest level since September, while Building Permits decreased by 0.6%, both readings on monthly figures. That reflects the aggressive path the Fed has taken, as they have expressed their commitment to tame inflation, even if it means slower economic growth than expected. Of late, US Existing home sales contracted to a two-year low, by 5.4%, exceeding the expectations of a 5.4% growth. That said, recessionary signals are beginning to show in the US, which could increase the appetite for XAUUSD, meaning higher gold prices lie ahead.

US Inflation grabbed the attention, but Retail Sales and Consumer Sentiment tempered Fed intentions of going 100 bps

Elsewhere, during the last week, US Retail Sales and the UoM Consumer sentiment exceeded estimations and tempered worries of a Federal Reserve hiking 100 bps at its July meeting, sparked by CPI topping above 9% YoY, further exacerbated by PPI above the 11% YoY threshold. Nevertheless, the University of Michigan Consumer Sentiment illustrated that consumer inflation expectations for a 5-year horizon fell from 3.1% to 2.8%, easing investors’ fears of a higher hike, which capped the ongoing gold downfall.

Last Wednesday, expectations of a 100 bps hike stood around 80%, but the CME FedWatch tool portrays a decrement to 30% chances while fully pricing in a 75 bps rate hike.

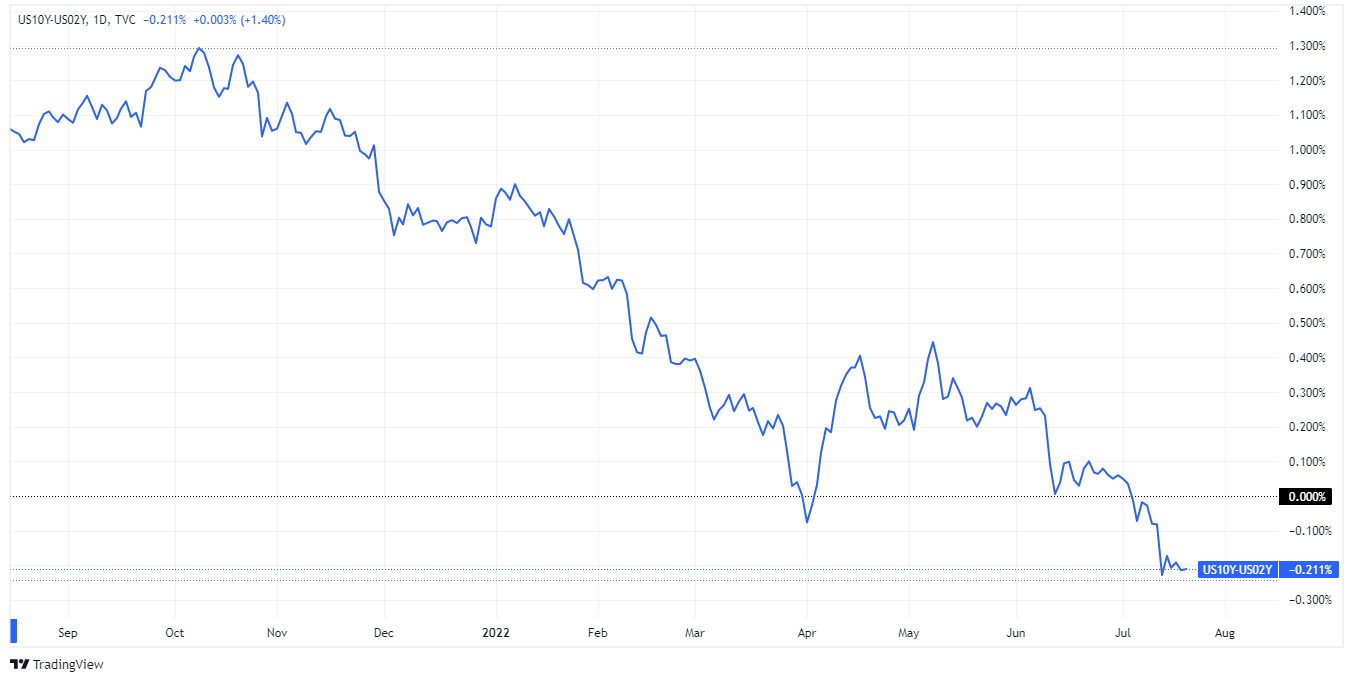

US recession fears linger in investors’ minds as the US 2s-10s yield curve stays inverted

The yield curve remains inverted for twelve days

Gold price will remain under pressure as the Fed keeps tightening. Nevertheless, the inversion of the US 2s-10-yield curve extends for twelve straight days, meandering around -0.217%, as traders’ fears about recession remain. Nonetheless, unless Fed policymakers express concerns about economic growth, that would not deter them from aggressive tightening. Consequently, if the Fed tightens too fast and is seen cutting rates, gold traders should be ready to take advantage of it.

Gold Price Analysis: Technical outlook

Gold price has been trading in a narrow $20 range since July 15, when US CPI data crossed the news wires. However, the XAUUSD outlook, from a technical perspective, is tilted to the downside, even though the Relative Strength Index (RSI), staying at oversold conditions during the last month, suggests that the XAUUSD price should bounce up.

Therefore, due to XAUUSD trading in a range, to the upside, its first resistance would be July 18 high at $1723.85. A decisive break will send the XAUUSD price towards July 6 daily low-turned-resistance at $1732.36, followed by $1750. On the downside, XAUUSD’s first support would be $1700. Break below will expose the August 9, 2021 swing low at $1681.95, followed by the 2021 year low at $1676.91.

Gold halts decline, but bearish risks still intact

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.